Growth in the Money Supply Will Likely Push Inflation Higher

In the long run, growth in the money supply will likely cause inflation, meaning a decline in the dollar’s purchasing power. Following the Great Recession, the Federal Reserve undertook unprecedented measures to jump-start the economy. The Fed dropped its target for short-term interest rates to historic lows. When low interest rates failed to boost the economy, the Fed set up asset-purchase programs known as quantitative easing, meant to loosen credit across the economy by expanding commercial-bank reserves held at the Fed.

The Fed’s balance sheet has reached record levels. On the asset side, the Fed’s balance sheet shows over $4 trillion in Treasury securities and mortgage-backed securities. During the quantitative easing programs, the Fed purchased Treasury securities and mortgage-backed securities. On the liabilities side, commercial banks have parked $2 trillion in excess reserves at the Fed. Combining reserves with currency in circulation, the monetary base reached record levels in the last two years. The huge increase in the money supply threatens to cause inflation only if excess reserves are loaned to households and firms. Bank lending is the transmission mechanism for reserves held at the Fed to enter the economy and bid up prices.

Bank lending corresponds to growth in private-sector debt, which includes household and business debt. After the Great Recession, households and businesses reduced their debt burden. During most of the current economic expansion, growth in private-sector debt has been weak, in part because of new regulations. Only recently has private-sector lending returned to its historical growth rate. In previous economic expansions, private-sector debt has grown between 5 and 10 percent per year. Lending should continue so long as households and businesses remain in decent financial shape. A low level of layoffs, brisk hiring, and wage growth should support household borrowing. With a healthy consumer, businesses are more likely to borrow and expand to meet demand.

Banks have money to lend into a growing economy, so prices have picked up. Over the past year, the headline Consumer Price Index has increased 2.4 percent. Core inflation, the CPI excluding volatile food and energy, is running slightly below the headline. Core inflation has increased 2 percent over the past 12 months. Both headline inflation and core inflation will move higher if banks accelerate lending. Housing is a good example of how bank lending drives prices higher. After a long deleveraging following the Great Recession, consumers have been taking on more mortgage debt. Over the past year, mortgage debt has risen 1.8 percent. Meanwhile housing prices have risen 3.1 percent over the past year. If banks move to lend out more of their reserves, consumers will have more money on hand. More money in the hands of consumers will bid up prices of other goods and services, which will continue to push the overall price level higher.

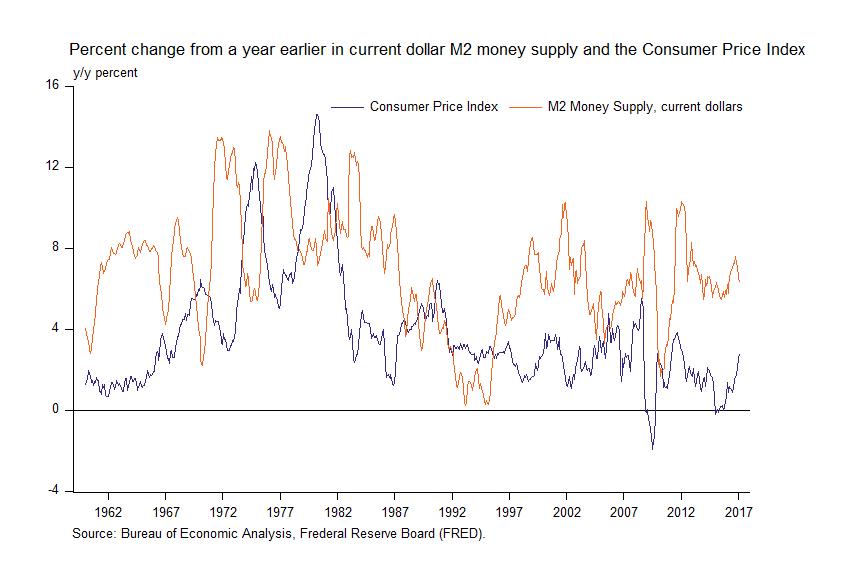

The chart below shows that the money supply and inflation tend to move together. Research at AIER has shown that growth in the money supply tends to lead inflation by a little less than 3 years.