Consumer Sentiment Continued to Recover in October

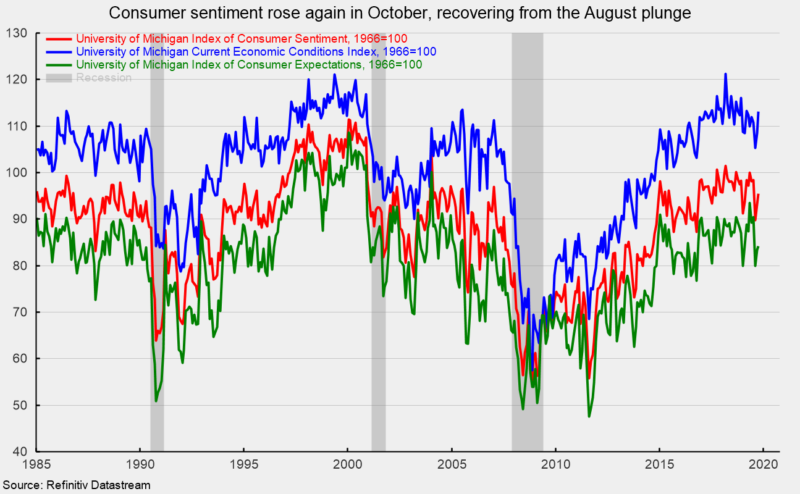

The October results from the University of Michigan Surveys of Consumer Sentiment show overall consumer sentiment improved slightly from the final September result. Consumer sentiment increased to 95.5 in October, up from 93.2 in September, a 2.5 percent gain. From a year ago, the index is off 3.1 percent. Despite recent volatility, sentiment is holding at favorable levels (see chart).

The two sub-indexes had small gains in October. First, the current-economic-conditions index rose to 113.2 from 108.5 in September (see chart). That is a 4.3 percent gain for the month but a 0.1 percent increase from October 2018.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — increased 1.0 percent for the month, to 84.2 (see chart), but was 5.7 percent below a year ago.

Consumer sentiment remained at broadly favorable levels in October, supported by a healthy labor market, income gains, and record-high net worth. However, negative headlines about on going trade wars and risks to the economy have caused volatility recently.

According to the report, “The overall level of consumer confidence has remained quite favorable and largely unchanged during the past few years. The October level was nearly identical to the 2019 average (95.6) and only a few Index-points below the average since the start of 2017 (97.0). The focus of consumers has been on income and job growth, while largely ignoring other news. The most spontaneous references were to the negative impact of tariffs, which fell to 27% in October from last month’s 36%; the impeachment inquiry totaled just 2% in October, less than the 5% who mentioned a negative impact from the GM strike. To be sure, the multiple sources of uncertainty will keep consumers focused on potential threats to their prevailing optimism, with the most critical being threats that could significantly diminish their job and income prospects.”