Consumer Sentiment Posts Surprising Gain in Early December

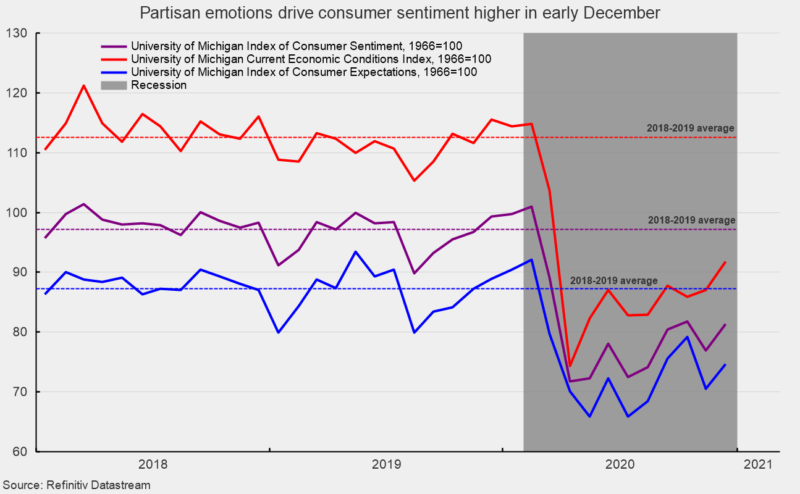

The preliminary December results from the University of Michigan Surveys of Consumers show overall consumer sentiment posted a surprisingly strong gain in early December though it remains well below pre-lockdown levels (see chart). Partisan emotions were the primary drivers of the early December move. However, resurging cases of Covid-19 and the reimplementation of government restrictions which may lead to more job losses, falling incomes, rising debt delinquencies and defaults as well as bankruptcies for consumers and small businesses may weigh on future survey results.

Overall consumer sentiment increased to 81.4 in early December, up from 76.9 in November, a 5.9 percent rise. From a year ago, the index is down 18.0 percent. The sub-indexes both gained in early December. The current-economic-conditions index rose to 91.8, the highest level since March (see chart). The 5.5 percent increase leaves the index 20.5 percent below December 2019. The second sub-index — that of consumer expectations, one of the AIER leading indicators — gained 4.2 points or 6.0 percent for the month to 74.7 (see chart) but is 16.0 percent below the prior year.

All three indexes remain well below the pre-pandemic levels, with the Current Economic Conditions index 18.4 percent below its 2018-2019 average and the Index of Consumer Expectations 14.4 percent below the recent average. Combined, the overall index sits 16.3 percent below the pre-pandemic average (see chart).

According to the report, “Consumer sentiment posted a surprising increase in early December due to a partisan shift in economic prospects. In the five months from August to December, the Expectations Index among Democrats rose by 39.5 points, and fell among Republicans by 34.9 points.” This development was the opposite of what happened following the 2016 election.

The report goes on to add, “Most of the early December gain was due to a more favorable long-term outlook for the economy, while year-ahead prospects for the economy as well as personal finances remained unchanged…These divergences may persist largely unchanged in the year ahead.”

While partisan emotion lifted sentiment in early December, renewed government restrictions in the face of rising Covid-19 cases and deaths may cause significant economic damage. New rounds of layoffs, rising unemployment, deterioration in personal finances, and increases in personal and business bankruptcies may yet drag consumer sentiment and the economy down. The outlook remains highly tenuous.