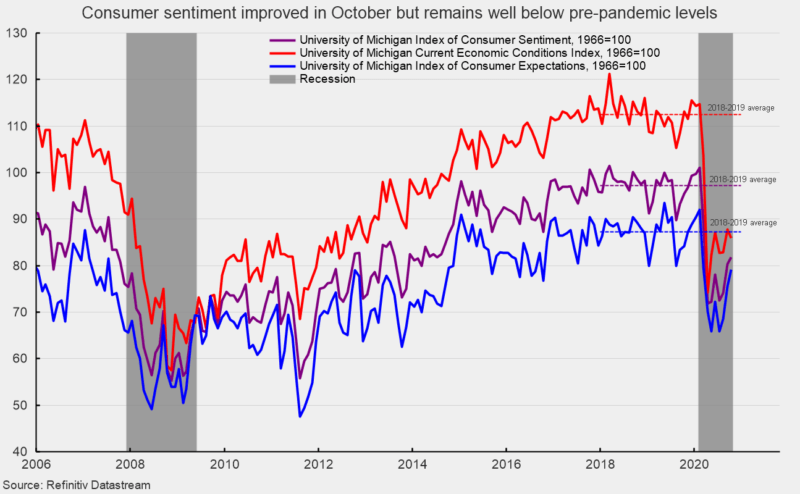

Consumer Sentiment Remains Subdued in October

The latest results from the University of Michigan Surveys of Consumers show overall consumer sentiment was little changed in October and remains well below pre-pandemic levels (see chart). Consumer sentiment increased to 81.8 in October, up from 80.4 in September, a 1.7 percent gain. From a year ago, the index is still down 14.3 percent and is 15.8 percent below the average level from 2018 through 2019.

The sub-indexes posted mixed results in October. The current-economic-conditions index fell to 85.9 from 87.8 in September (see chart). That is a 2.2 percent drop and still leaves the index with a 24.1 percent decrease from October 2019 and 23.7 percent below the pre-pandemic two-year average. The second sub-index — that of consumer expectations, one of the AIER leading indicators — rose 3.6 points or 4.8 percent for the month (see chart) but is 5.9 percent below the prior year and 9.3 percent below the pre-pandemic average.

According to the report, “Fear and loathing produced this false sense of stability. Fears were generated by rising covid infection and death rates, and loathing was generated by the hyper-partisanship that has driven the election to ideological extremes.”

The report goes on to add, “Moreover, the impact of the covid virus and the extremes of hyper-partisanship will continue long past next week’s election, with the potential to permanently alter the economic and political landscape. As noted when Trump won over Clinton in 2016, the economic expectations of Republicans and Democrats shifted in opposite directions and by large amounts given that two-thirds of all consumers incorrectly anticipated a Clinton victory. Since a Biden win over Trump (53% vs. 42%) was anticipated in the October survey, it should be no surprise that optimism among Democrats about their future finances rose substantially compared with Republicans. Importantly, for the first time in nearly four years, the financial expectations of Republicans and Democrats were nearly equal. Compared with three months ago, the Expectations Index rose by 50% among Democrats but just 7% among Republicans.”

The path of recovery may ultimately depend on progress understanding the virus that causes Covid-19 and the ability to develop and deploy a vaccine. The survey notes, “The outcome of the election can accelerate or narrow these partisan shifts, but unlike the 2016 election, renewed optimism now requires progress against the coronavirus and mitigating its uneven impact on families, firms, and local governments.”