Consumer Sentiment Collapses Amid Massive Job Loss

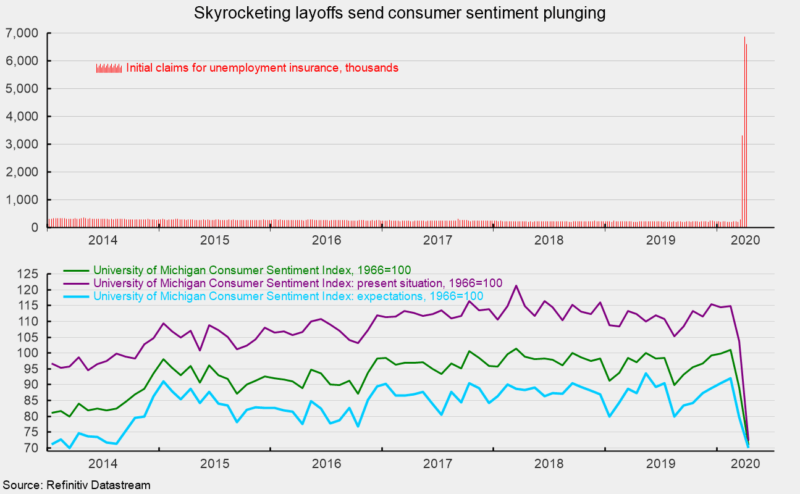

Initial claims for unemployment insurance totaled 6.61 million for the week ending April 4, marking the third consecutive week of massive, record-shattering layoffs, and dwarfing the previous high of 695,000 in October 1982 (see top chart). During the Great Recession in 2008-09, total job losses were 8.8 million over 25 months versus the current 3-week total of 16.8 million initial claims. The unprecedented flood in claims is likely just the first wave in a tsunami of negative economic statistics that will reflect the impact of the COVID-19 outbreak and drastic policy reactions implemented to contain the spread.

The preliminary April results from the University of Michigan Surveys of Consumers show overall consumer sentiment plunged from the final March result, registering the largest single-month decline on record. Consumer sentiment decreased to 71.0 in early April, down from 89.1 in March, a 20.3 percent decline (see bottom chart). From a year ago, the index is down 27.0 percent. March and April combined show a two-month drop of 30.0 Index-points, 50 percent larger than the prior record.

The two sub-indexes also posted sharp declines in early April. First, the current-economic-conditions index dropped to 72.4 from 103.7 in March (see bottom chart). That is a record 31.3-point drop, doubling the previous record decline. The fall results in a 30.2 percent plunge for the month and a 35.5 percent decrease from April 2019.

The second sub-index — that of consumer expectations, one of the AIER leading indicators — sank a much-less-severe 9.7 points (see bottom chart) or 12.2 percent for the month and is 19.9 percent below the prior year. While the 12.2-point decline puts the index at the lowest level since March 2014 (see bottom chart), the less severe drop in the expectations index perhaps indicates an underlying optimism about the future. According to the report, “This suggests that the free-fall in confidence would have been worse were it not for the expectation that the infection and death rates from COVID-19 would soon peak and allow the economy to restart.” It remains unclear if that underlying optimism is misplaced. The sharp rise in layoffs over the last three weeks has resulted in a record-shattering plunge in consumer sentiment. Stimulus efforts may help in the short term (though early indications are that there are major failures in government systems to actually distribute stimulus funds) but ultimately, beating COVID-19 and getting life back to normal is the only way to sustainably boost the economy and consumer sentiment. Whether that is a quickly achievable outcome or not is highly questionable. Expect extraordinarily weak economic reports over the next several months.