Existing-Home Sales Fall Again in April

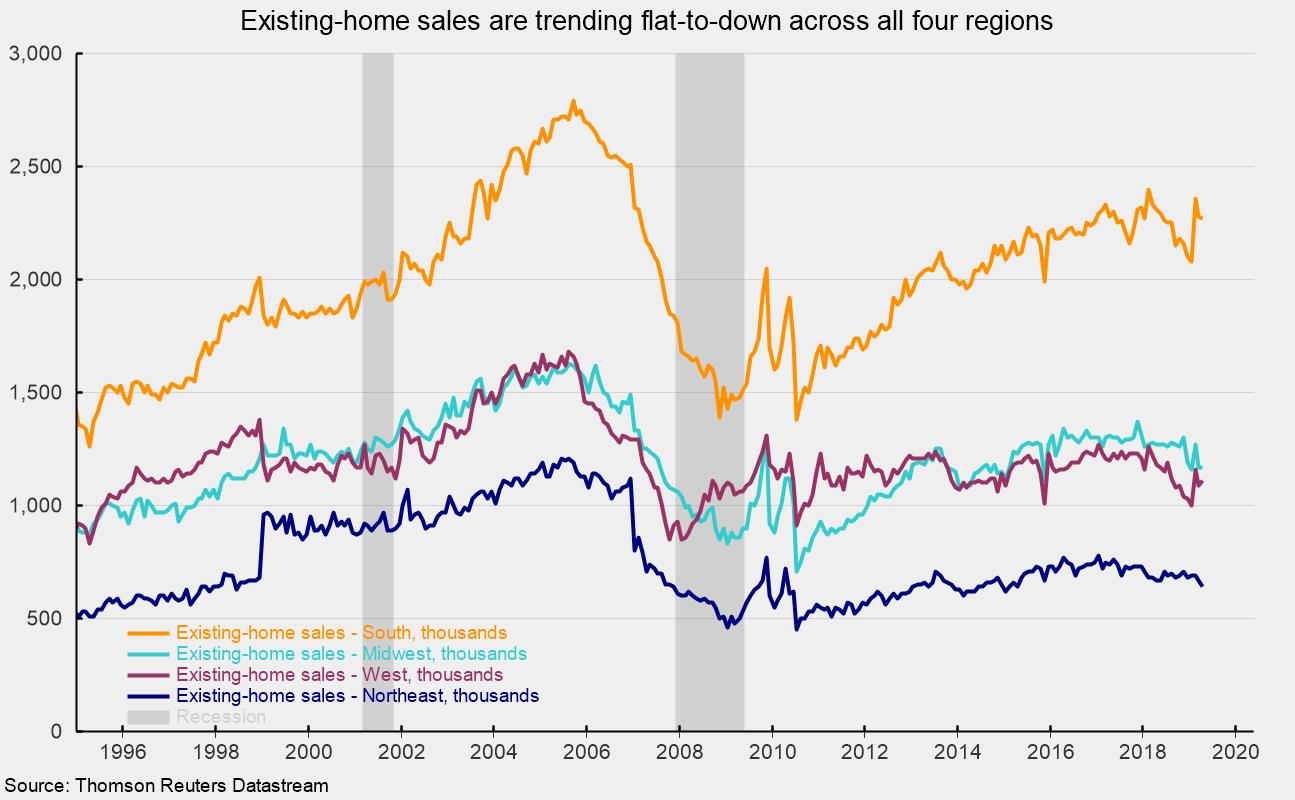

Sales of existing homes fell 0.4 percent in April to a 5.19 million seasonally adjusted annual rate. Sales are down 4.4 percent from a year ago and 8.0 percent from the recent peak of 5.64 million in November 2017. Sales declined in two of the four regions tallied: sales fell 4.5 percent in the Northeast, putting sales 4.5 percent below year-ago levels; and sales dropped 0.4 percent in the South, leaving that region’s sales rate 1.7 percent below the year-ago pace. Sales were unchanged for the month in the Midwest and 7.9 percent below the year-ago level while sales rose 1.8 percent for the month in the West but are 5.9 percent below the April 2018 rate. From a longer-term perspective, sales are trending flat or down in all four regions of the country (see chart).

Total inventory of existing homes for sale rose 9.6 percent for the month, putting the months’ supply (inventory times 12 divided by the annual selling rate) at 4.2 versus 3.8 in March, a relatively low number by historical comparison.

Sales in the market for existing single-family homes, which account for just under 90 percent of total existing-home sales, fell 1.1 percent in April, coming in at a 4.62 million seasonally adjusted annual rate. From a year ago, sales are down 4.0 percent. Total inventory of existing single-family homes for sale increased 9.5 percent to 1.61 million in April, leaving the months’ supply at 4.2, up 10.5 percent from March.

Sales are unlikely to move significantly higher in the coming months, and new-home construction is unlikely to contribute significantly on a sustained basis to growth in gross domestic product in coming quarters. Still, other areas of the economy remain generally healthy, supported by a tight labor market, rising incomes, solid balance sheets, and high levels of consumer confidence. The main risks on the horizon are uncertainty surrounding trade policy and fallout from escalating trade wars. Though economic reports continue to be somewhat mixed, the outlook is for continued economic growth as we approach the record for longest U.S. economic expansion.