Gas and Apparel Pull Everyday Prices Down in November

AIER’s Everyday Price Index fell 0.1 percent in November after posting a 0.4 percent increase in October. The Everyday Price index has fallen in four of the last six months. The Everyday Price Index measures price changes people see in everyday purchases such as groceries, restaurant meals, gasoline, and utilities. It excludes prices of infrequently purchased, big-ticket items (such as cars, appliances, and furniture) and prices contractually fixed for prolonged periods (such as housing).

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, decreased 0.3 percent in November after a 0.3 percent rise in October. The Everyday Price Index including Apparel has fallen in three of the past six months. Apparel prices fell 2.5 percent on a not-seasonally-adjusted basis in November and are down 1.6 percent over the past year. Apparel prices tend to be volatile, registering sporadic large gains or declines in between stretches of relatively steady prices.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, fell 0.1 percent in November, matching the decline in the Everyday Price Index. The Everyday Price Index is not seasonally adjusted, so we compare it with the unadjusted Consumer Price Index.

Over the past year, the Consumer Price Index is up 2.1 percent. Over the same period, the Everyday Price Index has risen 1.2 percent while the Everyday Price Index including apparel is up 0.9 percent. The modest increases in both indexes over the past year are largely due to weak energy and grocery store prices.

Motor-fuel prices fell 1.1 percent for the month on a not-seasonally-adjusted basis. Over the past year, motor-fuel prices are off 1.3 percent. Motor fuel prices are largely a function of crude oil prices. West Texas Intermediate crude oil prices fluctuated dramatically from mid-2017 through mid-2019, rising to a peak above $75 per barrel in October 2018 before plunging to less than $45 by December 2018. Crude prices have been relatively stable since May, bouncing around in a range of $50 to $60.

Grocery prices fell 0.3 percent in November and are up just 1.0 percent from a year ago. Over the last five years, grocery prices are essentially unchanged.

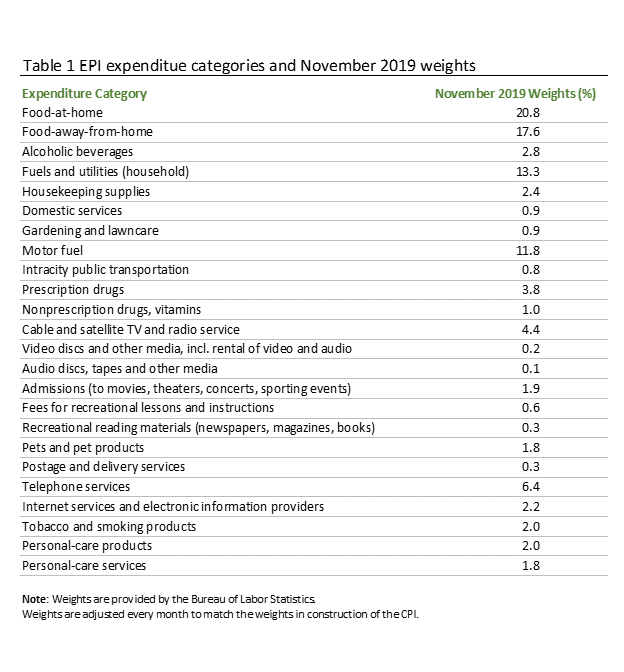

The components with the largest weights in the Everyday Price Index are food at home (weighted 20.8 percent and declining 0.3 percent in November), food away from home (17.6 percent and a 0.2 percent rise), household fuels and utilities (13.3 percent and a 0.3 percent drop), and motor fuel (11.8 percent with a 1.1 percent decrease). Together, these four categories account for 63.5 percent of the Everyday Price Index.

Overall, net changes in the Everyday Price Index remain modest. Energy prices are the most volatile component and have been, on balance, a negative contributor in recent months. Grocery prices (food at home) have also been rising at a slow pace and stand in sharp contrast to restaurant prices (food away from home) which have been rising more quickly and persistently. Apparel prices also remain volatile but in general have been a negative contributor. Other smaller components have had significant but largely offsetting trends. Notably, gardening and lawncare services prices are up 8.4 percent from a year ago, while tobacco products have risen 5.5 percent, postage and delivery services are up 5.4 percent, recreational reading materials are up 4.9 percent, and pet and pet products are up 3.3 percent. Partially offsetting these were audio discs and tapes, down 2.6 percent and video discs, down 2.5 percent. Several other smaller components have increases close to zero.