Holiday Spending Off to a Modest Start

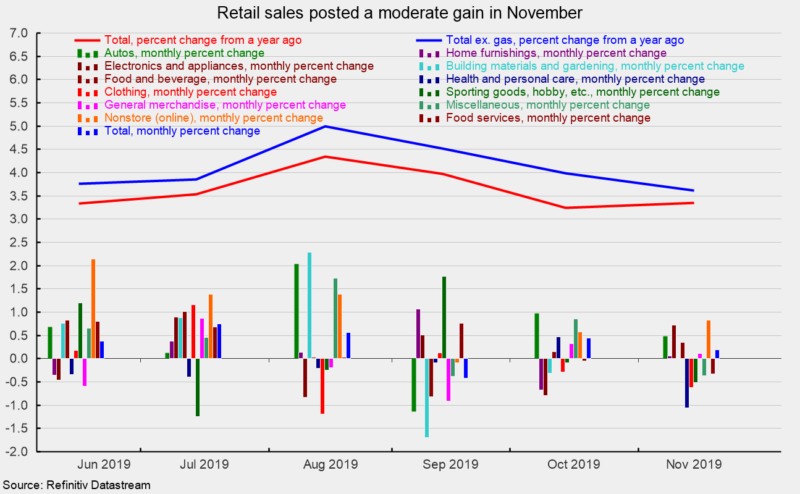

Retail sales and food-services spending increased 0.2 percent in November following a 0.4 percent gain in October. Excluding gasoline station sales, retail sales and food services were up 0.1 percent in November after a gain of 0.7 percent in October. Over the past year, total retail sales and food services were up 3.3 percent through November, while retail sales and food services excluding gas have increased 3.6 percent (see chart).

The November performance was mixed, with gains in 7 retail-spending categories, two posting declines and one essentially unchanged. Gains were led by a 0.8 percent increase for nonstore retailers (primarily online shopping), and a 0.7 percent rise for electronics and appliance stores – two traditional holiday spending categories. Gasoline stations also posted a 0.7 percent gain which is a surprise since average retail gasoline prices (which often drive monthly changes in retail sales spending) were actually down 2.0 percent. Also posting gains for the month were motor vehicles and parts (autos), up 0.5 percent, food and beverage stores, up 0.3 percent, home furnishings stores and general merchandise stores, each up 0.1 percent.

On the negative side, health and personal care stores saw sales fall 1.1 percent, clothing and accessories stores had a 0.6 percent fall, sporting-goods, hobby, musical-instruments, and book stores posted a 0.5 percent decline, miscellaneous retailers had a 0.4 percent setback, and food services (restaurants) saw a 0.3 percent fall. Building materials, and gardening supply store sales were essentially unchanged for the month.

The mediocre retail sales data for November suggest that the early predictions of a booming holiday spending season may have been premature. Certainly, consumer fundamentals are generally solid with a low unemployment rate, decent income growth, and positive consumer sentiment. Government data are subject to revisions and there is plenty of time for consumers to spend, but today’s data suggest slow growth remains the most likely path.