Consumer Confidence and Home Construction Drop

Housing construction activity slowed in February as starts fell by 8.7 percent. Total housing starts dropped to a 1.162 million annual rate from a 1.273 million pace in January. The dominant single-family segment, which accounts for about three-fourths of new home construction, fell 17.0 percent for the month to a rate of 805,000 units. Starts of multifamily structures with five or more units jumped 23.5 percent to 352,000. From a year ago, total starts are off 9.9 percent with single-family starts down 10.6 percent and multi-family starts off 5.4 percent.

Among the four regions in the report, total starts fell in three, the Northeast (−29.5 percent), the West (−18.9 percent), and the South (−6.8 percent), while the Midwest rose 26.8 percent. For the single-family segment, starts were down in all four regions, with declines ranging from −42.0 percent in the Northeast to −8.3 percent in the Midwest.

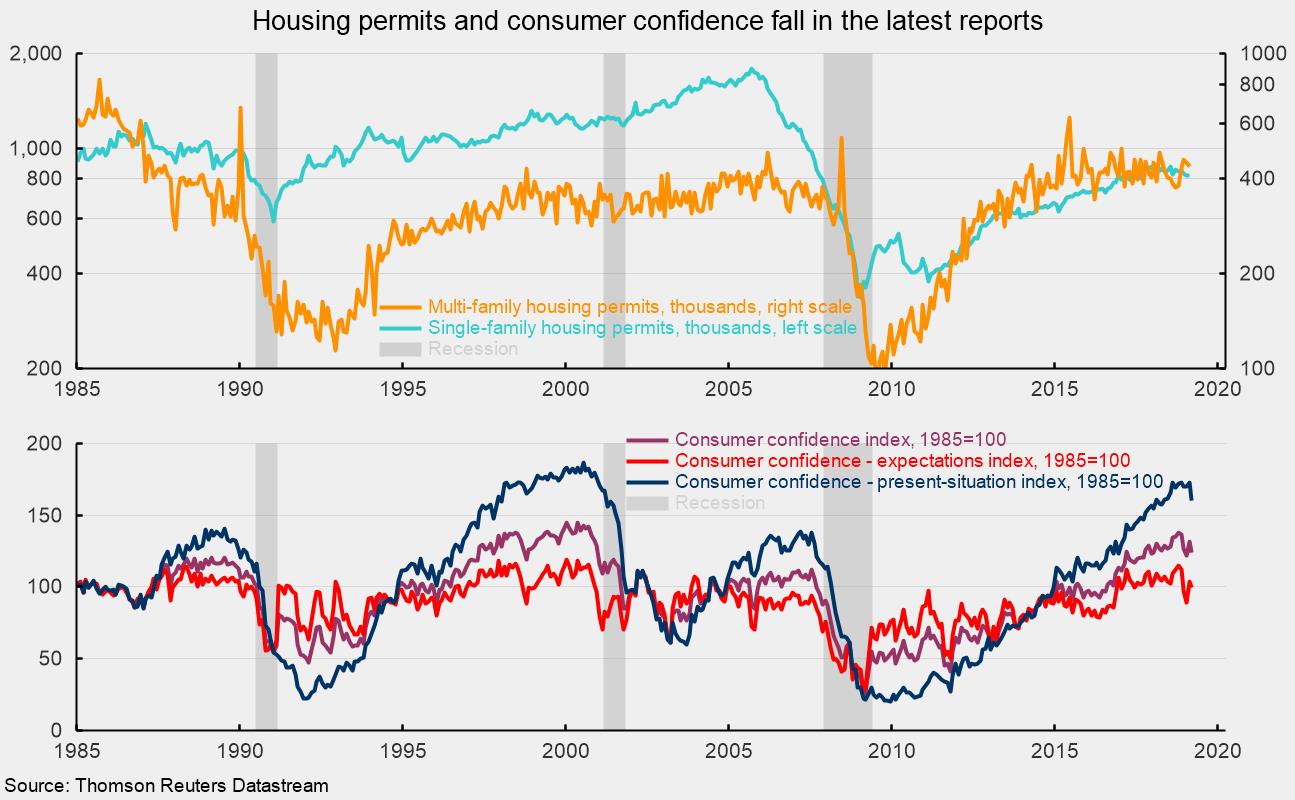

For housing permits, total permits fell 1.6 percent to 1.296 million from 1.317 million in January. Total permits are 2.0 percent below the February 2018 level. Single-family permits were unchanged at 821,000 in February (see top chart) while permits for two- to four-family units were off 18.2 percent and permits for five or more units down 2.9 percent to 439,000 (see top chart). Permits for single-family structures are down 7.3 percent from a year ago while permits for two- to four-family structures are off 21.7 percent. However, permits for structures with five or more units are up 12.3 percent over the past year.

Housing construction has continued to weaken over the last several months. A similar softening in permits for new-home construction suggests further weakness in construction activity in coming months. Despite a pullback in mortgage rates in recent months, rising home prices have continued to pressure affordability. Furthermore, the latest survey of senior loan officers at commercial banks indicates weakening demand for residential mortgages despite some modest easing of lending standards. There is little evidence to suggest a significant acceleration in housing activity in coming months and quarters; therefore housing is unlikely to contribute significantly to gross domestic product in the near term.

The Consumer Confidence Index from The Conference Board fell sharply in March, decreasing by 7.3 points to 124.1 (see bottom chart). The index is constructed so that it equals 100 in 1985. The March decline follows a nearly 10-point jump in February. Despite the latest drop, the composite index is still at a relatively high level.

Both components of the index posted declines for the month. The present-situation component fell 12.2 points to 160.6 while the expectations component lost 4 points, taking it to 99.8 from 103.8 in the prior month (see bottom chart). The expectations index has been a bit more restrained compared to the present-situation index, but both have risen sharply from the cycle lows and are still at levels consistent with economic expansion.

Overall, consumer attitudes remain at historically favorable levels, driven by solid gains in income and a tight labor market. The recent government shutdown and financial-market volatility have been the primary reasons for volatility in recent months.