Consumer Sentiment Fell Slightly in Early April but Remains at a High Level

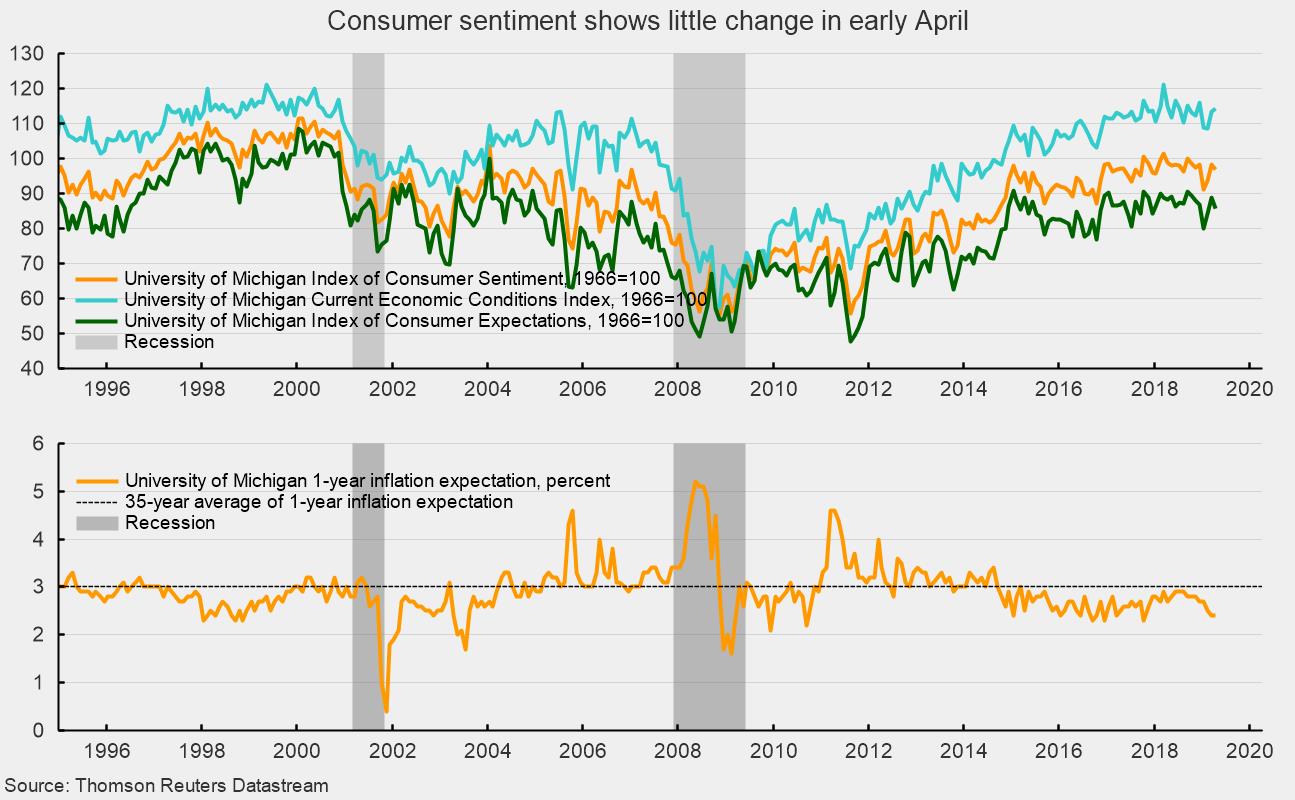

The preliminary April results from the University of Michigan Surveys of Consumer Sentiment show overall consumer sentiment fell slightly from the final March result. Consumer sentiment decreased to 96.9 in early April, down from 98.4 in March, a 1.5 percent decline (see top chart). From a year ago, the index is off 1.9 percent. Despite the decline, sentiment is holding at favorable levels. The average level over the past 24 months is 97.2, putting the preliminary April result just 0.3 percent below the recent average.

The two sub-indexes had opposing performances in early April. First, the current-economic-conditions index rose to 114.2 from 113.3 in March (see top chart). That is a 0.8 percent gain for the first part of the month but a 0.6 percent decrease from April 2018. The two-year average for the current-conditions index is 113.3, putting the early-April result 0.8 percent above the average.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — fell 3.4 percent for the month, to 85.8 from 88.8 (see top chart), and showed a 2.9 percent decline from the prior year. The early-April result is 1.3 percent below the recent average. According to the report:

Interestingly, the impact of the tax reform legislation on consumer confidence has all but disappeared. Spontaneous references to the tax reform program were on balance favorable in January 2018 (22% favorable minus 6% unfavorable). Since then, however, unaided references declined sharply so that by early April the net balance was zero (4% favorable minus 4% unfavorable). The data do not imply that consumers were pleased or displeased with the reforms, especially the limitations on SALT deductions. The data do suggest that consumers thought that its stimulative impact on the overall economy has now run its course. What has been of increasing importance to consumers are rising nominal incomes, and low inflation, producing strong gains in inflation adjusted incomes.

On the inflation (increases in consumer prices), the one-year expectation fell to 2.4 percent from 2.5 percent for the final March result. One-year inflation expectations continue to run well below the 35-year average expectation of 3 percent (see bottom chart).

Consumer sentiment remains at broadly favorable levels, supported by a robust labor market and income gains. The lack of significant deterioration in consumer sentiment is also supportive, especially given the effects of the government shutdown in December and January on economic activity, and equity-market volatility in the fourth quarter of 2018. Caution regarding the outlook is still warranted as economic data have been mixed in recent months, but the trend for the most recent data appears marginally more favorable.