Everyday Prices Rise Just 0.9 Percent in 2020

Note: The Everyday Price Index for December is based on incomplete data due to restrictions on data collection by Bureau of Labor Statistics personnel because of the Covid-19 outbreak.

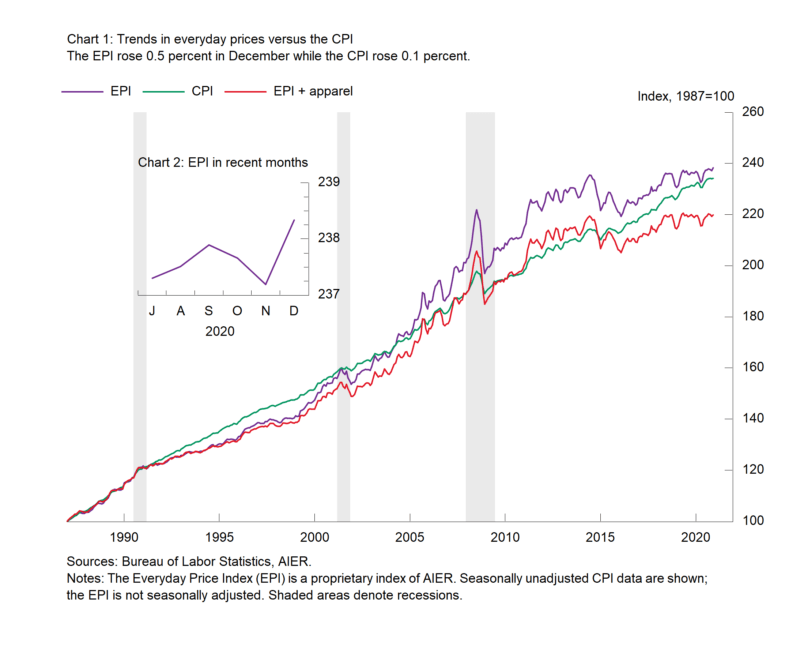

The AIER Everyday Price Index jumped 0.5 percent for the month of December while the more encompassing Consumer Price Index gained just 0.1 percent (on a not-seasonally-adjusted basis). December was the first increase in the Everyday Price Index following two consecutive decreases. Prior to those declines, the Everyday Price Index had risen for five straight months from May through September. The index had declines in three of the first four months of 2020; in total, the index posted seven increases and five decreases over the 12 months through December. For all of 2020, the Everyday Price Index is up just 0.9 percent.

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, rose 0.3 percent in December, reversing a 0.3 percent drop in November. Over the year, the index posted four declines, six increases, and was unchanged twice. In total, the index is up just 0.5 percent over the 12 months through December 2020.

Apparel prices fell 1.9 percent on a not-seasonally-adjusted basis in December and are down 3.9 percent over the past year. Within the apparel category, women’s and girls’ apparel fell 2.4 percent for the month (and are down 5.9 percent over 12 months) while men’s and boys’ apparel fell 1.6 percent for the month (and 3.2 percent over the past year). Footwear prices were down 1.5 percent in December and 2.2 percent from a year ago.

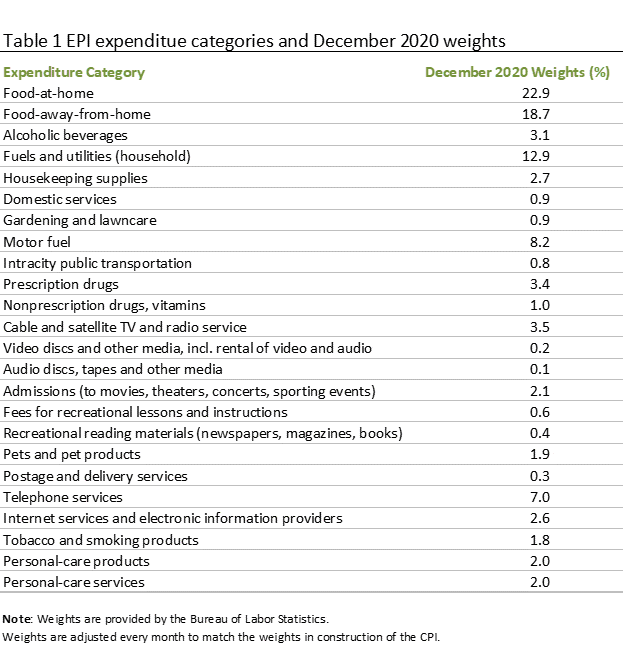

Food and energy items are the largest components in the Everyday Price Index. Food at home (groceries), food away from home (restaurants), household fuel and utilities, and motor fuel (primarily gasoline) all made positive contributions to the monthly change in the Everyday Price Index in December. Groceries rose 0.3 percent, restaurant prices increased 0.4 percent, household fuels and utilities gained 0.6 percent, and gasoline was up 3.4 percent for the month. Over the 12 months of 2020, three posted gains (groceries up 3.9 percent, restaurants up 3.9 percent, and household fuels up 2.3 percent) while one, motor fuel, had a decline (down 15.3 percent). In total, 12 categories had increases in December while 11 posted declines and one was unchanged. For the full year, 15 had higher prices while 9 had lower prices.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.4 percent on a seasonally-adjusted basis (versus the 0.1 percent increase on a not-seasonally-adjusted basis) in December. Over the past year, the Consumer Price Index is up just 1.4 percent. Excluding food and energy, the core Consumer Price Index was up 0.1 percent for the month after seasonal adjustment while the 12-month change came in at 1.6 percent.

Within the core, core goods prices rose 0.2 percent in December and are up 1.6 percent from a year ago while core services prices rose 0.1 percent for the month and are also up 1.6 percent from a year ago. Among the increases in core goods were new vehicle prices, up 0.4 percent for the month and 2.0 percent for the year, and apparel prices (on a seasonally-adjusted basis), up 1.4 percent in December. Partially offsetting those gains, used car and truck prices fell 1.2 percent for the month but are still up 10.0 percent from a year ago.

Within core services, motor vehicle insurance rose 1.4 percent, cable and satellite service rose 0.4 percent (and is up 4.2 percent for the year), tuition and childcare increased 0.2 percent, haircuts and personal services rose 1.0 percent, and bank services surged 8.5 percent.

Overall trends in prices remained moderate in 2020 though monthly volatility remains significant, especially as economic activity remains distorted by government restrictions on businesses and consumers.