Housing Remains a Bright Spot for the Economy

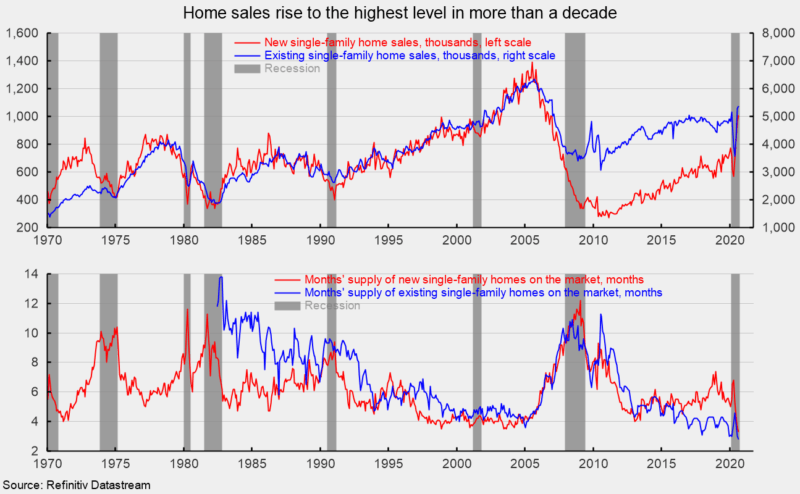

Sales of new single-family homes rose to the fastest pace since September 2006. Total sales rose 4.8 percent in August to a 1.011 million seasonally adjusted annual rate and are up an astonishing 43.2 percent from a year ago (see top chart).

Sales rose in two of the four regions tallied: sales surged 13.4 percent in the South – the largest region by sales volume – putting sales 50.0 percent above year-ago levels while sales were up 5.0 percent in the Northeast, leaving that region’s sales rate 27.3 percent above the year-ago pace. However, sales were down 21.4 percent in the Midwest (but still 54.7 percent above year-ago levels) and sales in the West decreased 3.1 in August and were 13.2 percent below the year-ago level.

Total inventory of new single-family homes for sale declined 3.1 percent to 282,000 in August, the fifth decrease in a row, leaving the months’ supply (inventory times 12 divided by the annual selling rate) at 3.3 – a record low, down 8.3 percent from July’s 3.6 months, and 40.0 percent below the year-ago level (see bottom chart).

Sales in the market for existing single-family homes rose 1.7 percent in August, coming in at a 5.37 million seasonally adjusted annual rate (see top chart). From a year ago, sales are up 11.0 percent. The August pace is the highest since December 2006 (see top chart).

By region, sales for existing single-family homes were up in three of four regions and flat in the fourth: sales were up 12.3 percent in the Northeast and are up 8.5 percent from the year-ago level; sales rose 0.9 percent in the West, leaving that region’s sales rate 9.9 percent above the year-ago pace; sales gained 0.8 percent for the month in the Midwest and are 9.0 percent above the August 2019 rate; and sales were unchanged in the South, leaving sales 13.4 percent above year-ago levels.

The existing single-family home segment saw inventory fall 2.3 percent to 1.27 million, pushing months’ supply to 2.8 from 3.0. Months’ supply for the existing single-family segment is also at a new record low (see bottom chart).