Everyday Prices Surge on Food and Energy Gains in June

Note: The Everyday Price Index for June is based on incomplete data due to restrictions on data collection by Bureau of Labor Statistics personnel because of the COVID-19 outbreak.

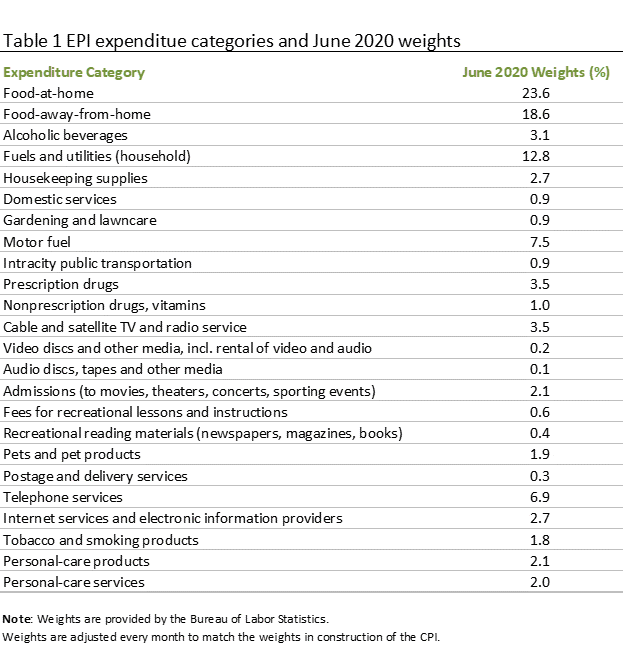

Food and energy purchases account for more than 60 percent of AIER’s Everyday Price Index. They are the things most people consume every day. Furthermore, motor-fuel prices tend to be extremely volatile, driven largely by the price of crude oil.

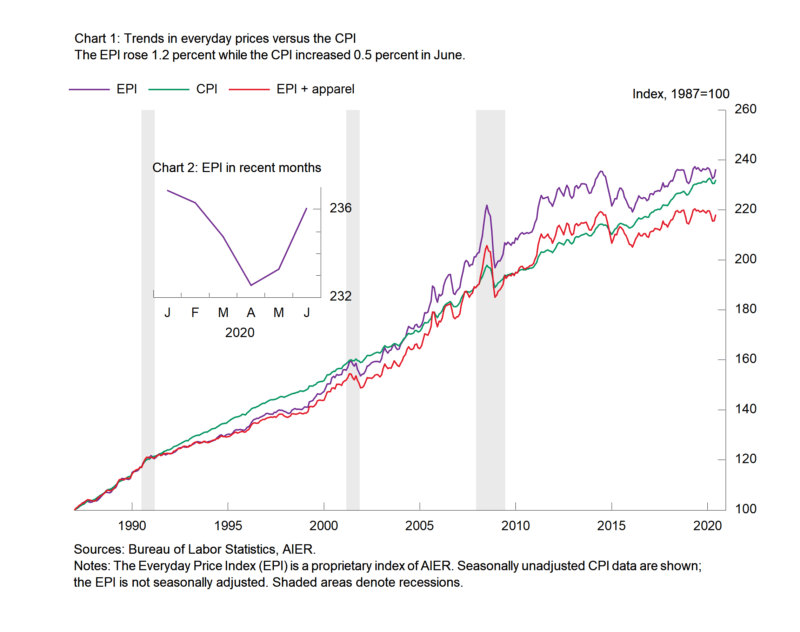

In some months, component price moves may be subdued and in other months, prices may move in opposite directions resulting in offsetting effects. However, for the month of June, the four largest components, two food and two energy, all showed large upward changes. The result was a 1.2 percent jump in the Everyday Price Index in June after posting a 0.3 percent increase in May. The Everyday Price index had fallen for three consecutive months in February through April and has been flat or down in eight of 11 months from June 2019 through April 2020 but has now posted two consecutive increases. Over the past year, the Everyday Price Index is still down 0.2 percent.

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, rose 1.1 percent in June after being flat in May. The Everyday Price Index including Apparel has been flat or down in six of the 7 months through May and is down 0.7 percent over the past year. Apparel prices rose 0.1 percent on a not-seasonally-adjusted basis in June and are down 7.3 percent over the past year.

Among the four largest components, grocery prices (food at home) rose 0.5 percent in June, contributing 11 basis points to the 118 basis-point rise in everyday prices, and are now up 5.6 percent from a year ago. Prices for food away from home also rose 0.5 percent for the month and are 3.1 percent above June 2019. Motor fuel prices surged 9.8 percent for the month on a not-seasonally-adjusted basis, putting the 12-month change at -23.3 percent while fuels and utilities prices jumped 1.8 percent, leaving the price index equal to June 2019. Combined, those four components accounted for 62.5 percent of the Everyday Price Index in June. Other notable contributions to the Everyday Price Index were from personal care services (+0.2 basis points) offset by pets and pet products (-0.2 basis points).

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.5 percent on a not-seasonally-adjusted basis in June. The Everyday Price Index is not seasonally adjusted, so we compare it with the unadjusted Consumer Price Index. Over the past year, the Consumer Price Index is up just 0.6 percent. For the Consumer Price Index excluding food and energy, the index rose 0.2 percent for the month while the 12-month change came in at 1.2 percent. Within the core, core goods prices were unchanged in June and are down 1.1 percent from a year ago while core services prices rose 0.3 percent for the month and are up 1.9 percent from a year ago.