Broad Weakness in Retail Sales in December

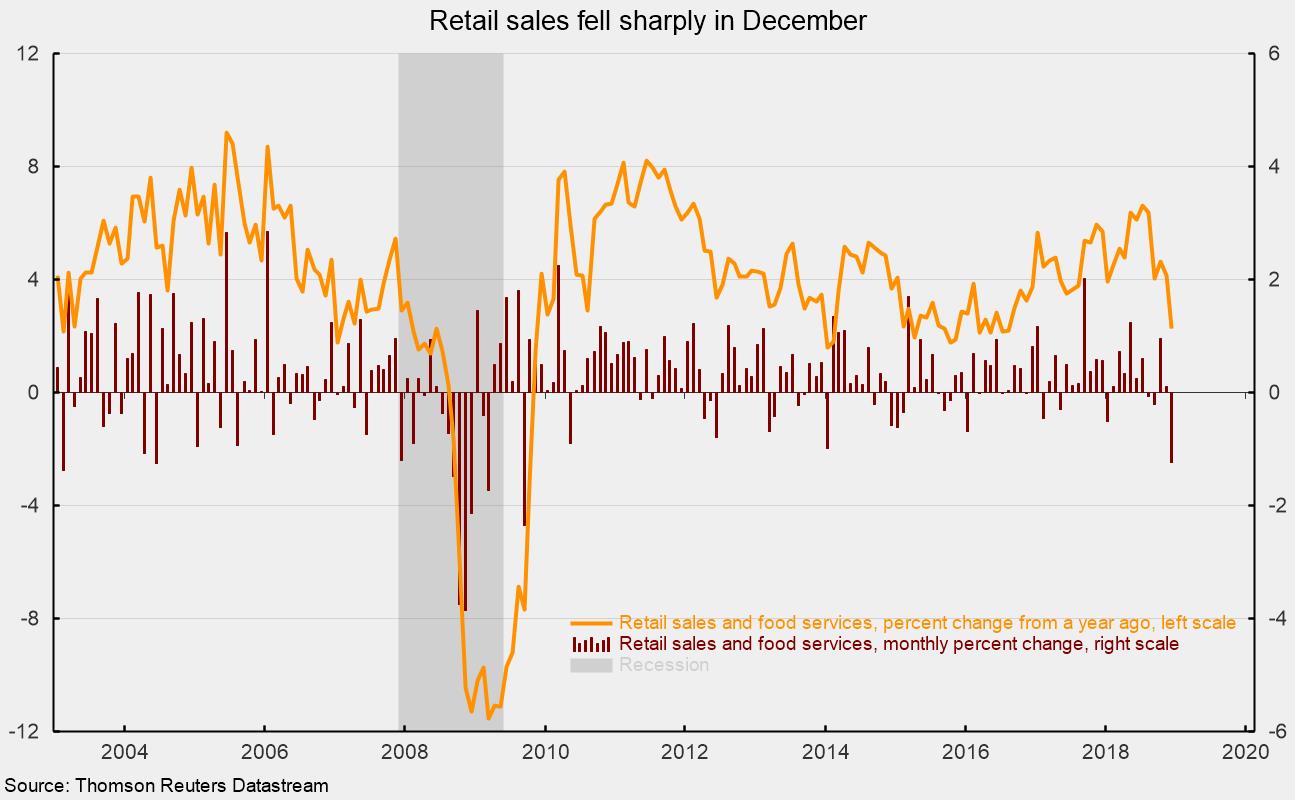

Retail sales and food-services spending fell 1.2 percent in December following a 0.1 percent gain in November. Excluding the volatile auto and energy categories, core retail sales and food services were down 1.4 percent in December after a gain of 0.5 percent in November. Over the past year, total retail sales and food services were up 2.3 percent through December, while core retail sales and food services have increased 2.2 percent (see chart).

Weakness in December was widespread with declines in all but two retail-spending categories. Declines were led by a 5.1 percent drop at gasoline stations (volatility in gasoline spending tends to reflect changes in prices), a 4.9 percent decline at sporting-goods, hobby, musical-instrument, and book stores, a 4.1 percent fall at miscellaneous store retailers, and a 3.9 percent drop at nonstore retailers.

On the positive side, motor vehicle spending rose 1.0 percent as unit vehicle sales increased 0.3 percent to a 17.6 million annualized rate in December. Building-material, garden-equipment, and supplies dealers also posted a gain for the month, rising 0.3 percent.

The weak data for December may have been somewhat impacted by the federal government shutdown. The weakness is also consistent with a bit of a pullback in consumer attitudes, especially about the outlook for the economy. However, attitudes regarding current economic conditions remain generally positive, supported by a robust labor market. The January employment report was quite strong, and the latest data show a record number of job openings across the country.

There is broadening evidence of an economic slowdown; however, it is too soon to expect a recession in the coming months. The most likely path remains continued economic expansion, but heightened caution is warranted.