Everyday Prices Pushed Higher by Phone Service and Restaurants

Note: The Everyday Price Index for August is based on incomplete data due to restrictions on data collection by Bureau of Labor Statistics personnel because of the Covid-19 outbreak.

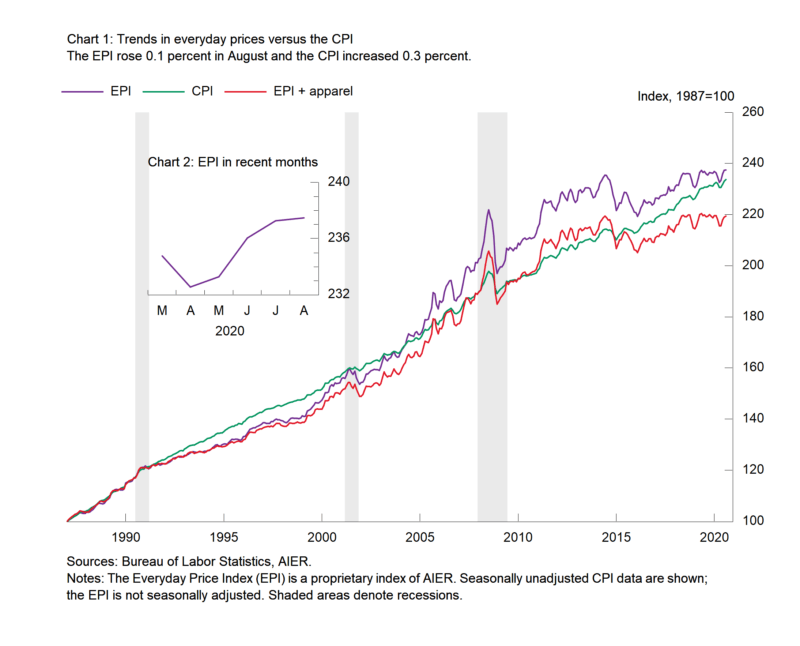

The AIER Everyday Price Index rose 0.1 percent for the month of August, less than the 0.3 percent rise in the more encompassing Consumer Price Index (on a not-seasonally-adjusted basis). The Everyday Price index had fallen for three consecutive months in February through April and had been flat or down in eight of 11 months from June 2019 through April 2020 but has now posted four consecutive increases. Over the past year, the Everyday Price Index is now up 0.7 percent, the fastest pace since February.

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, rose 0.2 percent in August after increasing 0.4 in July and 1.1 percent in June. The Everyday Price Index including Apparel had been flat or down in eight of the 12 months from June 2019 through May 2020 but has posted three consecutive gains from June through August 2020. The index is now up 0.1 percent over the 12 months through August 2020, the first increase since March. Apparel prices rose 1.8 percent on a not-seasonally-adjusted basis in August but are still down 5.9 percent over the past year.

The largest contributors to the rise in the Everyday Price index in August were telephone services prices (primarily wireless phone services) and restaurant prices with smaller contributions coming from cable and satellite services, pets and pet products, admissions prices to movies, theaters, concerts, and sporting events, nonprescription drugs, and alcoholic beverages.

Telephone services prices rose 0.6 percent on a not-seasonally-adjusted basis following a 3.0 percent jump last month and small declines in four of the five months between February and June. From a year ago, telephone services prices are up 5.0 percent. Prices for food away from home (restaurants) also rose, increasing 0.3 percent and are 3.5 percent above August 2019.

Partially offsetting those increases was a sharp decline in intracity transportation, plunging 6.8 percent for the month and the fourth decline in a row. Over the past years, intracity transportation prices are down 9.0 percent. Declines in food at home (groceries), household fuels and utilities, housekeeping supplies, and personal care services also helped offset the gains.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.3 percent on a not-seasonally-adjusted basis in August, and 0.4 percent after seasonal adjustment. Over the past year, the Consumer Price Index is up just 1.3 percent. Food and energy prices rose in August with food prices up 0.1 percent and energy prices gaining 0.9 percent. For the Consumer Price Index excluding food and energy, the index rose 0.4 percent for the month after seasonal adjustment while the 12-month change came in at 1.7 percent.

Within the core, core goods prices were up 1.0 percent in August and are up 0.4 percent from a year ago while core services prices rose 0.2 percent for the month and are up 2.2 percent from a year ago. Among the increases in core goods were used vehicle prices (up 5.4 percent, the largest increase since March 1969), appliances (2.0 percent), video and audio products prices (up 1.4 percent), and furniture (1.6 percent).

Within core services, gains were led by car and truck rentals (up 4.6 percent), and moving, storage and freight prices (up 2.6 percent), airline fares (1.2 percent), and motor vehicle repair services (1.0 percent).

Like other economic measures such as production (supply) and consumption (demand), prices have been severely impacted by the shutdown of the economy. Distortions to activity and prices will continue as long as restrictions are in place.