Energy Price Jump Leads Broad-based Increase in Everyday Prices

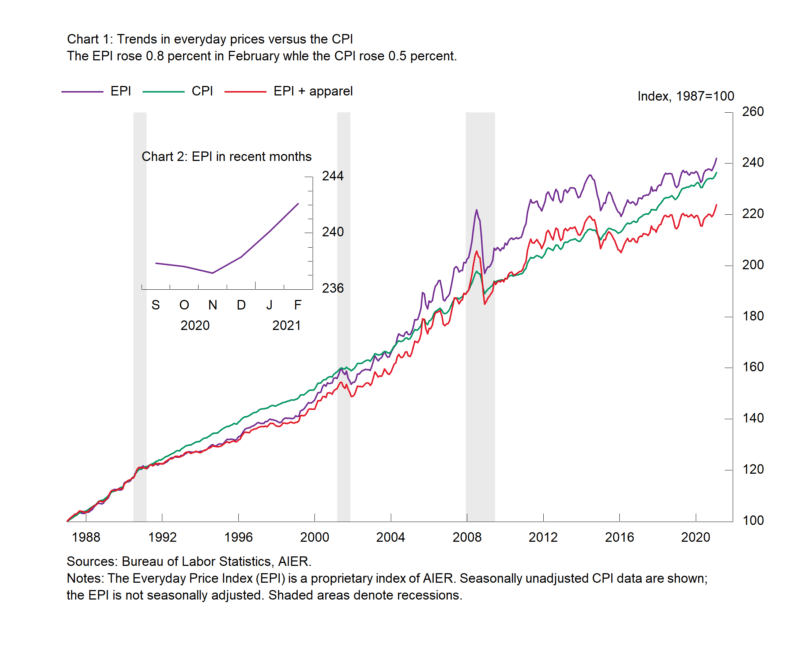

For a second consecutive month, everyday prices moved sharply higher with gains led by energy goods and services, especially motor fuels. The AIER Everyday Price Index increased by 0.8 percent for the second month in a row, putting the 12-month gain at 2.5 percent, the fastest pace since January 2020 and second fastest since October 2018. Gains were widespread for categories within the Everyday Price Index with price increases outnumbering categories with decreases by almost 3 to 1.

The Everyday Price Index including apparel, a broader measure that includes clothing and shoes, rose 0.9 percent in February, matching the gain in January. Over the past year, the Everyday Price Index including apparel is up 2.0 percent, the fastest since January 2020. Apparel prices rose 1.9 percent on a not-seasonally-adjusted basis in February following a 2.9 percent jump in January. However, from a year ago, apparel prices are off 3.6 percent.

The Consumer Price Index, which includes everyday purchases as well as infrequently purchased, big-ticket items and contractually fixed items, rose 0.5 percent on a not-seasonally-adjusted basis in February. Over the past year, the Consumer Price Index is up 1.7 percent. For the Consumer Price Index excluding food and energy, the index rose 0.3 percent for the month (not seasonally adjusted) while the 12-month change came in at 1.3 percent. Within the core, core goods prices were up 0.4 percent in February and are up 1.3 percent from a year ago while core services prices rose 0.3 percent for the month and are up 1.3 percent from a year ago.

Among the major contributors to the February change in the Everyday Price Index, motor fuel prices jumped 6.9 percent on a seasonally unadjusted basis, contributing 58 basis points to the 0.8 percent increase, household fuels and utilities added 12 basis points, and food at home added 6 basis points. Other positive contributors included intracity transportation, cable and satellite service, and admissions prices. The few negative contributors included housekeeping supplies, as well as prescription and nonprescription drug prices.

Volatile energy prices continue to drive month-to-month moves in the Everyday Price Index though increases also broadened among the components in February. However, prices, like many measures of activity within the economy, continue to be distorted by government restrictions on consumers and businesses. As restrictions are lifted and activity returns to normal, prices will begin to reflect true market forces.