Consumer Confidence Ticked Down in March but Remains at a Very High Level

The Consumer Confidence Survey from The Conference Board shows consumer attitudes pulled back slightly in March relative to February but remain at historically favorable levels overall. The Consumer Confidence Index fell to 127.7 in the latest reading, down from 130.0 in February.

Of the two major components, the present-situation index decreased from 161.2 to 159.9 while the expectations index fell to 106.2 from 109.2 last month. Despite the drops, the overall index and the present-situation index are above the peaks of two of the past three economic expansions, only falling short of the levels achieved during the expansion of March 1991 through March 2000, while the expectations index is about in line with previous cycle highs.

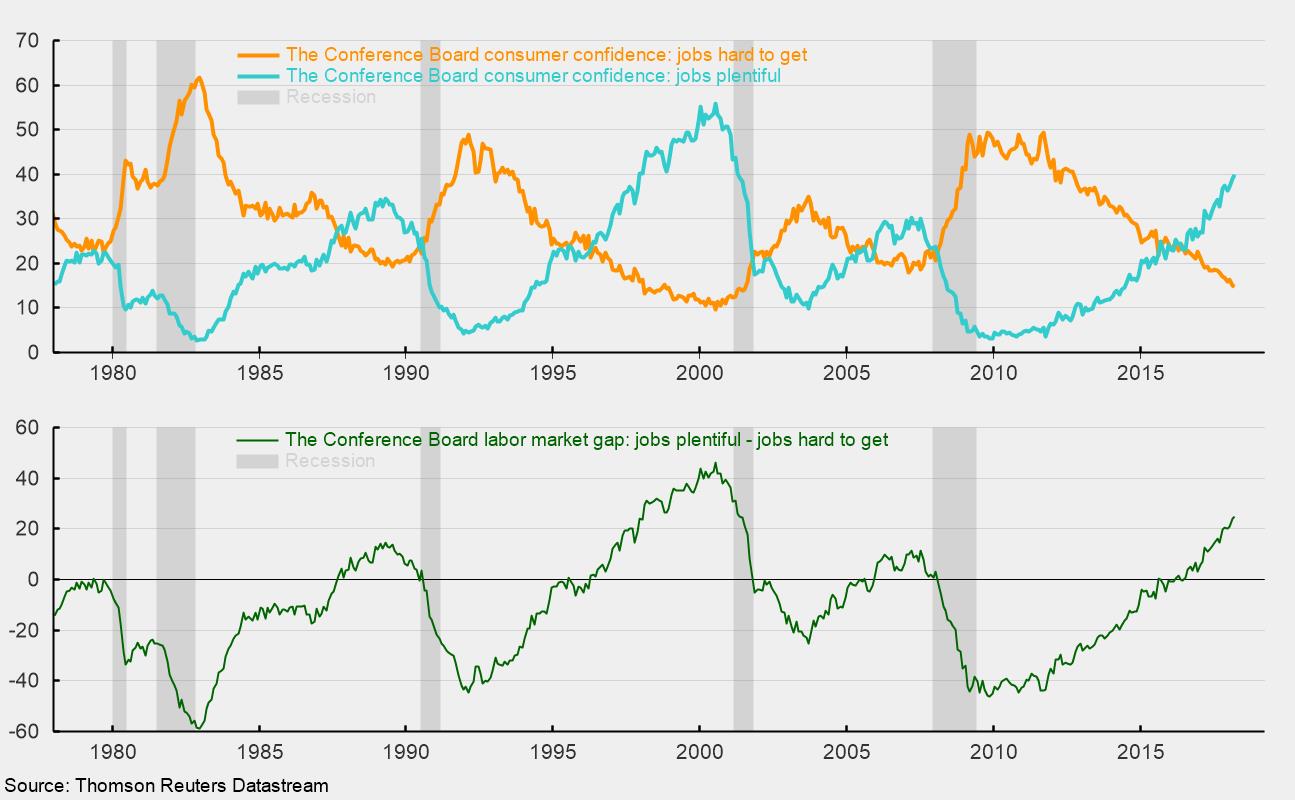

One key source of support for the strong levels of confidence in the present-situation index is the robust labor market. According to the survey, the percentage of respondents reporting jobs are hard to get fell from 15.1 in February to 14.9, the lowest since July 2001, though it is still above the all-time low of 9.6 in 2000. Conversely, the percentage of respondents saying jobs are plentiful came in at 39.9, up from 39.1 in February, the highest since May 2001. The gap between these two labor-market sentiment measures is sometimes called the labor market gap. The labor market gap came in at 25 in March, the highest since April 2001 and well above the −46.1 reading in November 2009, just after the end of the Great Recession (see chart). Concerning their short-term income prospects, the percentage of consumers expecting an improvement fell from 23.5 percent to 22.0 percent; however, the proportion expecting a decrease also fell, from 8.6 percent to 7.2 percent.

Among the other details in the survey, the percentage of consumers saying current business conditions are good increased from 36.5 percent to 37.9 percent while those claiming current business conditions are bad also increased, from 11.3 percent to 13.4 percent. The percentage of consumers anticipating future business conditions will improve over the next six months decreased from 25.0 percent to 23.0 percent, while those expecting future business conditions will worsen increased from 9.4 percent to 9.8 percent. According to Lynn Franco, director of economic indicators at The Conference Board, “Consumers’ short-term expectations also declined, including their outlook for the stock market, but overall expectations remain quite favorable.”

Overall, despite a slight dip in March, consumer confidence remains at historically favorable levels, supported by a robust labor market, suggesting support for ongoing economic expansion.