Consumer Sentiment Fell in March with More Declines Likely

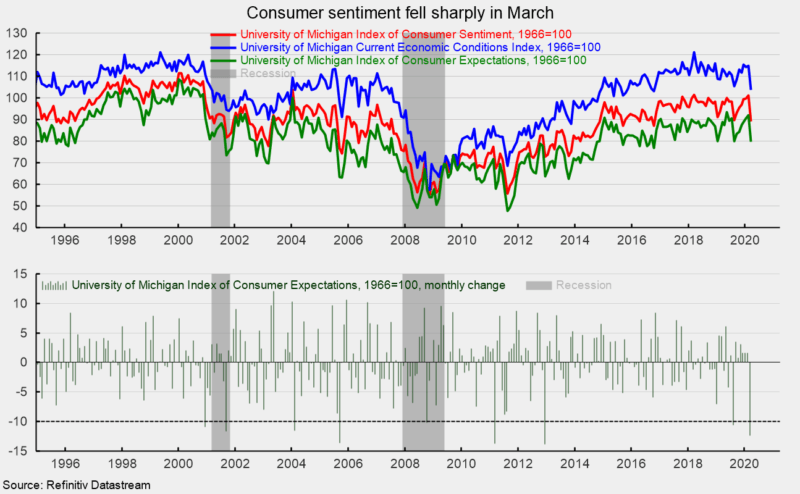

The final March results from the University of Michigan Surveys of Consumers show overall consumer sentiment fell sharply from the final February result. Consumer sentiment decreased to 89.1 in March, down from 101.0 in February, a 11.8 percent decline (see top chart). From a year ago, the index is down 9.5 percent. Consumer sentiment has been fairly volatile over the past year or so but has been holding at generally favorable levels. Given the unprecedented surge in layoffs recently, that is unlikely to continue.

The two sub-indexes also posted sharp declines in March. First, the current-economic-conditions index dropped to 103.7 from 114.8 in February (see top chart). That is a 9.7 percent fall for the month and an 8.5 percent decrease from March 2019.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — sank 12.4 points (see bottom chart) or 13.5 percent for the month and is 10.2 percent below the prior year. The 12.4-point decline was one of just eight declines of more than 10 points (see bottom chart) since 1995. The index came in at 79.7 in March versus 92.1 in February. That is the lowest level since October 2016 (see top chart).

According to the report, “Stabilizing confidence at its month’s end level will be difficult given surging unemployment and falling household incomes. The extent of additional declines in April will depend on the success in curtailing the spread of the virus and how quickly households receive funds to relieve their financial hardships. Mitigating the negative impacts on health and finances may curb rising pessimism, but it will not produce optimism.” Furthermore, the report stated, “To avoid an extended recession, economic policies must quickly adapt to a new era that will reorder the spending and saving priorities of consumers as well as the relative roles of the public and private sectors in the U.S. economy.”

Overall, consumer sentiment remains at historically high levels despite a sharp monthly decline. However, the sharp rise in layoffs recently is likely to result in additional sharp declines. Stimulus efforts may help in the short term but ultimately, beating COVID-19 and getting life back to normal is the only way to sustainably boost the economy and consumer sentiment.