Does monetary equilibrium equal NGDP targeting?

In the last recent years, the idea of NGDP targeting as a better, if not the optimal, target for central banks has received special attention. Surely the idea is not new, but the recent increase in interest is hard to deny. The idea is that the central bank should not target an interest rate, like the Fed Funds rate in the U.S. or the price level, but Nominal Gross Domestic Product (NGDP.) The idea is quite simple and straightforward. If there is monetary equilibrium, arguably what any central bank should aim to achieve, then nominal income (per capita) becomes stable.

The connection between monetary equilibrium and NGDP comes from the quantitative theory of money: MV = Py where M is money supply, V is money velocity or the inverse of money demand, P is the price level, and y is real GDP. If money is a good, it then follows that there is a demand and a supply. It also follows then that there is an equilibrium in this market where quantities demanded and supplied are the same. In equilibrium then, MV remains constant (per capita) and therefore Py, which is NGDP, remains constant as well.

There are different versions of this rule. Hayek’s rule, for instance, argues for a 0% growth of NGDP or nominal income. Market Monetarists tend to favor a positive growth rate (for instance 5%) where what is fixed is the trend but not the level. Regardless of what the right path of NGDP should be, a previous questions remains unanswered, and is why NGDP is the best proxy for monetary equilibrium.

When we write MV = Py, the meaning of the term that plays the role of money demand (V) is not independent of the right-hand side of the equation. In this equation, V is the average number of times a dollar is used to buy final goods and services. Similarly, P is the price level associated to final goods and services. There is no reason, however, to ignore all the transactions that take place before the final stage of production of final goods and services, like the exchange of intermediate goods or any transaction that economics agents are involved with that may not be capture in GDP calculations.

Consider now MV = PT where T denotes all the transactions that take place in the economy and P the price level associated to all transactions in the economy rather than only final goods and services. Because the right-hand side of the equation changes, also does the left-hand side of the equation. Namely, M*V(y) and M*V(T) are not the same [where V(y) and V(T) are the money velocities associated to GDP and all transactions respectively.]

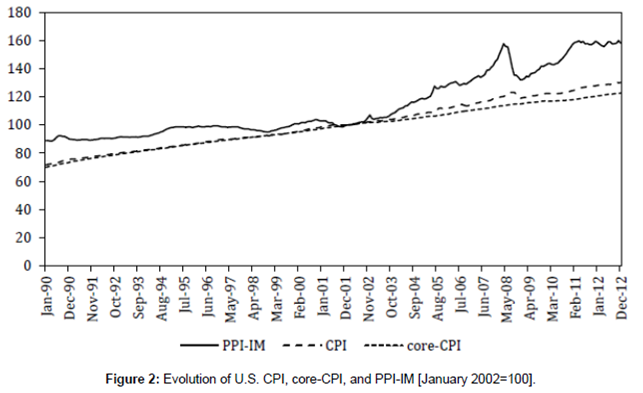

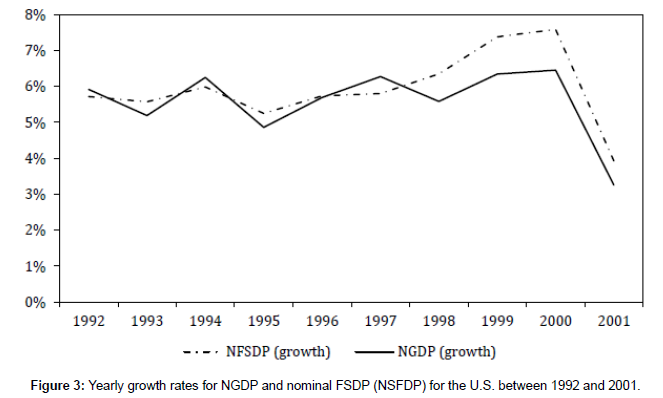

There is more than one nominal income variable then. And therefore NGDP may or may not be the best variable to target. Below are two graphs that compare behavior of alternative variables. The deviation between NGDP and the alternatives suggests that the question of what the best target is requires more scrutiny. The first graph shows the evolution of the CPI (and core-CPI) and the PPI for intermediate goods. In monetary equilibrium, the nominal income to the factors of production (labor and capital) should remain stable. An increase in the price of factors of production with respect to the CPI suggests a potential excess of money supply even if NGDP grows at the desired target level. The second graph compares NGDP with Nominal Final Sales to Domestic Purchasers (NFSDP). Especially in the years before the dot-com crisis a faster growth of NFSDP can be observed. The graphs come from this paper.