Did Tight Monetary Policy Result in a Sluggish Recovery?

There is little doubt that the Federal Reserve’s failure to stabilize nominal spending in 2008 and 2009 resulted in a severe economic contraction. Production slumped and the unemployment rate climbed to 10 percent. But, in recent years, some have claimed that monetary policy remained tight thereafter, slowing down what would otherwise have been a rather speedy recovery.

David Beckworth provides a clear statement. He argues that monetary policy has been “too tight … for the better part of a decade.” The Fed has failed to hit its 2 percent inflation target, with its preferred measure “averaging about 1.5 percent since 2009.” And nominal spending, which grew at roughly 5.6 percent from 1987 to 2007, has “averaged only 3.6 percent per year” in the last decade. “By the inflation and nominal-GDP measures, then,” Beckworth concludes, “the Fed has been too tight since 2009.”

Is Beckworth right? There is no denying that inflation and nominal spending growth have been lower than in the years leading up to the Great Recession. But that, in and of itself, does not amount to tight monetary policy, at least as it is conventionally understood. I also agree that the recovery was unusually sluggish and that the Fed is largely to blame. But the problem, I will argue, is not tight monetary policy. It is, instead, the Fed’s new operating regime, which has unintentionally constrained credit.

Conventional theory maintains that an unexpected nominal contraction will cause people to underproduce until expectations are updated and prices adjust downward. If the contraction is anticipated, prices will be set accordingly and output will be in line with the economy’s underlying productive capacity (i.e., labor, capital, technology, etc.). The problem, in other words, is not low inflation or nominal spending growth, but rather inflation or nominal spending growth that is lower than anticipated.

It is hard to believe that expectations and prices have been too high for the better part of a decade. Expectations tend to adjust pretty quickly. And prices, some of which are very sticky in the short run, usually adjust in the 12 to 24 months following a shock. When purchase-order contracts are renegotiated, for example, revised expectations are taken into account.

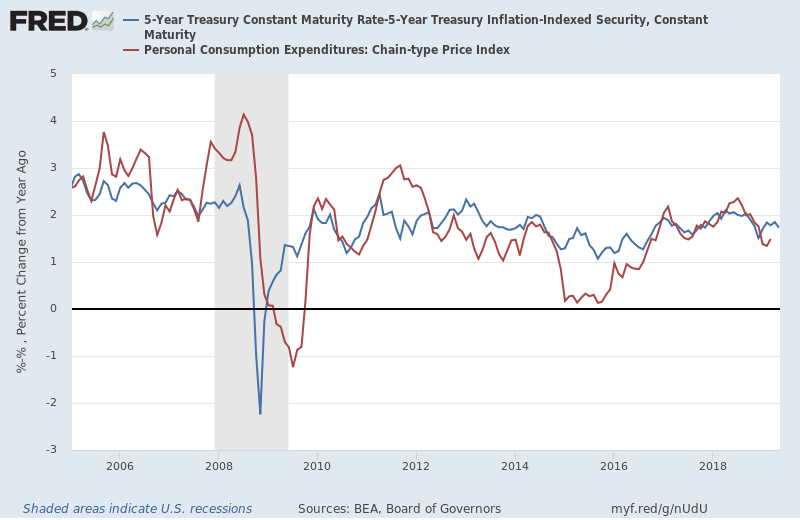

A market-based measure of inflation expectations can be constructed by subtracting the (real) interest rate on Treasury Inflation-Indexed Securities from the (nominal) interest rate on traditional Treasuries of the same duration. This measure, known as the TIPS spread, is presented in the following chart alongside the Fed’s preferred measure of inflation, the PCEPI.

The chart makes clear that while inflation has averaged less than 2 percent over the last decade, so too have inflation expectations. And, for the last two and a half years, the two measures have lined up almost perfectly. Hence, while one might maintain that monetary policy was somewhat tight over some of the period (e.g., Q2 2012 to Q3 2016), it was not as tight as Beckworth suggests and does not appear to be tight at present.

If monetary policy was not excessively tight, as is conventionally understood, why was the recovery so slow? In brief, the Fed’s new operating regime constrained credit.

As I have written before, the Fed adopted a new operating regime in October 2008. That regime, known as a floor system, discourages banks from lending. Indeed, Thomas Hogan estimates that the new regime “accounts for more than half of the post-crisis decline in bank loan allocations.” That means some valuable investment projects have gone unfunded and, hence, unrealized. Production has suffered as a result.

Perhaps you think my view sounds a lot like Beckworth’s. We both agree that the Fed is to blame for the sluggish recovery. And we both think it would be better if the Fed were to adopt and adhere to a strict nominal income level target. But there is an important distinction. Beckworth thinks the problem is nominal and, hence, sees faster nominal spending growth as the solution. I argue that the problem is real. The Fed has made the economy less productive by interfering with the ability of private banks to allocate credit. If I am right, faster nominal spending growth would result in a higher rate of inflation without addressing the real problem. So long as the Fed maintains its floor system, the economy will remain less productive.