Broad-based Gains for Retail Sales in December

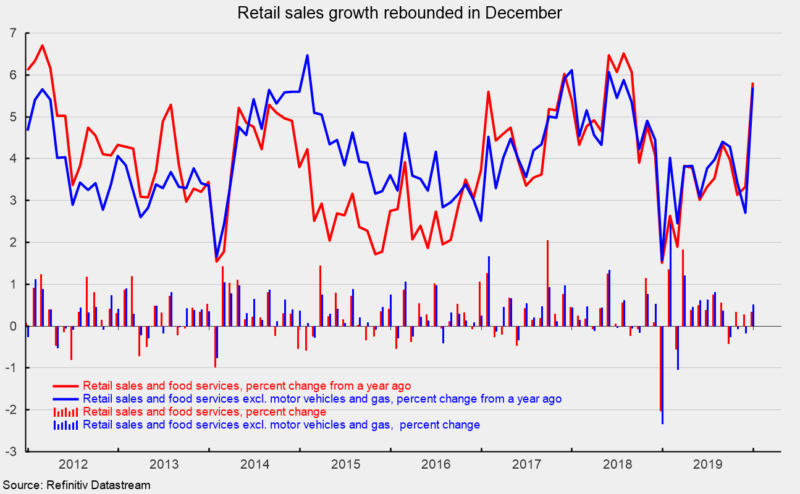

Retail sales and food services rose 0.3 percent in December, following a 0.3 percent rise in November. Over the past year, they are up 5.8 percent. Core retail sales, which excludes motor vehicles and gasoline, rose 0.5 percent in December following a 0.2 percent decline in November. From a year ago, core retail sales are up 5.7 percent (see chart).

Total and core retail sales have been a bit weak over the prior three months heading into the important holiday selling season. The 12-month increase for both measures slowed to the three to three-and-a-half percent range prior to December. However, December’s rebound has pushed the 12-month gains back above 5.5 percent for both, hitting the fastest pace since August 2018. The gains are consistent with supportive consumer fundamentals including a tight labor market, rising hourly earnings growth, and favorable consumer confidence.

Gains in retail sales in December were widespread among the components. The only major component to show a decline for the month was motor vehicle and parts dealers, for which sales fell 1.3 percent for the month; the category is still up 4.1 percent over the past year. Unit-auto sales fell 2.3 percent for the month, selling at a 16.7 million annualized pace.

Gasoline stations was the top gaining category in December, rising 2.8 percent followed by clothing and accessory stores (up 1.6 percent) and building materials and gardening equipment stores (up 1.4 percent).

Non-store retail sales rose 0.2 percent and led all categories with a 19.2 percent rise over the past year. Non-store retailers accounted for about 12.5 percent of all retail sales and 21 percent of retail sales excluding motor vehicles, gasoline, and restaurants for all of 2019.

Weekly data on initial claims for unemployment insurance show the labor market remains very tight. Claims fell to 204,000, a drop of 10,000 from the prior week. The four-week average decreased to 216,250 from 224,000 in the prior week. As a share of payroll employment, claims continue to hover at all-time lows.

Today’s data suggest consumers continue to lead the economy, with spending supported by a tight labor market. However, other areas of weakness in the economy keep growth in overall activity at a moderate pace. Caution remains warranted.