Durable-Goods Orders Post Sixth Consecutive Gain

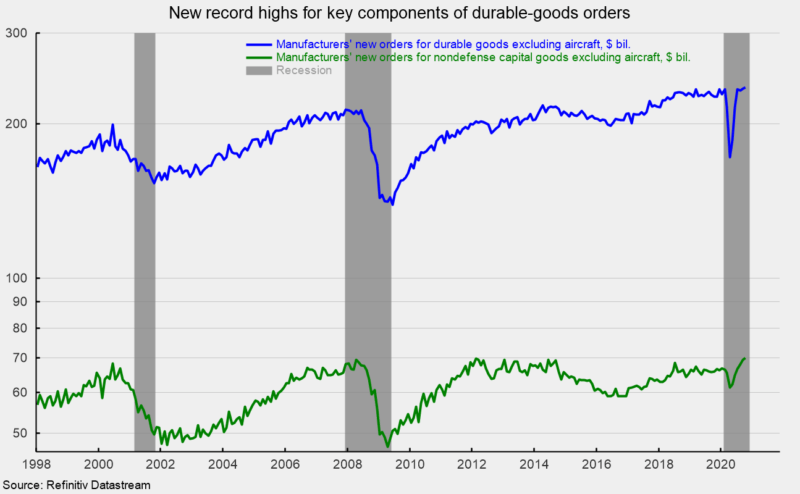

New orders for durable goods posted a sixth consecutive gain in October, rising 1.3 percent following a gain of 2.1 percent in September. Durable-goods orders excluding aircraft and parts rose 0.4 percent for the month following a gain of 0.9 percent in September. That is the fifth gain in the last six months and puts the level of orders at $235.2 billion, a new record high (see first chart).

New orders for nondefense capital goods excluding aircraft, a proxy for business equipment investment, rose 0.7 percent in October after gaining 1.9 percent in September, putting the level at $70.0 billion, a new record high. This important category had been in the $65 to $70 billion range for several periods over the past 15 years before dropping to $61.3 billion in April 2020. The $61.3 billion pace was the slowest since August 2017 (see first chart).

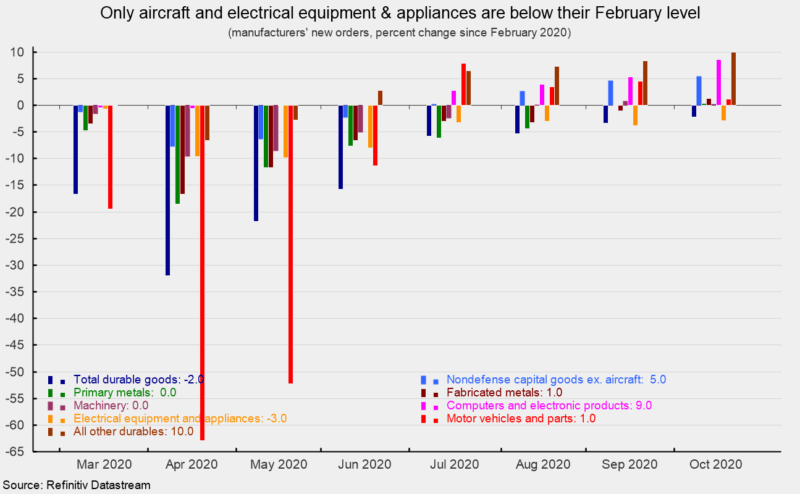

All but one of the major categories of durable goods shown in the report had a gain in the latest month. Among the individual categories, primary metals rose 4.0 percent, fabricated metal products gained 2.3 percent, machinery orders were off 0.6 percent, computers and electronic products increased 3.1 percent, electrical equipment and appliances gained 1.0 percent, transportation equipment orders rose 1.2 percent, and the catch-all “other durables” category was up 1.4 percent. Following the sharp declines in March and April, six relatively solid months of gains leaves only one category outside of aircraft below its February 2020 level, electrical equipment and appliances; all other non-aircraft categories are back above their February level (see second chart).

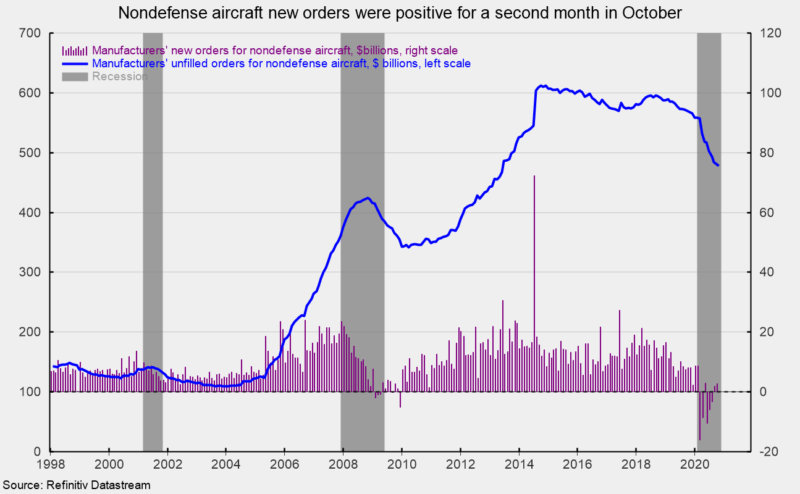

Nondefense aircraft orders were positive in October, totaling $38.8 billion after suffering net negative orders in five of the past eight months (see third chart). Net negative new orders represent cancellation of previously placed orders totaling more than total new orders for the period. Despite the recent gains in orders, significant cancellations over the past several months have left unfilled orders for nondefense aircraft at $484.5 billion, the lowest total since May 2013 (see third chart).

The report on durable-goods orders reflects the continued positive effects of the easing of government shutdown policies implemented in reaction to the outbreak of Covid-19. Extraordinary damage has been caused, but as government restrictions are eased, signs of recovery have emerged. However, the recovery is very uneven across the economy and the recent surge in new Covid-19 cases has resulted in renewed government restrictions, threatening the recovery.