Bracket Creep: A Real Problem for Taxpayers

Nothing raises Americans’ ire more than tax increases, but most of us don’t know that we face a hidden income-tax hike almost every year that the economy grows. Since 2013, these tax increases have cost the median earner about $195, and higher earners have paid thousands. This seems counterintuitive, since rates have not changed since 2013 and brackets have been adjusted for inflation. But due to the peculiar math of a progressive tax system, our tax burden tends to drift upward over time. The phenomenon is called bracket creep.

When an individual gets a new job at a higher salary, a larger proportion of his earnings are in a higher tax bracket, meaning he pays a higher percentage of his income in taxes. Agree or disagree with the system, this is how it was designed. But inflation and real economic growth, economy-wide forces that tend to push incomes up over time, have the same effect. When these forces cause everyone’s salaries to rise, people who work the same job and stay at the same point on the income distribution will pay a higher tax rate.

In this article, I estimate the size and incidence of bracket creep for Americans over the past 25 years. While the change from year to year is subtle, it adds up both over people and time. Since 1993, bracket creep due to real economic growth has added an estimated $1.6 trillion (in 2017 dollars) to the government’s coffers. I show below that the impact of bracket creep increases for higher earners, a point that should not be lost in debates about tax cuts and policy.

Inflationary Bracket Creep

Since 1981, the IRS has adjusted tax brackets yearly for inflation, using the percentage change in the previous year’s CPI. Without such an adjustment, inflationary bracket creep would on average cause people to have a higher tax burden with no increase in real purchasing power, as inflation increases wages along with prices. However, there are two reasons why bracket creep from inflation can remain an issue even with this adjustment.

First, since people face different rates of inflation depending on the products they buy and where they live, the IRS adjustment creates winners and losers every year. For example, tax-bracket thresholds in 2016 increased by about 0.4 percent, reflecting the low level of inflation in the previous year. However, residents of the Los Angeles MSA faced an inflation rate for the same period of 3.1 percent, while Cleveland MSA residents faced a rate of only 0.1 percent. Taking these differing rates into account, bracket creep from inflation cost a Los Angeles resident about $108 while saving a Cleveland resident of the same income about $17. To the extent that some areas experience higher inflation than others over multiple years, these amounts can add up.

Second, there is much debate over whether the CPI itself is an accurate measure of overall inflation. In some ways, the CPI likely both understates and overstates inflation, leaving it difficult to determine its accuracy with any amount of certainty. If (but only if) the CPI understated inflation over a given period, inflationary bracket creep would increase tax burdens overall.

Real Bracket Creep

Americans’ real incomes grow along with the economy, providing another source of bracket creep. While less frequently discussed than inflationary bracket creep, real bracket creep is perhaps more important, as the IRS makes no adjustment for real wage growth. Chris Edwards of the Cato Institute wrote in 2001 that real bracket creep “is an annual ‘stealth’ tax increase that no politician is required to vote for.”

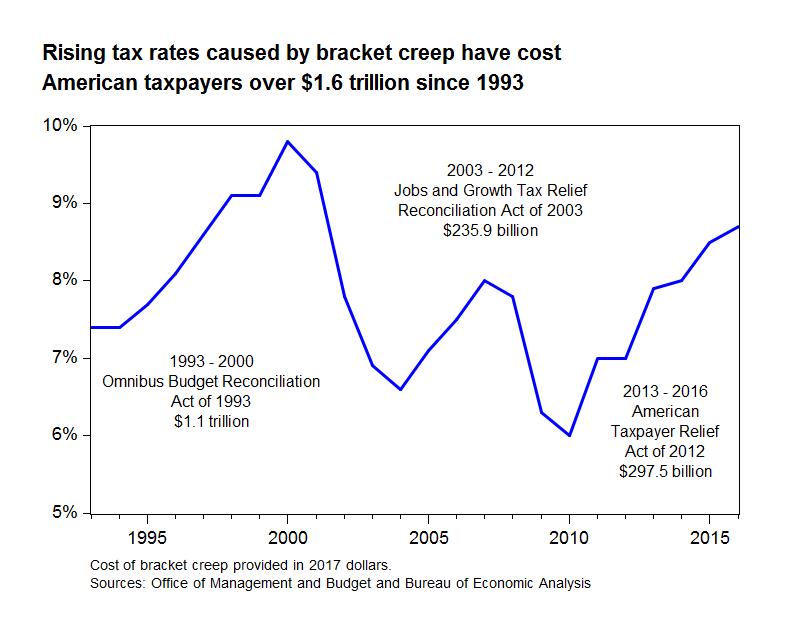

To calculate the cost of real bracket creep to American taxpayers, I examined three recent periods where the income-tax code did not change other than by adjusting brackets for inflation. Because the IRS has made this inflation adjustment, increases in the actual tax rates paid by Americans are the result of increasing real wages (i.e., real bracket creep). The chart below shows the average tax rate (as percentage of GDP) paid by Americans since 1993 and estimates the cost of real bracket creep for the periods 1993 through 2000, 2003 through 2012, and 2013 through 2016 (years not included in this sample had changes to the underlying tax code, making calculations of bracket creep impossible).

In 1995, for example, income taxes were 7.7 percent of GDP. Since no changes other than inflation adjustments had been made to the income-tax code since 1993 (7.4 percent of GDP), the cost of bracket creep to Americans in 1995 was 0.3 percent multiplied by the year’s GDP ($7.7 trillion), equaling $22.4 billion (all dollar amounts in this article are provided in 2017 dollars). These amounts increase as years go by without changes to the tax code, with economic growth pushing real incomes higher and higher. For the period 1993 through 2000 (the final year before George W. Bush’s tax cuts began to take effect), real bracket creep cost American taxpayers a staggering $1.1 trillion. Adding in the two more recent periods, we find that real bracket creep has resulted in a transfer of $1.6 trillion from taxpayers to government coffers since 1993.

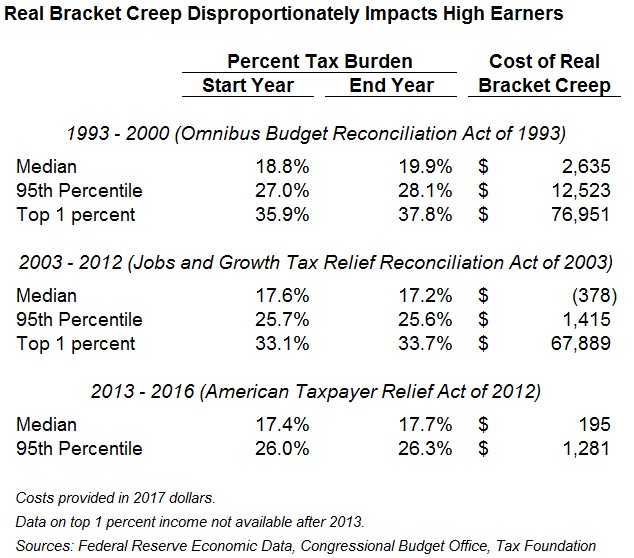

While high earners are disproportionately impacted by real bracket creep due to the higher marginal tax rates they pay, wage growth for long periods without tax cuts impacts many people up and down the income distribution. As the table below shows, this is exactly what happened in the 1990s. The table shows tax rates and the cost of bracket creep at three points on the income distribution: the median, the 95th percentile, and the average earner in the top 1 percent. From 1993 through 2000, the tax rate faced by the median earner increased from 18.8 percent to 19.9 percent, resulting in an additional $2,635 per person paid in income taxes over the whole period. The cost increased as one moved up the income distribution: for the top 1 percent, rates on average increased by almost two percentage points and resulted in an extra tax burden of $76,951 per person.

The period from 2003 through 2012 illustrates that bracket creep can happen in reverse: when real wages decrease, taxpayers can pay lower percentages of income tax relative to the year when the tax code was enacted. Real wages declined precipitously from 2007 through 2010, before recovering somewhat by 2012. For the median earner, this drop outweighed increases in the real wage earlier in the period, and resulted in tax savings from real bracket creep. However, the earners in the 95th percentile and average top 1 percent still pay higher taxes due to overall wage growth.

Real Solutions

Some might argue that real bracket creep isn’t a problem at all. After all, it’s a countercyclical tax that has people pay more when times are good and real wages are growing, and less during recessions. Whether or not that’s a good reason, there are reasons beyond the cost alone to consider real bracket creep a real problem.

First, real bracket creep results in uncertainty, especially among high earners, who are responsible for the most spending in the economy. Knowing the size of future economic growth and of the resulting tax increase with certainty is not possible. The individual impact of this risk might be small, but if it results in slightly less consumption or investment across many individuals in the economy, it can impact overall growth.

Second, real bracket creep makes contentious debates about the size and incidence of tax cuts inevitable. The overall trend of positive economic growth will continue to push tax rates higher, meaning the government must eventually cut taxes either by lowering rates or increasing bracket limits beyond the usual adjustment for inflation. Furthermore, cuts to offset real bracket creep must go disproportionately to higher earners, as they bear the brunt of the cost every year. All else equal, we can expect real bracket creep to cause the same debate about “tax cuts for the rich” about once per decade.

The obvious solution is to index tax brackets not just for inflation but also real wage growth. This would reduce economic uncertainty and cut down on wasteful political wheel spinning. It would also force the government to be transparent about what tax rate it intends to charge, rather than counting on “stealth” increases of which most taxpayers remain unaware. Absent such a practical solution, both policy makers and the media should keep in mind during our next tax debate that some cuts, especially for the wealthy, are eventually necessary.