Consumer Sentiment Shows Partisan Divide

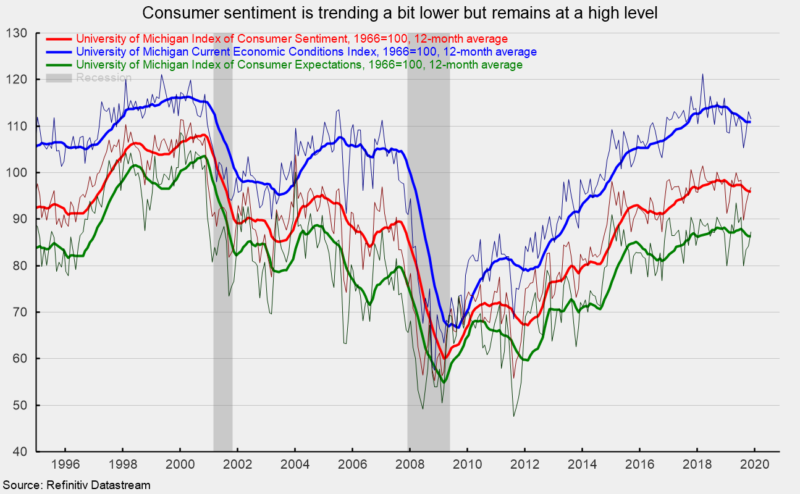

The November results from the University of Michigan Surveys of Consumer Sentiment show overall consumer sentiment improved slightly from the final October result. Consumer sentiment increased to 96.8 in November, up from 95.5 in October, a 1.4 percent gain. From a year ago, the index is off 0.7 percent. Smoothing out recent volatility, overall sentiment on a 12-month average basis has been trending slightly lower, falling 2.3 percent over the past year (see chart).

The two sub-indexes had mixed results in November. First, the current-economic-conditions index fell to 111.6 from 113.2 in October (see chart). That is a 1.4 percent drop for the month and a 0.6 percent decline from November 2018. For the 12-month average, the index is down 2.8 percent since November 2018.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — increased 3.7 percent for the month, to 87.3 (see chart), but was 0.9 percent below a year ago. The 12-month average was 1.9 percent below the year-ago level.

Consumer sentiment remained at broadly favorable levels in recent months, supported by a healthy labor market, income gains, and record-high net worth. However, negative headlines about ongoing trade wars and risks to the economy have caused volatility recently.

According to the report, “The November 2019 consumer sentiment figure was nearly identical to the average level recorded since the start of 2017 (97.0). In 30 of the past 35 months the Sentiment Index was 95.0 or higher, a level of optimism second only to when the Index was above 100.0 for 34 out of 36 months from January 1998 to December 2000, averaging 106.0. Although impeachment proceedings occurred in both time periods, the current period is distinctive for the much sharper partisan divisions in the economic expectations among consumers as well as the wide gap in optimism between consumers and business firms. One side anticipates a recession, while the other side expects an uninterrupted expansion in the year ahead. To be sure, there is ample reason for both optimism as well as pessimism, but not the extreme differences voiced by these groups.

Most consumers are not so naive as to anticipate continued declines in inflation, unemployment, and interest rates, but few consumers anticipate sizable increases in these key economic factors anytime soon. Personal spending will be energized by record favorable evaluations by consumers of their personal financial situation, with gains expected across the entire income distribution, net increases in household wealth, the renewed appeal of price discounting, and reduced mortgage rates. Nonetheless, there is little point in dismissing the significant risks from potential negative shocks, associated with tariffs, impeachment, the presidential election, global growth, and geopolitical events. It has been differences in how these risks have been assessed that underlie the partisan differences among consumers and the gap in sentiment between the business and consumer sectors.”