Consumer Confidence Closing In on a New Record High

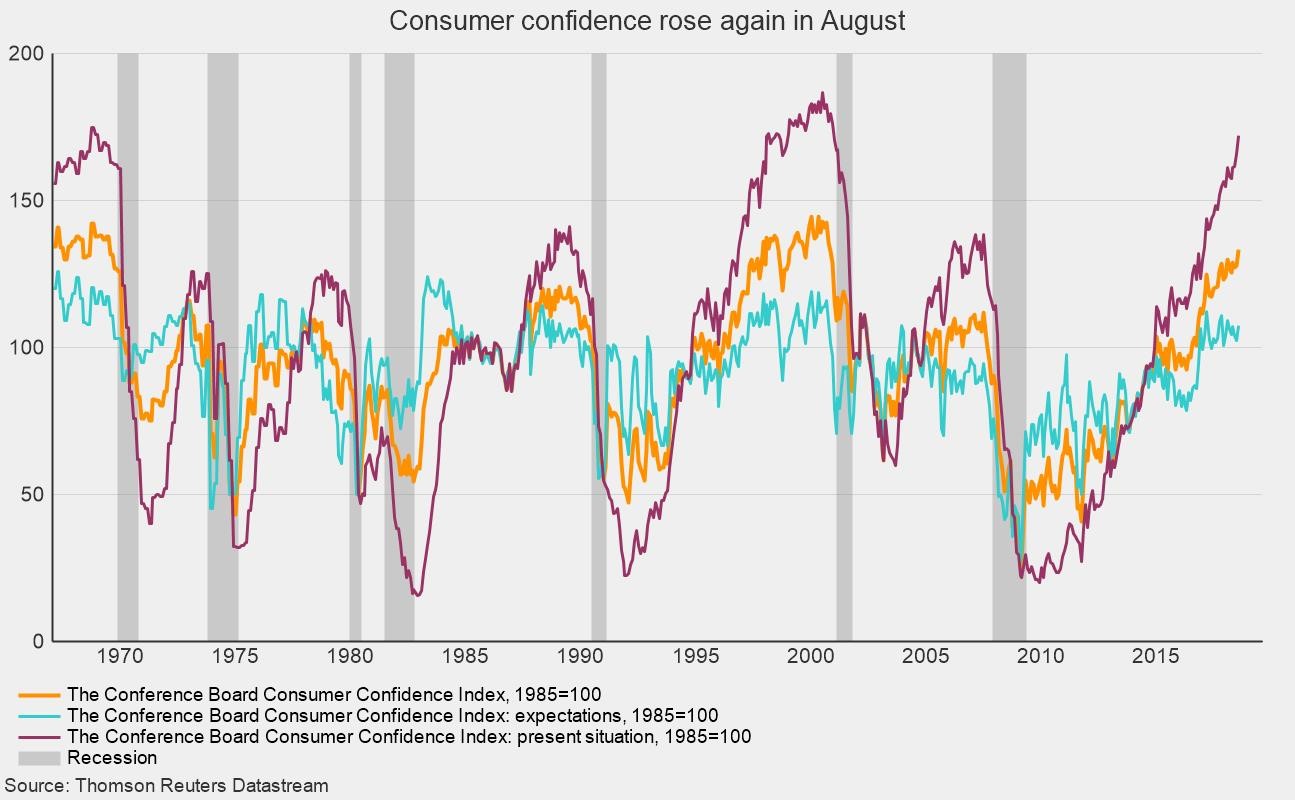

The Consumer Confidence Index from The Conference Board rose for the second month in a row, increasing by 5.5 points to 133.4. The index is constructed so that 1985 equals 100. The index is now at the highest level since October 2000 and just 11.3 points below the all-time record of 144.7 in May 2000 (see chart).

Both components of the index posted gains for the month. The present-situation component rose 6.1 points to 172.2, the highest level since December 2000. This index has posted a remarkable rebound, rising 152 points since a low of 20.2 in December 2009, just after the end of the Great Recession. The expectations component added 5.2 points, taking it to 107.6 from 102.4 in the prior month. The expectations index has been a bit more restrained compared to the present-situation index, bouncing around in the 100-to-112 range for most of the past two years. That pattern is consistent with prior cycles. The all-time high for the expectations component is 125.8, recorded in April 1967.

According to the details of the report, the short-term outlook improved in August as the percentage of consumers expecting business conditions to improve increased from 22.9 percent to 23.4 percent. Partially offsetting the gain was a rise in the percentage of respondents expecting business conditions to worsen, reaching 10.5 percent versus 10.3 percent in the prior month.

Consumers’ current assessment of the labor market was more upbeat, though consumers’ outlook for the labor market was mixed. Consumers saying jobs are “plentiful” was unchanged at 42.7 percent, while those claiming jobs are “hard to get” fell to 12.7 percent. The percentage of consumers expecting more jobs in the months ahead dropped to 21.7 percent, while those expecting fewer jobs decreased slightly to 14.1 percent.

Overall, consumer attitudes remain at historically favorable levels, driven by solid gains in income and a tight labor market. Expectations for the future are still at historically favorable levels. Both suggest support for future gains in consumer spending and overall economic growth.