Do or Die: We Need a Corporate-Tax Face-Lift

Both the Obamacare quagmire and corporate taxes stand in the way of US economic competitiveness. President Donald Trump campaigned on overhauling the tax code and has recently proposed numerous tax cuts, most notably reducing the notoriously high corporate tax rate of 35 percent down to 20 percent.

Any substantial reduction to the current corporate tax rate would be a welcome development for fiscal matters. Just last year a report from the Treasury Department claimed that the federal government’s ever-growing budget deficit can be largely attributed to a shrinking corporate tax base and lagging productivity.

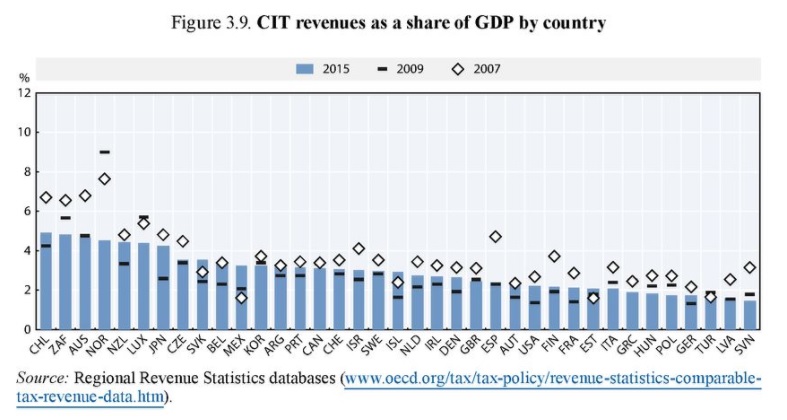

Naturally, many will spin this report as an opportunity to justify tax hikes. However, despite the popular belief that tax hikes lead to increased tax revenues, the United States has the highest corporate tax rate in the industrialized world and still struggles to extract high rates of revenue when compared to her OECD rivals.

Enter the Laffer curve.

Developed by renowned economist Arthur Laffer, the Laffer curve is elucidates the premise that the more an activity is taxed — in this case corporate revenue — the less tax revenue is generated, at least once the disincentive effects grow large enough. In other words, there is a ceiling for revenue maximization. If tax rates are raised too high, less taxes are collected due to people working less, evading taxes, or deciding to take their talents and investments elsewhere.

The United States does not live in an institutional vacuum; her citizens respond to tax incentives just like they do with prices. As a result of onerous US corporate taxes, many corporations choose to establish their headquarters in low-tax countries and also invest abroad.

In this equation, corporations are not the sole victims. They pass higher taxes down to consumers and workers through more expensive products and lower wages. Similarly, these policies also hurt shareholders and deter capital investment that is crucial for economic growth.

Perhaps lagging productivity has contributed to the widening budget deficit. That being said, raising corporate tax rates — a policy that is hardly conducive to fostering entrepreneurship and investment — is not the way to boost productivity. A study by the World Bank demonstrates that increases in corporate tax rates have adverse effects on both investment and productivity.

On the other hand, the rest of the developed world has reduced its average corporate tax burden to almost 22 percent. Increased tax competition has allowed for countries to attain the most productive businesses and individuals across the globe.

In addition, this dynamic has limited the predatory nature of many governments, which now must tread lightly when catering to the needs of individuals. A government that faces the threat of individuals taking their businesses and talents elsewhere will be compelled to behave differently.

The United States must compete or fall behind, and that means joining the rest of the developed world in reducing her overall corporate tax burden. Businesses win out, as they can now invest more domestically and expand their operations. Average consumers also benefit, as they can enjoy cheaper and more readily available goods and services thanks to a low-tax environment.

Image: a1myjob course.