ECB: On the Credit Wave towards Zombification

When recently Christine Lagarde, president of the European Central Bank, invited on Twitter the European youth to help shape the future of the euro, she was swamped by a wave of criticism. Most of the responses contained the hashtag #bitcoin, revealing a certain distrust against the euro, the ECB and Christine Lagarde. Indeed, the asset purchase programs of the ECB have pushed up asset prices, making it difficult for young people to buy a home or build up wealth. As we will show, the so-called (Targeted) Longer-term Refinancing Operations ((T)LTROs) further zombify the European economy and deteriorate the real income prospects of young Europeans.

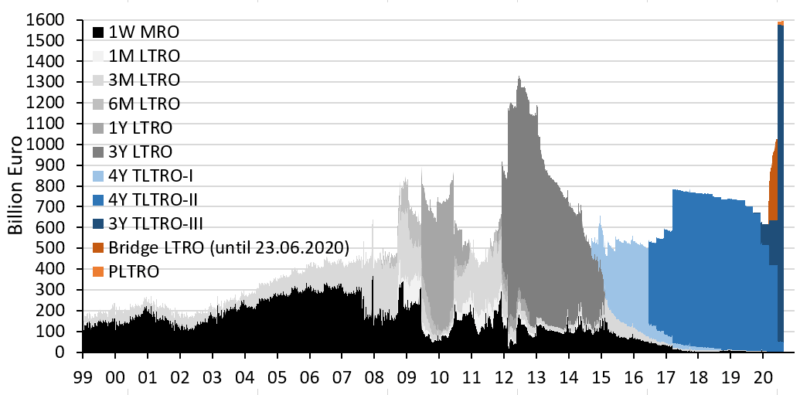

Outstanding Refinancing Operations of the ECB

(T)LTROs – are the second important monetary policy instrument of the European Central Bank. On 24 June 2020, euro area banks raised €548 billion in additional loans in the fourth round of the Targeted Longer-Term Refinancing Operations III (TLTRO-III) (Schnabl and Sonnenberg 2020). The stock of outstanding long-term loans, most of which now have a maturity of three years, has jumped to about €1,600 billion (see chart). The ceiling is currently set by the ECB at 50% of the sum of the commercial banks’ outstanding loans to companies and households (excluding real estate loans) as of February 2019. This implies a credit limit for (T)LTRO loans of around €3,000 billion (Lagarde 2020).

Most of the outstanding long-term loans are distributed among four countries (as of the end of June): Italian and French banks accounted for 22% each, German banks for 18% and Spanish banks for 16%. Thus, the ECB does not seem to follow a country distribution according to her capital key when granting longer-term loans. Moreover, given full allotment, the allocation policy seems to be driven by the demand of the individual banks. To ensure that banks with higher risks have access to long-term refinancing operations, the collateral requirements were relaxed on 7 April 2020 (European Central Bank 2020).

The interest rate on long-term refinancing operations is based on the interest rate of the ECB deposit facility, which is currently -0.5%. In the wake of the corona crisis, the ECB has established a one-year special interest rate period: If the commercial banks do not reduce net lending in the period from March 2020 to March 2021, the interest rate can even be lowered to -1% during this period. Banks thus receive particularly large subsidies from the ECB if they take out additional loans from the ECB and pass them on to companies and households.

In the current crisis, this “Funding for Lending” supports the enterprises in the euro area, because more favorable loans are available and investment projects with low profitability can be continued. Banks also benefit because bankruptcies are avoided and the volume of nonperforming loans is reduced. The interest margins of banks can rise again thanks to negative interest rates, because in the private capital markets the refinancing costs would probably be positive.

One problem arises from the negative incentive effects. As the conditions for the continuation of loans are softened, investment projects with low or even negative returns are kept alive. For Japan Sekine, Kobayashi and Saita (2003) have dubbed this phenomenon “forbearance lending:” Companies only survive because the banks no longer sufficiently price in the credit default risk. Over time, the expected return and the productivity gains of these “zombified” companies are kept low or are further declining.

Banerjee and Hofmann (2018) from the Bank for International Settlements show that the proportion of zombie companies in most industrialized countries has been rising in trend even before the crisis. This process is likely to be intensified further with the extensive corona emergency lending. IMF data show that the share of nonperforming loans has been higher among southern European banks than in the northern euro area before the crisis. Albeit declining before the crisis, they can be expected to rebound.

Combined with the negative interest rates that commercial banks have to pay for deposits at the ECB, this results in a regional redistribution effect within the monetary union. The banks in the northern euro area hold a disproportionately high amount of deposits with the ECB and thus pay disproportionately high penalty interest to the ECB. By contrast, banks in the southern euro area benefit over-proportionally from the negative interest rates on (T)LTRO loans. This implies that weak banks in the south may become a burden for still stronger banks in the north.

All in all, the process of capital allocation, as is usually the case in a market economy, is turned upside down. In the old world, companies strived for profits by investing in more efficient production processes or innovative products. Because they expected higher profits, they were prepared to pay a positive rate of interest (see Böhm von Bawerk 1884). The banks charged a risk premium, which gave companies a permanent incentive to keep the risk of default low, also anticipating lower profits in a downturn.

In the new world, the ECB is the originator of lending. As collateral requirements are softened, the ECB transfers a premium to the banks, which lend to enterprises. As in the wake of the euro crisis, weak banks can keep weak companies afloat by not charging sufficiently high risk premiums (see Storz et al. 2017). The banks may even have an incentive to convince companies to launch new investment projects with a low expected return. In theory, even a new project with a nominal return of zero (e.g. cash hoarding) is advantageous because the bank and the company can share the premium paid by the ECB.

The growth effects of the (T)LTRO wave are therefore likely to be negative in the long run as bankruptcies and painful restructurings will be prevented in the short term. Hence productivity gains are likely to continue to decline or even become negative on average. Kornai (1986) once spoke of soft budget constraints for the Central and Eastern European planned economies: Since restructurings of loss-making state-owned enterprises was taboo to avoid unemployment, the state-controlled banking sector granted mainly unconditional loans. The banks’ losses were covered by the central bank via the printing press.

The European Monetary Union is now following a similar path. With the (T)LTRO wave it is moving into an increasingly soft budget constraint for a growing number of companies. The zombification that has already begun in the south of the monetary union is likely to spread to more and more companies in the north of the union.

As in the planned economies, negative productivity gains and painful prosperity losses will be unavoidable. Because productivity gains are the basis for real wage increases, the benign long-term credit conditions of the ECB increasingly become a burden for the young people in Europe. Their wages tend to decline in comparison to former generations. If the ECB would like to be a custodian of youth, it should therefore fundamentally revise its lending policy.