ECB Opens Real-Time Retail Payments System

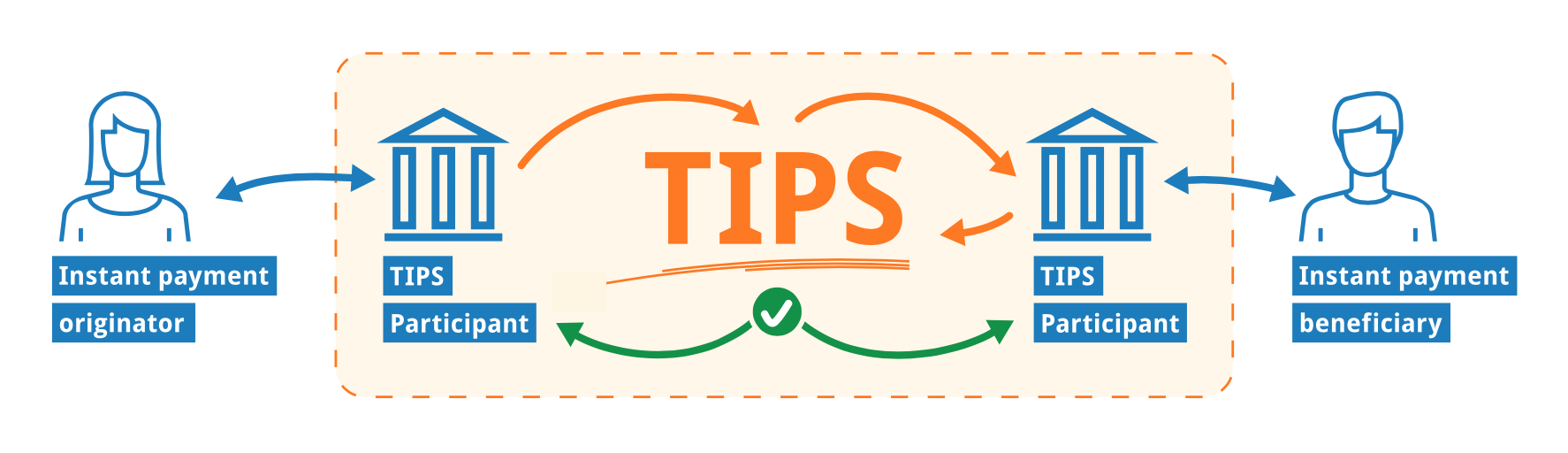

European payments just got a whole lot faster. Last week, the European Central Bank (ECB) announced that its new Target Instant Payments Settlement (TIPS) system was open for business. TIPS will allow regular Europeans to make instant small-value payments, say $10 to $100, through the ECB 24 hours a day, seven days a week.

Faster payments are great, but they do not come free. National payments systems must make trade-offs among speed, finality, and efficiency.

In Europe, like the rest of the world, small-value retail payments have typically been glacially slow, taking two or three days to settle. A €100 payment sent to a friend’s account would be batched over the course of the day with millions of other payments. That evening, the ECB would clear these batches by calculating each bank’s owing or owed amount. The next day, the banks would settle their tabs using funds held at the ECB. Only then would the €100 be accessible to the friend. If the payment was made on a Friday afternoon, the funds probably wouldn’t arrive till the following Tuesday morning. That’s a long wait!

TIPS speeds everything up by getting rid of batching and next-day settlement. For each payment, the sender’s bank immediately settles with the destination bank over TIPS in central bank funds. In the next instant, the receiving bank credits the friend’s account with €100. There’s no longer any need to worry about beating bank closing times. Not only will TIPS be open 24 hours a day, it will also be up and running on holidays and weekends.

Europe is by no means a trailblazer. The U.K. was one of the first nations to set up a real-time retail payments system when it rolled out the Faster Payments system 10 years ago. About two dozen other systems have now been installed across the globe including India’s IMPS in 2010, Sweden’s BiR in 2012, Singapore’s FAST in 2014, and Australia’s NPP earlier this year. In the United States, privately owned The Clearing House went live with its RTP platform in late 2017.

For retail customers, fast speeds are great. No more worrying whether a rent payment will be settled on time; rent payments can be processed in a few seconds. If a son or daughter has an emergency and needs funds ASAP, parents needn’t fear that funds will be held up by batching and next-day settlement. Small businesses use these systems to quickly pay suppliers while remittance companies like Western Union and Transferwise are using them to make lightning-fast cross-border payouts.

It’s tempting to see central bankers as Luddites. After all, we’ve been sending email instantaneously for decades; what took central bankers so long? But in payment systems, speed should never be analyzed in isolation. Higher speeds often come at the expense of efficiency or credit quality. Viewed in this light, sluggishness isn’t necessarily a bug; it may in fact be a wise design choice.

Assume that over the course of a day retail customers of two different European banks submit 1,000 individual payments requests to their bank, the recipient in each case being a customer at the other bank. If these are to be settled in real time on TIPS, banks A and B will have to transact with each other on a line-by-line basis 1,000 times that day. That’s a lot of work!

The seemingly archaic combination of batching and delayed settlement that TIPS is replacing is actually quite magical. By batching these 1,000 payments and then cancelling the ones from A to B with those from B to A, the entire system can balance with just a single end-of-day payment from one bank to the other. Much easier, right? That’s how the legacy systems work: delayed, but efficient.

Further, to ensure that each of the 1,000 customer payments requests can be made in real time on TIPS, the ECB requires the two banks to keep a permanent balance in their central bank accounts. If either bank runs out of a balance, they’ll have to tell their customers that the payment temporarily can’t be processed. Banks generally don’t like to deny customer requests.

However, maintaining a sufficiently large buffer stock of liquidity at the central bank is costly. Bank resources are kept inert in a queue rather than being productively invested. Sure, old-fashioned batching and end-of-day settlement may be slow. But they have the advantage of obviating the need for a permanent buffer stock. Resources that would have been queued can be liberated for better uses. These cost savings flow back to customers in the form of cheaper, albeit slower, payments.

Interestingly, the U.K.’s Faster Payments service provides real-time payments while also relying on good old-fashioned batching and deferred settlement. When a British customer at bank A pushes £50 to the account of a customer at bank B, bank B will immediately make the £50 available to its customer. However, bank B is now out of pocket. It still hasn’t received a compensating £50 from bank A in central bank funds. Final reckoning will be deferred to one of Faster Payment’s three daily-settlement windows, at which point all of A’s and B’s payments will be summed and cancelled, the net amount being paid from debtor to creditor. Only then will bank B be made whole.

Compared to TIPS, Faster Payment is relatively efficient. Because settlement is deferred for a few hours, banks need not keep a permanent reserve of funds on hand at the central bank. And since payments will be netted against each other rather than being settled on a line-by-line basis, the amounts that eventually pass back and forth at each settlement window will be much smaller.

There is a drawback, however. Faster Payments sacrifices what is often referred to as finality. Until the next settlement window, bank B is forced to become a creditor to bank A. If bank A goes under, bank B might never get the £50 it’s owed. This credit risk is a real cost of doing business. To recover it, U.K. banks may be forced to burden their customers with higher fees. By contrast, neither slow legacy systems nor TIPS does away with finality. In both systems, a bank will only credit its customers’ accounts with funds after it has settled with the originating bank.

Speed is a nice feature. But even as nations shift to instant retail payments, don’t forget that speed comes at a price. Whereas TIPS gains speed at the expense of efficiency, the U.K.’s Faster Payments system sacrifices finality to get higher speed. Sometimes slow really is best.