Existing-Home Sales Trending Flat; Upside Limited

Sales of existing homes rose 1.9 percent in October to a 5.46 million seasonally adjusted annual rate. Sales are up 4.6 percent from a year ago, recovering from a slowdown during 2018 and early 2019. However, sales are about even with levels from 2016.

Sales in the market for existing single-family homes, which account for just under 90 percent of total existing-home sales, rose 2.1 percent in October, coming in at a 4.87 million seasonally adjusted annual rate. From a year ago, sales are up 5.4 percent. The October pace is about in line with the mid-2016 pace. Sales of existing single-family homes has been in a range of 4.2 million to 5 million since 2015, well below the peak pace of 6.34 million from September 2005.

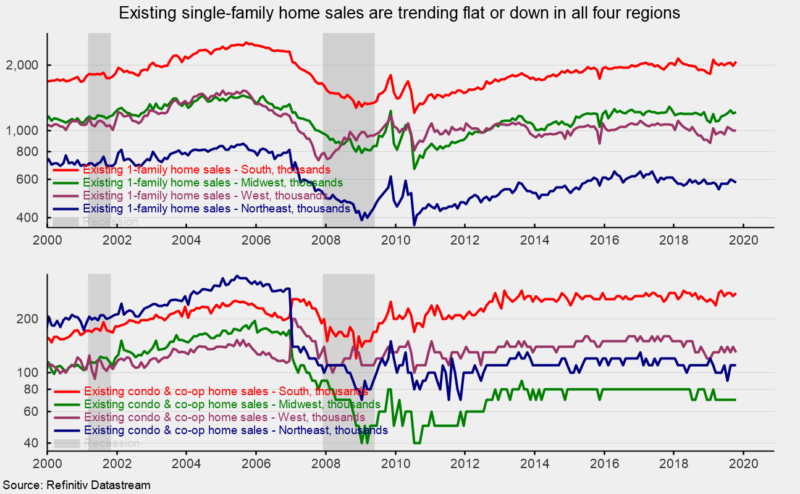

Sales of single-family existing homes were mixed across the four regions: sales dropped 1.7 percent in the Northeast to 580,000 while sales rose 1.7 percent in the Midwest and 4.5 percent in the South. Sales were unchanged at 1.0 million in the West (see top chart).

Condo and co-op sales were unchanged for the month, totaling 590,000, putting sales 1.7 percent below the October 2018 pace. Among the regions, sales were unchanged in the Northeast (110,000) and the Midwest (70,000) while the South saw a 3.7 percent rise to 280,000 and the West posted a 7.1 percent decline to 130,000. From a year ago, sales were up 3.7 percent in the South, down 7.1 percent in the West, down 12.5 percent in the Midwest, and unchanged in the Northeast.

Housing activity is enjoying a tailwind from the drop in mortgage rates recently though some of the decline has begun to reverse. Still, rising home prices continue to weigh on home affordability. For the housing market overall, affordability remains somewhat favorable, but sales are unlikely to move significantly higher in the coming months. Furthermore, new-home construction is unlikely to contribute significantly to growth in gross domestic product in coming quarters. Still, consumer spending is growing, supported by a tight labor market, rising incomes, strong balance sheets, and generally high levels of consumer confidence. The main risks on the horizon continue to be uncertainty surrounding trade policy and fallout from ongoing trade wars, uncertainty regarding monetary and fiscal policy, and uncertainty from the expanding controversies surrounding the current administration and potential for impeachment. The latter is likely to worsen as the 2020 election cycle approaches.