Durable-Goods Orders Excluding Aircraft Surge to a Record

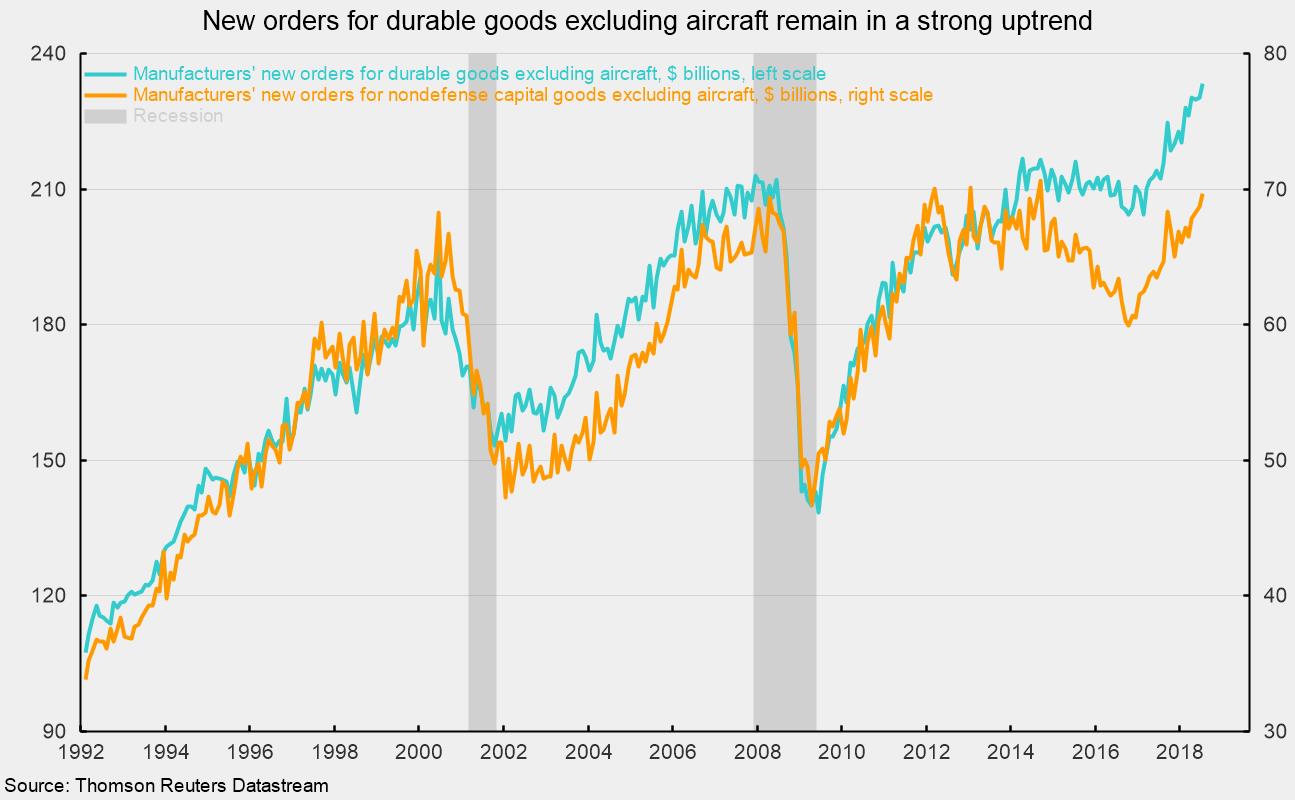

New orders for durable goods fell 0.2 percent in July, dragged down by a 35.4 percent plunge in nondefense aircraft and a 34.6 percent drop in defense aircraft. Because of the large per-unit price and the tendency for buyers to place orders for multiple aircraft at once, both of these series tend to be extremely volatile. If aircraft are excluded, new orders for durable goods jumped 1.3 percent in July following a gain of 0.2 percent in June. Since February 2017, new orders for durables excluding aircraft have been on a strong uptrend, rising 14.2 percent (see chart).

The majority of categories of durable goods shown in the report posted a gain in the latest month. Among the industries showing increases, orders for primary metals rose 0.3 percent, putting the year-to-date gain for 2018 versus the first seven months of 2017 at 16.8 percent; machinery orders were up 0.6 percent, pushing the year-to-date gain to 6.5 percent; orders for computers and related equipment gained 12.6 percent, though orders year-to-date are still down 13.5 percent from 2017; and motor vehicles gained 3.5 percent, resulting in a year-to-date gain of 6.3 percent. Orders for fabricated metal products were unchanged in July and are up 11.0 percent year to date.

Categories showing declines for July are electrical equipment and appliances, down 0.2 percent (up 5.8 percent for 2018), communications equipment, down 3.2 percent for the month but still up 8.1 percent for the year, and the catchall “other durables” category, off 0.4 percent in July but still 4.4 percent ahead of last year.

Within the report on new orders for durable goods are data on new orders for capital equipment, or business investment. This subcategory is particularly important for two reasons. First, business investment can have a major impact on future productivity trends, and productivity is critical for helping offset cost increases as well as raising living standards over the long term. Second, capital-goods orders are important as they tend to be early indicators of turns in the business cycle. Real new orders for core capital goods — that is, real nondefense capital goods excluding aircraft — is one of the indicators in AIER’s Leading Indicators index.

On a nominal basis, new orders for core capital goods rose 1.4 percent in July following gains of 0.6 percent in June and 0.7 percent in May. In a manner similar to the broader durables-goods category, the trend of new orders for core capital goods has been solidly upward since late 2016. New orders for core capital goods are up 16.2 percent since October 2016 (see chart again). Year to date, new orders for nondefense capital goods excluding aircraft are up 7.2 percent over 2017.

Today’s report on durable-goods orders suggests that demand remains strong, especially for business investment, and that the broader economy is maintaining solid momentum in the second half of 2018. Combined with the latest favorable results of the AIER Leading Indicators index and other data on the labor market, business and consumer sentiment, household and corporate balance sheets, personal income, and corporate sales and earnings, the outlook remains positive with little risk of recession in the coming months and quarters.