Corporate Earnings Challenged By Slow Growth

With fourth quarter corporate earnings reports nearly complete, and the beginning of first quarter 2016 earnings reports less than a month away, a final look at the tally suggests corporate earning power remains challenged by slow growth.

More than 98 percent of companies in the S&P 1500 have reported fourth quarter results. Among those reporting, earnings growth was -3.5 percent. As we have noted in prior posts, that aggregate hides a wide divergence among the 10 economic sectors. The Energy and Materials sectors fell the most, down 74 percent and 23 percent respectively, and more than accounted for the entire decline in overall earnings.

On the positive side, Telecommunication Services, Health Care and Consumer Discretionary all posted solid gains for the quarter (80.1 percent, 8.3 percent, and 6.3 percent). Top-line sales growth was -4.0 percent and showed a similar pattern as the earnings numbers among the sectors.

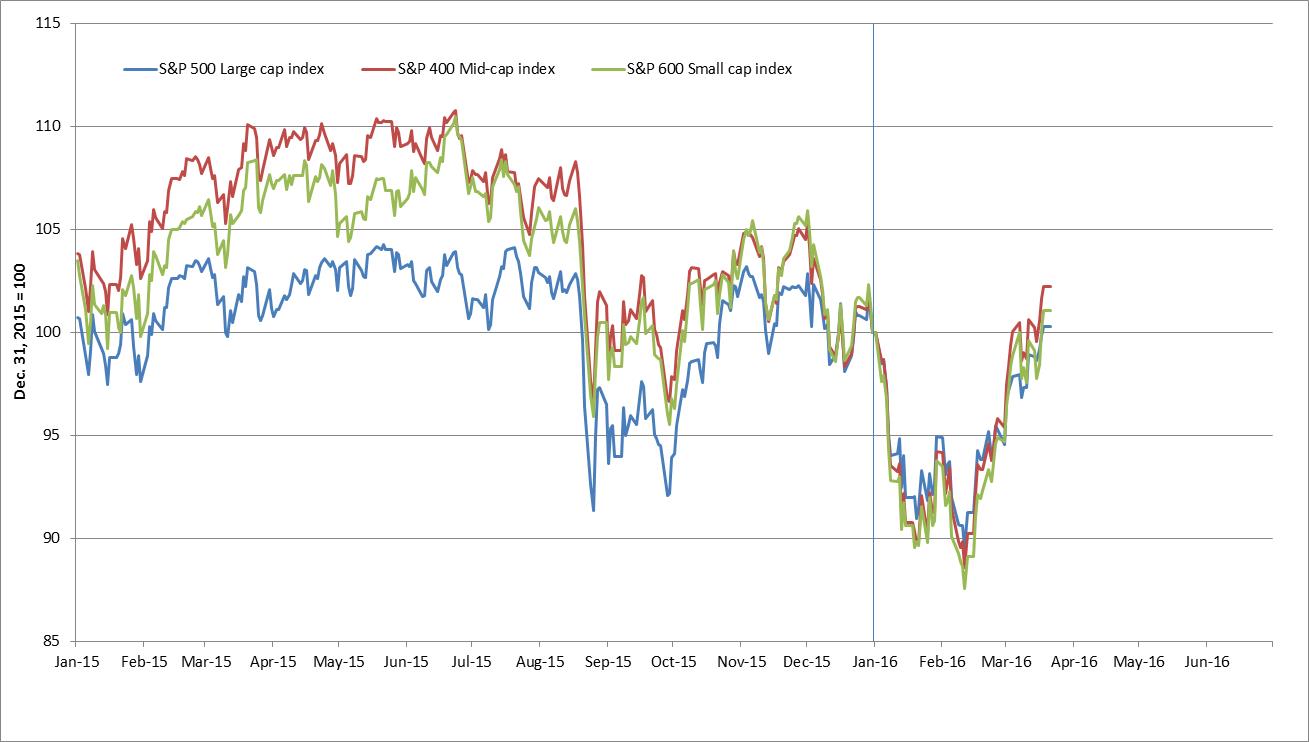

U.S. equity benchmarks have moved back into positive return territory for the year though all three remain below their all-time highs, which they set in 2015 (see chart). As we have stated before, although the economy and the stock market are different entities, they do intersect, and their health are inevitably intertwined.

Improvement in top-line sales growth will be critical to supporting the recent rebound in U.S. equity markets. Furthermore, the potential impact on profit margins from rising labor costs could also be a critical factor in future earnings growth.

Chart: U.S. equity benchmark indexes are back in positive territory for the year