Exit the Bond Vigilantes, Enter the Crypto Vigilantes

Alongside expansionary monetary policy, government efforts to beat back the effects of the coronavirus––more aptly, the effects of fear mongering and knee-jerk policy responses––in 2020 included the largest issuance of US Treasury debt in decades. Measured on the basis of debt-to-GDP ratios, the last time that Western countries were as fiscally profligate was during and just after World War II.

After years of Federal Reserve programs to monetize debt, yields have been pushed down to historically low levels: by buying Treasury bonds the Fed pushes and holds their prices up. And because bond prices and their yields (the interest paid to holders of them) move inversely, rising bond prices mean falling yields.

It’s not surprising that this is happening, with deficit and debt hawks nowhere to be found and the global appetite for US Treasuries – one thought insatiable – tested with each bond auction. The minutes of the December 2020 Federal Open Market Committee indicated a nearly unanimous inclination toward dovish, highly accommodative monetary policy for years to come, with a gradual tapering planned whenever the decision is made to end it.

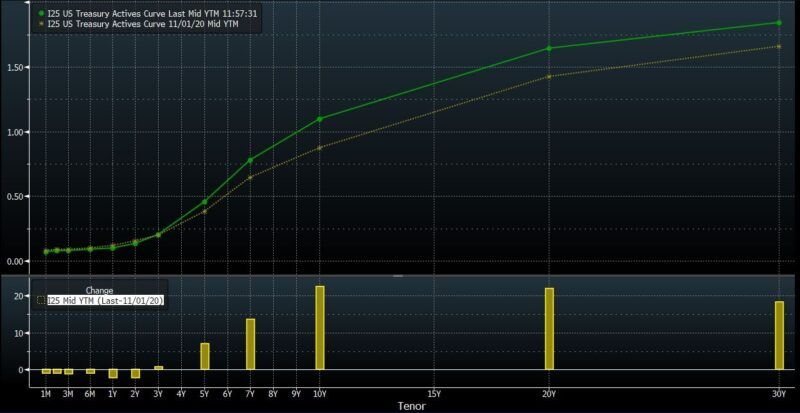

Global bond investors and traders have taken notice of this, with the effect of their trades and portfolio allocations recently creating a “bear steepening.” This occurs when yields on longer-term issues rise more than on shorter-term issues, and signals heightened expectations of inflation among many of the most knowledgeable and experienced financial market actors in the world.

Below are the changes in price of various maturities of US Treasury bonds as measured by five exchange traded funds (ETFs) since early November, when the bear steepening began. The funds are listed from short- to long-term maturities: BIL (1–3 months), SHY (1–3 years), IEI (3–7 years), IEF (7–10 years), TLH (10–20 year), and TLT (20+) years.

It’s evident, over the time period, that much larger price declines (total return between November and 15 Jan 2020) hit bonds with longer maturities than shorter maturities.

It’s also depicted here, on the yield side. Between early November (yellow curve, lower) and 19 January 2020 (green curve, higher), yields rose more for longer-term than shorter-term issues.

And so the question arises: Are the bond vigilantes back?

The Golden Age of the Bond Vigilantes

A quick step back. Bond vigilantes are institutional investors who oppose inflationary (or otherwise unwise) monetary or fiscal policies by selling their bond holdings. As a group, the bond vigilantes tend to be somewhat emergent in nature. There are no fixed “members,” but banks, securities firms, and other large asset managers with massive US government bond holdings, both domestic and international, are typical participants.

As the market for US Treasuries grew in the late 1960s and early 1970s as a result of both the Vietnam War and Lyndon B. Johnson’s “Great Society” programs, the flood of new US government debt had a number of side effects. One was the arrival of dealers specializing in sovereign debt. Another was the birth of repo markets, short-term (often overnight) securities lending arrangements. But the one that directly led to the coalescence of the bond vigilantes was increasing government dependence upon large financial institutions to purchase that debt.

During the 1980s and early 1990s, whenever federal budgets or new programs seemed particularly spendthrift, the bond vigilantes would swing into action, selling government securities of various maturities and in turn sending prices down and yields up. To the issuers of those bonds and thus debtors––in this case, to the US government––this meant rising yields and higher borrowing costs. This was their heyday, and the vigilante era is generally agreed to have seen one of its finest moments in 1994 with the “Great Bond Massacre.”

As the Clinton administration proposed exorbitant budgets and slugged it out with Congress, the bond vigilantes dumped US Treasury securities at a rate which, in just nine months, drove the US government’s cost of borrowing up from just over 6% to nearly 8%. Not long thereafter, the government bonds of other industrialized nations were dumped, with similar effects on borrowing costs.

New York magazine summarized the moment of epiphany with characteristic elan in 1999:

Hard as it may be to believe right now, the most important thing that Bill Clinton ever said was not “I did not have sexual relations with that woman.” Although that statement did have the virtue (from the perspective of memorability) of being, well, a bald-faced lie, there’s nothing especially profound about it. Consider, by contrast, the passage from Bob Woodward’s The Agenda in which Clinton asks the rhetorical question, “You mean to tell me that the success of the economic program and my re-election hinges on the Federal Reserve and a bunch of [expletive deleted] bond traders?” … And for a time, that moment when Clinton realized that the US bond market had effective veto power over all of his economic plans took on the force of a primal scene. Bond traders … were understood as controlling the secret levers of the economy. If they didn’t like what they saw in Washington, or the housing market, they’d stamp on the brakes, sending interest rates soaring[.]

By mid-October 1994, the selloff had generated over $1 trillion in losses. The bond vigilantes had spoken, and fiscal sobriety became the order of the day.

But this is a financial market narrative. A more scientific, macroeconomic account would include some counterfactuals and take into account related issues. Tradeoffs, for example: does the market discipline imposed upon the government by bond vigilantes do so at the cost of taxpayers––since rising interest rates mean higher borrowing costs, which over time results in either inflation, higher taxes, or both? And what is the tradeoff between a government less able to borrow and one raising taxes in response to higher rates? What effect did those rising interest rates, caused by bond vigilantes smashing the sell button on countless trading desks, have upon the Fed’s inclination to prick the tech bubble several years later?

More importantly: are heads of bond trading desks at private firms more accountable than, say, public officials presiding over fiscal or monetary policy? On the other hand, who is more likely to take inflation seriously and have skin in the game: traders with Brooklyn accents, or Ivy League economics Ph.Ds?

Hibernation

A host of factors conspired to create a bull market in debt; it “officially” began in 1981 (when Treasury yields were over 14%) and since then yields have fallen fairly steadily.

The bond vigilantes began to disperse around the turn of the century. Inflation was chronically low; financial markets expanded tremendously in both volume and the number of issues traded; savings rose in the wake of both the 9/11 attacks and the bursting of the tech/dotcom equity bubble; and budget deficits remained––certainly by today’s standards––low. The possibility of future budget surpluses, as quaint a notion as any in public finance today, were discussed. Interest rates were held near zero for roughly three years, and then between 2004 and 2006 rose from about 1% to just over 5%.

With the housing collapse and the Great Recession (2007-2010) the Fed pulled out all the stops, taking interest rates down to effectively zero interest rate policy (ZIRP) levels and initiating three quantitative easing programs. And when in 2008–2009 the Federal Reserve began to directly monetize US debt, buying US Treasuries directly to push money into the economy, a persistent upward pressure was applied to the price of US government debt, holding yields at historically low levels for over half a decade. If the vigilant, inflation-sensitive bondholders attempted to act, they weren’t successful. Yields became nearly impossible to push up as bond sales were readily digested and US Treasury prices stayed high. The vigilantes were neutralized.

Owing to the tremendous facilities directed at pandemic mitigation efforts beginning in March, global indebtedness increased by an estimated $15 trillion in 2020, with an estimated 60% of that accounted for by government borrowings. In any other time period, the bond vigilantes would have been out in force. And although bond yields have risen a bit recently, leading to some speculation about an awakening, the Fed’s demonstrated capacity and willingness to suppress yields with unlimited bond buying programs have sidelined bond activists indefinitely.

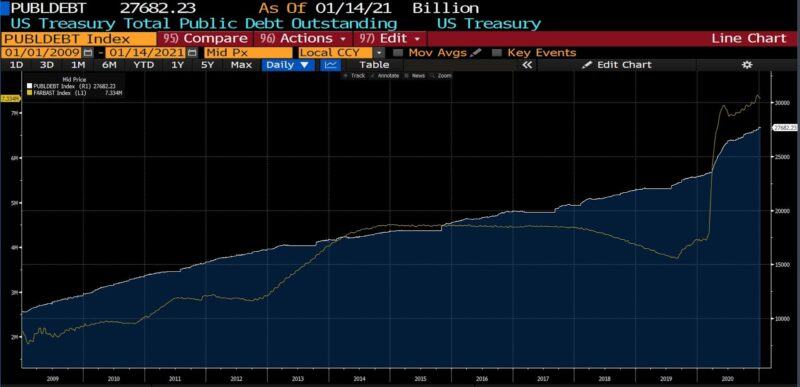

(The upward trend of outstanding US debt and the size of the Fed balance sheet is shown here; note the jump in the Fed’s balance sheet surrounding the pandemic response in the first quarter of 2020.)

It is true that, with rates as low as they are, the interest payments (“debt service”) the government is obligated to pay are relatively small. Additionally, even at record low yields––the US 10-year Treasury yield hit 0.318% on 9 March 2020––there’s arguably room for them to fall still further. Indeed, a major tool in the category known euphemistically as unconventional monetary policy is negative interest rates. They’ve already been employed in Europe and Asia.

Will Other Vigilantes Come Forward?

Are there other means of alerting fiscal and monetary policymakers of the dissatisfaction of market participants? Are there other, or new, avenues for instilling fiscal discipline among government officials?

Buying credit default swaps (CDS), thus raising the cost of “insurance” on US government debt may serve that purpose, but CDS trades are extremely expensive. And unless changes in CDS prices lead to a change in rating agencies’ evaluations of the creditworthiness of the US government, they are unlikely to be noticed beyond a very narrow scope of large, sophisticated financial institutions.

Dollar-focused “activism” might be an option, too, especially coming in concert with changes in gold and silver prices. A market-driven devaluation of the dollar (sales of the dollar with the proceeds directed into other currencies) would probably both catch the attention of central bankers and participants in international trade and, quite possibly, send inflation higher. But that––especially in light of recent comments made by Fed Chairman Jerome Powell, among others––would actually assist in accomplishing the Fed’s inflationary goals, even as it erodes the value of savings and undermines creditors. And with the US dollar still the global reserve currency, the potential impact of “dollar vigilantes” is likely limited.

Enter the Crypto Vigilantes

There is an alternative; one removed from the pitfalls of other forms of financial market militancy and without the aforementioned tradeoffs. Clearly the cryptocurrency market has the attention of political officials and other crafters of economic policy. The former US president made several comments regarding Bitcoin in July 2019, and though his arguments were childish he confirmed the view that heads of state are cognizant of crypto’s existence and potential. (The new US Treasury Secretary has made similar statements in the past few days.) Bipartisan opprobrium is the clearest sign that cryptocurrencies, and Bitcoin in particular, are an effective referendum on policies that incur debt, inflation, and other pernicious aspects of banking and financial regulation.

For some years now, a handful of countries have attempted to ban Bitcoin, with predictable levels of success: none. And despite volatility (engendering a never-ending flurry of premature obituaries), the market for Bitcoin has grown to include exchange-traded futures, a vast dealer network, research coverage, and dozens of exchanges all without compromising the underlying instrument.

The cryptocurrency asset class is stateless, borderless, unfettered by bureaucrats, and presents barriers to entry no higher than downloading a phone app or running an .exe file. Bitcoin, trading 24/7 globally with low and declining transaction costs, is ideal as a silent, incorruptible barometer of trends and events in monetary and fiscal policy. With the heightened pace and expanded scope of economic intervention over the last ten or fifteen years, the avenues through which markets can respond to government policies have been blunted. But fortunately for the genius of Satoshi Nakamoto, where the bond vigilantes once stood––and may someday return––now stand the crypto vigilantes.