Existing-Home Sales Fell in February as the Outlook Becomes Clouded

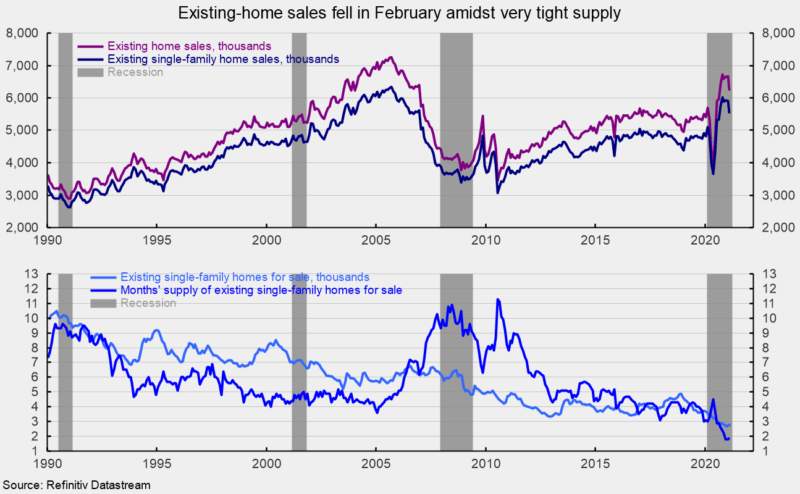

Sales of existing homes fell 6.6 percent in February, to a 6.22 million seasonally adjusted annual rate. Despite the decline, sales were above the 6 million mark for the sixth consecutive month (see top of first chart). Sales are still up 9.1 percent from a year ago.

Sales in the market for existing single-family homes, which account for around 90 percent of total existing-home sales, also fell 6.6 percent in February, coming in at a 5.52 million seasonally adjusted annual rate. From a year ago, sales are up 8.0 percent. The February pace is the eighth consecutive month above the 5 million mark but is down from a recent peak of 6.01 million in October 2020 (see top of first chart).

Condo and co-op sales posted a 6.7 percent drop for the month, leaving sales 18.6 percent above the February 2020 pace. Sales came in at a 700,000 pace for the month versus 750,000 in January, the fifth month in a row at or above 700,000.

Total inventory of existing homes for sale was unchanged at a record low 1.03 million in February, leaving the months’ supply (inventory times 12 divided by the annual selling rate) at 2.0, up from a record low 1.9 in January.

For the single-family segment, inventory was unchanged at 870,000, the lowest on record since tracking began in the mid-1980s. The months’ supply rose to 1.9 (see bottom of first chart) from a record low 1.8 in January, while the condo and co-op inventory rose 0.6 percent to 161,000, putting months’ supply at 2.8 versus 2.6 in the prior month.

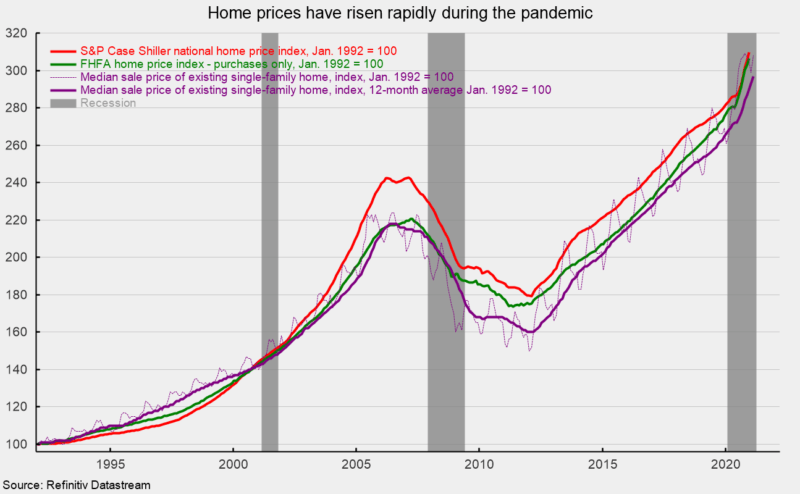

The median sale price in February of an existing home was $313,000, 15.8 percent above the year ago price. For single-family existing home sales in February, the price was $317,100, a 16.2 percent rise over the past year, while the median price for a condo/co-op was $280,500, 12.3 percent above February 2020. The sharp gains in home prices are also reflected in other home price measures. The S&P Case Shiller national home-price index is up 10.4 percent from a year ago through December 2020 while the Federal Housing Finance Agency home price index for purchases is up 11.4 percent over the past year through December. All three measures suggest home prices are at record highs (see second chart).

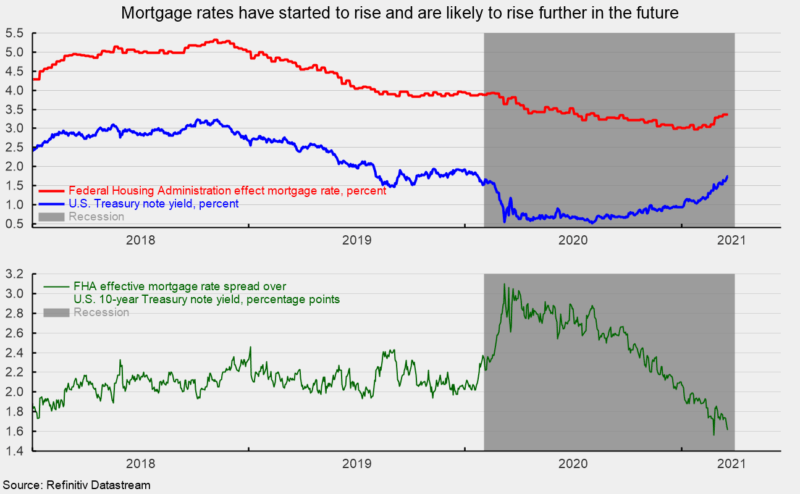

In addition to rapidly rising home prices, rising mortgage rates are likely to weigh on housing activity in coming months and quarters. While mortgage rates are still extremely low by historical comparison, mortgage rates have begun to rise along with yields on 10-year Treasury notes (see top of third chart). The spread of mortgage rates over Treasury yields has narrowed recently and if it returns to recent levels, it also suggests mortgage rates are likely to rise further.

The combination of high prices and rising mortgage rates will hurt affordability and likely contribute to slower housing activity in the future. It is likely that in time these conditions will significantly impact the overall housing market, but for now it remains one of the brightest areas of the economy with strong demand, tight supply, and rising prices.