Food and Gasoline Offset in the Everyday Price Index

Note: The Everyday Price Index for October is based on incomplete data due to restrictions on data collection by Bureau of Labor Statistics personnel because of the Covid-19 outbreak.

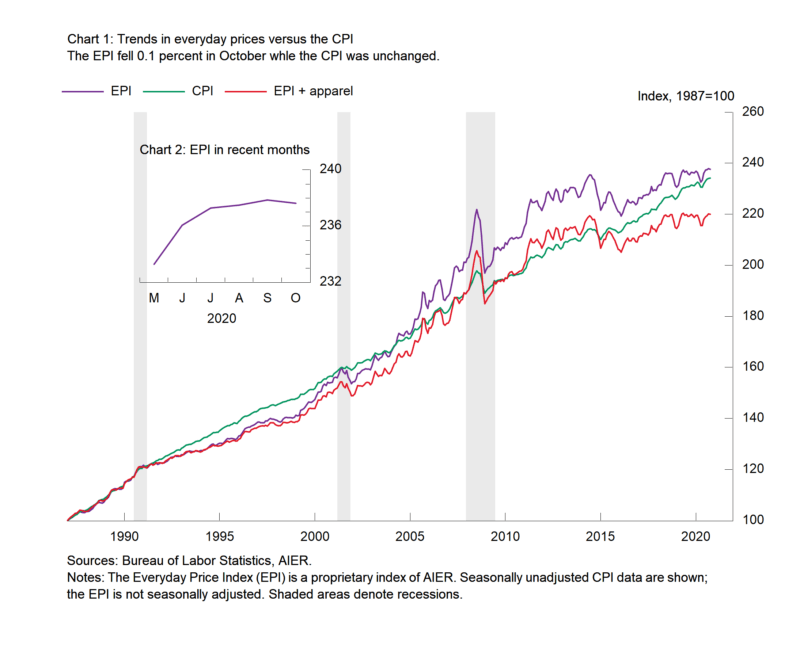

The AIER Everyday Price Index fell 0.1 percent for the month of October while the more encompassing Consumer Price Index was unchanged for the month (on a not-seasonally-adjusted basis). The fall in the Everyday Price index follows five consecutive increases from May through September. Over the past year, the Everyday Price Index is up just 0.5 percent.

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, also fell 0.1 percent in October following a 0.3 percent rise in September. The index is unchanged over the 12 months through October 2020. Apparel prices fell 0.2 percent on a not-seasonally-adjusted basis in October and are down 5.5 percent over the past year.

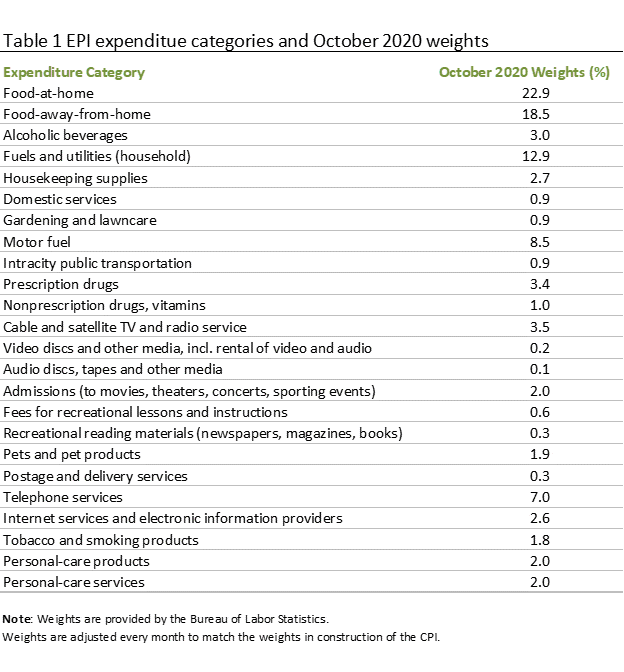

The largest contributors to the Everyday Price index in October had offsetting impacts. Food at home (groceries) was up 0.2 percent for the month, contributing 5 basis points while prices for food away from home (restaurants) rose 0.3 percent, also contributing 5 basis points. Telephone services prices (primarily wireless phone services) rose 0.3 percent for the month, adding 2 basis points. These were more than offset by a 1.6 percent drop in gasoline prices for the month. The drop reduced the Everyday Price Index by 13 basis points.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, was unchanged on both a seasonally-adjusted and a not-seasonally-adjusted basis in October. Over the past year, the Consumer Price Index is up just 1.2 percent. Food and energy prices rose in October with food prices up 0.2 percent and energy prices gaining 0.1 percent. For the Consumer Price Index excluding food and energy, the index was unchanged for the month after seasonal adjustment while the 12-month change came in at 1.6 percent.

Within the core, core goods prices fell 0.2 percent in October and are up 1.2 percent from a year ago while core services prices rose 0.1 percent for the month and are up 1.7 percent from a year ago. Among the increases in core goods were new vehicle prices, up 0.4 percent, and alcoholic beverages, up 0.3 percent. Medical care commodities fell 0.8 percent for the month. Within core services, car and truck rentals were up 7.4 percent for October (and 9.7 percent from a year ago) while airline fares rose 6.3 percent for the month (but are down 20.0 percent over the past year). Motor vehicle insurance prices continued to fall, dropping 2.3 percent in October and 7.1 percent from a year ago.

Overall price pressures remained moderate in October as economic activity remains distorted by government restrictions on businesses and consumers. However, shifting consumption patterns are likely to make relative price changes somewhat more volatile.