Florence Hits Jobs Report but Trends Remain Positive

The impact of Hurricane Florence was evident in the September employment report. Nonfarm payrolls rose a less-than-expected 134,000 for the month. Weakness was largely concentrated in the retail industry and the leisure and hospitality industry. Most other details of the report were generally in line with recent trends and suggest the labor market remains healthy.

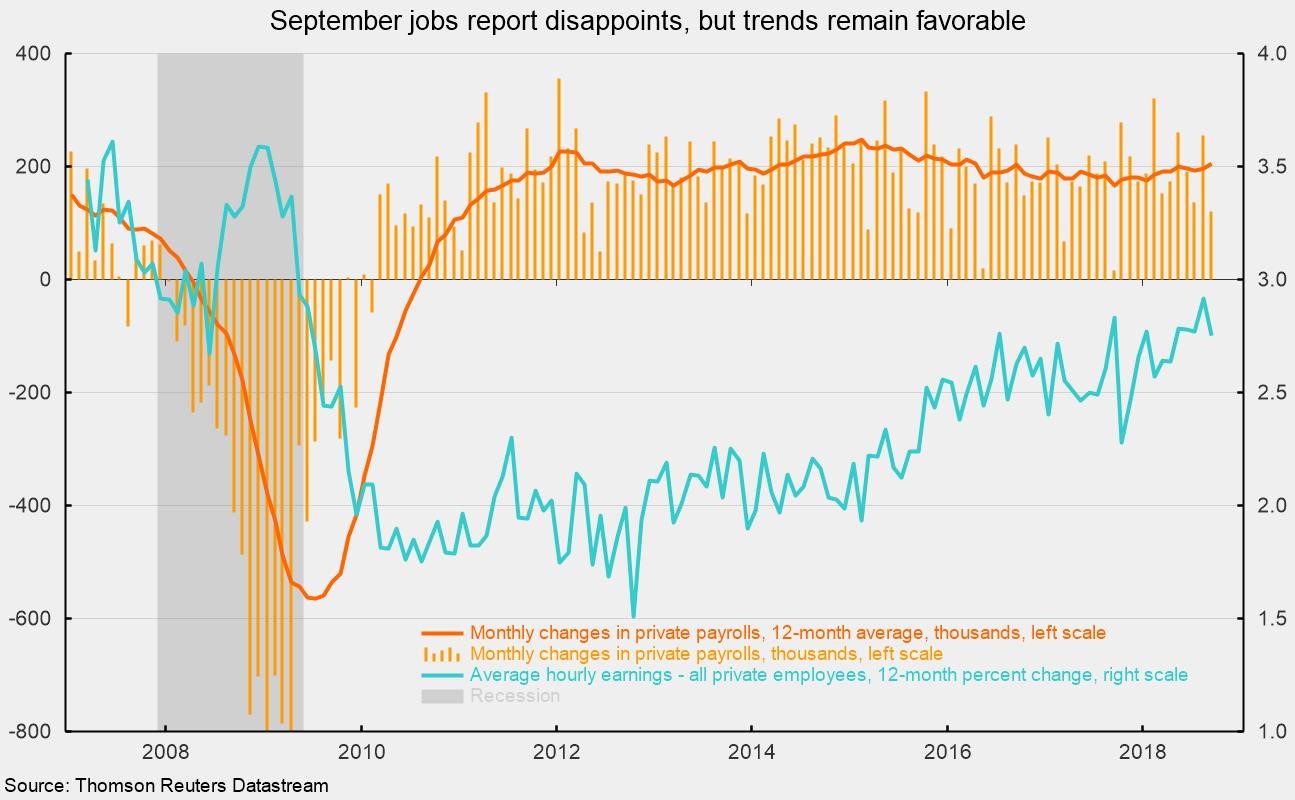

The private sector added 121,000 jobs, well below the ADP Research Institute prediction of 230,000 new private sector jobs. Over the past three months, total payrolls have risen an average of 190,000 while private sector payrolls have averaged a gain of 171,000. Those compare to 12-month average gains of 211,000 for total payrolls and 206,000 for the private sector. The 12-month average for private payrolls is up from a recent low of 166,000 in September 2017 and suggests that hiring in the private sector is maintaining solid momentum (see chart).

Gains were prevalent among many goods-producing industries in September. Among the gainers, construction added 23,000 jobs versus 26,000 in August, manufacturing industries added 18,000 jobs for the month compared to 5,000 in the prior month, and mining industries added 5,000 versus 6,000 previously. Combined, goods-producing industries added 46,000 new jobs in September.

Private-services industries added just 75,000 jobs in September compared to 217,000 in August. Among the individual private-services industries with the weakest performance, leisure and hospitality lost 17,000 jobs for the month compared to an average monthly gain of 25,000 over the past year, retail industries lost 20,000 compared to an average monthly gain of 5,000, education lost 12,000, and the catchall “other” category lost 1,000 in September, below the average monthly gain of 7,000.

Despite the impact of the hurricane, many private-services industries posted solid results. Professional- and business-services payrolls rose by 54,000, health care added 30,000 employees, transportation industries added 24,000, and financial industries gained 13,000.

The solid pace of job creation attracted 150,000 more people into the labor force in September. Despite those new entrants, the labor-force participation rate was unchanged at 62.7 percent. The unemployment rate dropped by 0.2 percentage points to 3.7 percent in September, hitting a new low for the current cycle and the lowest since December 1969.

Average hourly earnings rose 0.3 percent in September, pushing the 12-month change to 2.8 percent versus 2.9 percent last month. Despite the deceleration, the trend in wage growth is likely to continue (see chart). The length of the average workweek held steady at 34.5 hours. Combined, the gains in payrolls, hours worked, and hourly earnings resulted in a 0.4 percent increase in the aggregate-payrolls index in September and a 12-month rise of 5.4 percent. This index is a proxy for take-home pay and has been growing in the 4 to 5.5 percent range since 2011, providing a solid base to support consumer spending.

Caution is warranted when interpreting the September employment report, given the distortions from the hurricane. However, the preponderance of evidence suggests the labor market remains robust and that the economy is likely to grow at a healthy pace. Under those assumptions, it seems likely that the Fed will continue to raise the federal-funds-rate target slowly, including an additional 25 basis points in December. Beyond December, the latest summary economic projections suggest some additional increases in 2019 and 2020, though at a slower pace than in 2018. There is significant debate about what the long-run neutral rate for the fed funds rate might be and whether economic conditions will warrant moving the rate into restrictive territory for a time. While the former topic is more theoretical, the latter will likely be largely dependent on incoming economic data.