The Good Guys are Winning This

Two important items are worth celebrating right now. Indeed, we should all be swooning with joy, raising a glass with the toast: “To rising so far above the state of nature!” The lives of each and every one of us have been made better off because of this news.

First, Apple, a consummate American company with massive and complex international connections to global supply chains, just passed $1 trillion in market capitalization.

Second, Amazon, the online retailer that twenty years ago was dismissed as a ridiculous idea that only benefited from a financial bubble, also passed $1 trillion in market capitalization (it is down, of course, as of this writing).

These companies are solidly digital-age enterprises, symbols of the gradual refashioning of our economic lives according to cutting-edge technology that departs from anything we’ve known before. Nothing like either of them or the services they deliver on this scale were imagined twenty years ago.

Apple has sold more than 1 billion iPhones over the last ten years. IT employs 50,000 people in the US but is indirectly responsible for supporting 10 times as many. It has total assets of $367.5 billion. Meanwhile, Amazon employs half a million people. It processes an amazing 35 orders per second or 1 billion per year. It posts $20 billion in liquid assets.

These numbers were once unthinkable. They are now becoming more common. The one-trillion mark this seems huge but the overall market capitalization of US public companies exceeds $30 trillion. Not only that, the US easily leads the world in high-capitalization public companies. No one else is even close.

Wealth Creation

But these aren’t just numbers. They point to the great achievement of humankind: we’ve learned how to create wealth. Aristotle, as smart as he was, couldn’t make heads or tails out of economics, and even declared with great certainty that “retail trade is not a natural part of the art of getting wealth” and is “justly censured.” He was stunningly wrong on this, and this is precisely why economics emerged as a science in the late Middle Ages, to explain where and why wealth comes from.

All of this wealth has been created out of what? Out of the creativity of the human mind, the drive to serve the needs of others toward the mutual benefit of everyone involved. The more we cooperate peacefully with each other, and so long as property rights are secure and trade is unencumbered, wealth can be created. The Industrial Revolution taught us just how awesome this can be. The flourishing of commerce means the flourishing of everything we call civilization.

The rise of prosperity is not baked into the logic of history. It requires heroism and faith because nothing is certain about enterprise. It relies on the freely-chosen decisions on the part of everyone involved. The business must speculate on the needs of others, and the consumers they serve must make the choice, every step of the way.

Consider too that every profitable company faces formidable foes to its own success. It deals with competition from others who are free to emulate its every move, which means that every company must innovate constantly, daily, hourly, just to stay ahead. It deals with the uncertainty of the future; everything must be built in the hope that people will buy but one can never be sure. And every enterprise must deal with an unfathomable amount of government regulations and taxes that get in the way.

It’s one thing for such wealth creation to take place in the Gilded Age, when there was no income or corporate tax, and government did not regulate wages or products and services. It was a world of laissez faire. Today, it is different. The state knows no limits to its power, and looks for every opportunity to pillage both individual and corporate wealth makers and holders. The obstacles in compliance are stunningly daunting.

Given all of this, it is the highest tribute to the human mind that this has happened, despite every attempt to stop it. It is nothing short of heroic.

So where is the celebration? At the political level, the great achievement is being put down. Donald Trump never misses a chance to threaten Amazon with regulatory action. VanityFair sums it up: Donald Trump will not rest until Amazon is a smoldering pile of radioactive ash. That article was published in May 2018. He has since posted a dozen more tweets against the company.

Meanwhile, on the left side of the political spectrum, there is a growing movement, stemming from a similar hatred of these companies, to tax them to the extent that workers receive welfare benefits. Bernie Sanders is already introducing legislation, based entirely on a simple economic error over what determines wages.

Workers are paid not based on their household income (whatever that would mean) but rather their contribution to the productivity of the firm. There is absolutely no relationship between wages at Amazon and the benefits workers receive from the welfare state. It’s even the opposite: the more job experience these workers gain, the more they can work themselves into an income bracket that makes them ineligible for welfare.

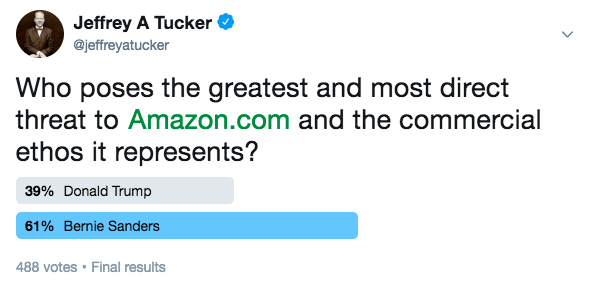

Faced with this left/right attack, I decided to conduct a poll on my Twitter feed. Which side of the political spectrum represents a greater threat to these companies?

I have no idea if the poll results are correct. Politicians can do terrible damage to companies. However, if I were to place bets this time, I would predict that they won’t get away with it. The larger and more impressive is the private sector, the better position they are in to fight off the attempt by political actors to pillage and smash them. And these days, the sheer might and resources of the private sector is growing at a remarkable rate. This speaks well of the prospects for human freedom.

Meanwhile, if you are a seriously political person, you are right now watching the incredible antics taking place over the nomination of a new Supreme Court nominee. You have chosen your sides based on the media you watch. You are convinced that the enemy of your enemy is necessarily your friend. It’s a dog-eat-dog world.

You might see the whole frenzy about the control of the powers of government as the key struggle of our time, an existential crisis that will determine the fight over the future of civilization itself.

You know what? You might actually be paying attention to the wrong thing. What matters more is the battle that is taking place that gets very little public attention at all: the private vs. the public sector in overall wealth. Here the good guys are winning.

Despite every conspiracy against wealth creation and wealth creators, despite a bipartisan attack on enterprise that dates back 100 years, despite every attempt to stop the material advance of humanity, commerce is still flourishing, still showing us better ways to do things, still inventing what no one thought possible, still lifting us further out of the state of nature, still giving us hope in a brighter future.