Housing Permits Fall to the Lowest Level in Two Years

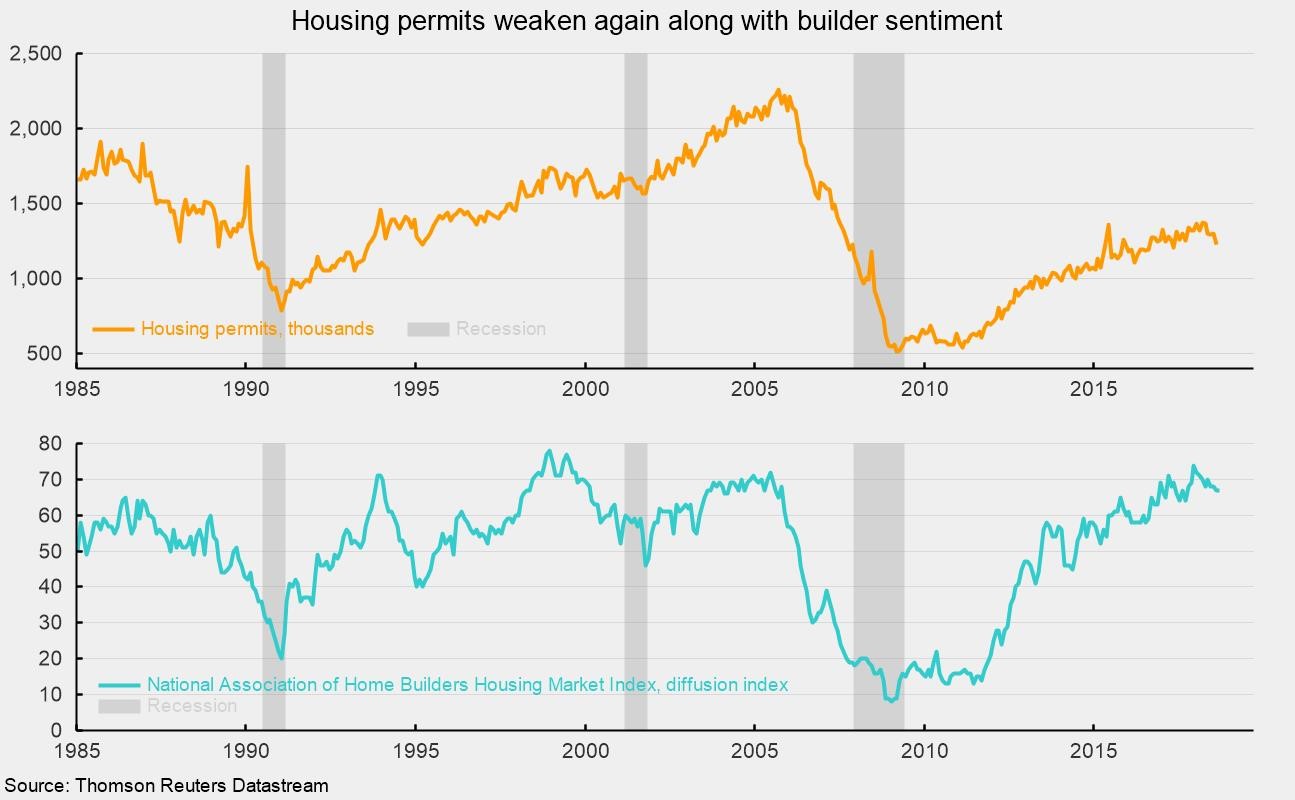

Housing construction rebounded in August as single-family and multifamily starts rose by 1.9 percent and 27.3 percent, respectively. However, housing permits, an indicator of future activity, fell in the latest month, hitting the lowest level since August 2016. Overall, housing construction and permits appear to be plateauing after rebounding from the housing boom-bust cycle in the early 2000s. Along with the decline in permits for future construction, home builder sentiment from the National Association of Home Builders held at its lowest level in a year (see chart). Combined with rising interest rates and falling affordability, the outlook for housing is deteriorating.

Total housing starts rose 9.2 percent in August to a 1.282 million annual rate. The dominant single-family segment, which accounts for about three-fourths of new home construction, rose 1.9 percent for the month to a rate of 876,000 units. Starts of multifamily structures with five or more units surged 27.3 percent to 392,000. Among the four regions in the report, total starts rose in three of the four regions, the Midwest (9.1 percent), South (6.5 percent), and West (19.1 percent). Total starts were unchanged for the Northeast region. For the single-family segment, starts were down in two regions, the Northeast and the Midwest, but up in the South and the West.

For housing permits, total permits fell 5.7 percent to 1.229 million from 1.303 million in July. That is the lowest level since 2016. Single-family permits fell 6.1 percent to 820,000 while permits for two- to four-family units were up 39.3 percent and permits for five or more units fell 8.0 percent to 370,000. Among the major regions, permits were down in all four regions.

Along with the developing weakness in housing permits, home builder sentiment from the National Association of Home Builders is also showing signs of weakness. The index came in at 67 in September, unchanged from August. That is down from a recent peak of 74 in December. Among the three components of the overall index, the current single-family sales index rose 1 point to 74 while the expected-sales component added 2 points, also to a reading of 74. Both indexes had been as high as 80 over the past year. The traffic-of-prospective-buyers component came in at 49 in September, unchanged from the prior month but well below the 58 reading in December. On a regional basis, all four regional Housing Market Indexes are down from recent peaks, with the South showing the smallest drop (5.4 percent) from its peak while the Midwest HMI is off 18.1 percent from the recent high.

Housing permits is one of the AIER leading indicators. It posted a strong run of positive results as the housing market recovered from the Great Recession. However, permits turned to a neutral trend in June and moved to a negative trend last month. While the overall economy remains very solid, some headwinds may restrain further gains for housing.