Hints of Improvement for Manufacturing

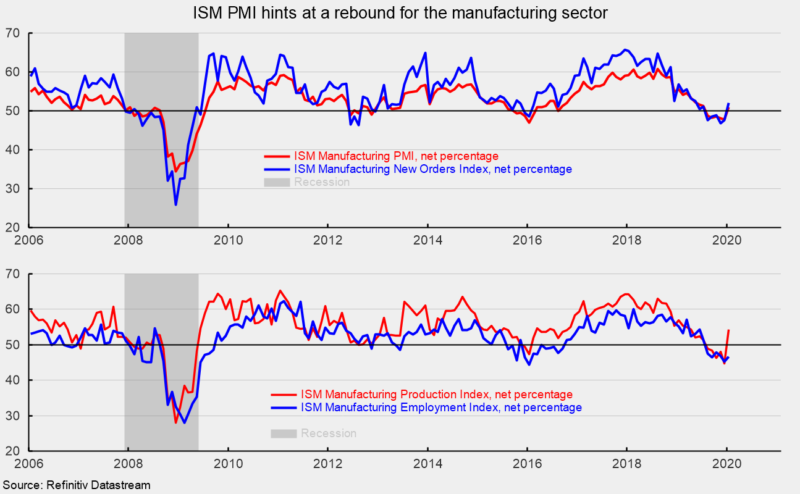

The Manufacturing Purchasing Managers’ Index from the Institute for Supply Management registered a 50.9 percent reading in January, up from 47.8 in December (see top chart). The January reading was the first above the neutral 50 threshold since July. According to the Institute for Supply Management, “Comments from the panel were positive, with sentiment improving compared to December.” The report also stated, “Global trade remains a cross-industry issue, but many respondents were positive for the first time in several months.”

Among the key components of the Purchasing Managers’ Index, the New Orders Index came in at 52.0 percent, up from 47.6 in December (see top chart). January was the first month with a reading above 50 following five months below neutral. Analysis by the Institute for Supply Management suggests that readings above 52.5 for a period of time are consistent with rising real new orders for manufacturers.

The production index was at 54.3 percent in January, up from 44.8 in December (see bottom chart). Seven industries reported growth for the month while seven reported contraction. The results suggest production as measured by the Federal Reserve’s industrial production for manufacturing index may also return to growth soon. The better performance for production contributed to a decrease in the backlog-of-orders index. That index came in at 45.7 in January, the ninth month below 50, suggesting backlogs continue to contract.

The employment index improved to 46.6 percent in January, up from 45.2 in December (see bottom chart). Despite the slightly higher reading, the result suggests employment in manufacturing likely fell in January. The Bureau of Labor Statistics’ Employment Situation report for January is due out on Friday, February 7. Consensus expectations are for 160,000 new nonfarm-payroll jobs including a drop of 5,000 jobs in manufacturing.

Supplier deliveries, a measure of delivery times from suppliers to manufacturers, came in at 52.9, up from 52.2 in December. January was the 3rd consecutive month above 50, suggesting suppliers delivering to manufacturers are falling behind but at a slightly faster pace. Slower supplier delivers are consistent with stronger manufacturing activity.

The prices index rose 1.6 percentage points to 53.3 in January from 51.7 in December. That is the second month above 50 following 6 months of falling prices.

Customer inventories in January are still considered too low, with the index rising to 43.8 from 41.1 in the prior month (index results below 50 indicate customers’ inventories are too low). The index has been below 50 for 40 consecutive months but the index suggests inventories are moving closer to desired levels.

Today’s report from the Institute for Supply Management suggests the manufacturing sector may be turning the corner after a weak period. The improved readings for new orders, new export orders, production, and employment hint at a positive outlook for manufacturing in the coming months.