Bitcoin Continues Steady Mainstream Adoption

At the time of this writing (10:00 PM EST), the value of Bitcoin stands around $53,000 after falling from $57,000 to roughly $43,000 near the end of February. In 2020, the cryptocurrency saw a meteoric rise from less than $6,000 in March to its current value.

As Bitcoin approached its peak historic highs of around $20,000 back in December of 2020, many investors feared that it would simply be a repeat of 2017 when it shot up suddenly and then crashed almost as quickly. However, unlike 2017, Bitcoin’s rise in 2020 was not due to retail consumer hype but interest from large-scale institutional investors which lent a massive degree of stability to the currency’s trajectory. Blockchain technology and cryptocurrencies have also seen wider adoption since 2017 as well.

AIER noted this key and important difference back in December of 2020 as Bitcoin was inching closer to its historic $20,000 price level. We noted that with the advent of large-scale institutional investments from financial technology companies such as Square, PayPal, endorsements from banks like JPMorgan, combined with fears regarding global inflation due to large-scale quantitative easing, Bitcoin’s price increase was likely justified.

Media Hype Vs Growing Investment

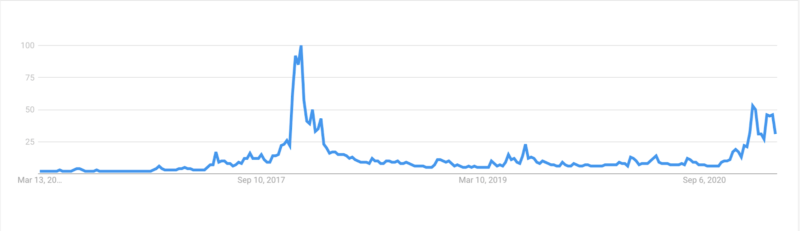

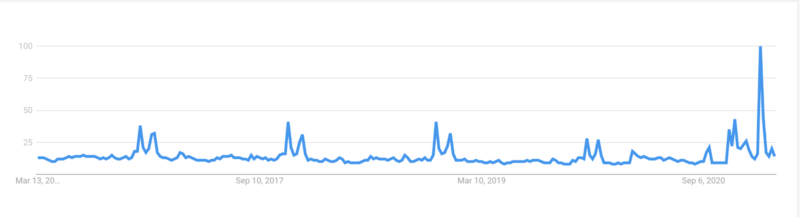

One insightful indicator to demonstrate the starkly different environments surrounding the rise of Bitcoin in 2017 compared to now is to analyze the levels of Google searches to measure general hype. An increase in prices due to a spike in media attention is far less sustainable than one that is primarily fueled by institutional and committed investors. Included below is a Google Search Trend graph for Bitcoin and a graph for GameStop, a stock that saw an extreme spike in value and media attention before crashing much like Bitcoin did in 2017.

As demonstrated by the graphics above, Bitcoin’s media attention has barely reached half of where it was during its sudden rise in 2017 fueled primarily by frenzied retail traders. Cryptocurrency and blockchain were a fringe idea back in 2017 but as Nasdaq noted in December of 2020,

“Traditional banks are now taking the plunge and coming out with crypto-related services. The shift coincides with bitcoin’s price hitting all-time highs in December.

Banks may have been looking closely at digital assets for some time now, but have been skittish about saying anything in public. Now they appear to be joining a general shift towards crypto in the latter half of 2020 that has included payments giant PayPal (PYPL) and hedge fund mavens including Paul Tudor Jones and Stanley Druckenmiller.“

With the price of Bitcoin steadily rising month after month without large spikes in media attention, there is reason to believe that its value can be attributed more so to sustainable institutional adoption rather than retail hype.

Increasing Mainstream Adoption

Prior to 2020, there was certainly interest from institutional investors in blockchain technology and Bitcoin but now interest has turned into action. Market Insider noted in February of 2021 that,

“A research report from Bank of America shows banking behemoths JPMorgan and Citi are using blockchain technology, while other banks are considering allowing commercial and institutional clients to hold cryptocurrencies in their accounts.”

An article from Coindesk says that Goldman Sachs as recently as January 2021 added Bitcoin to its rankings of global assets. The article notes,

“Goldman Sachs, the storied Wall Street firm, didn’t start including bitcoin in its weekly ranking of global asset-class returns until late January, when the largest cryptocurrency quietly appeared atop the chart.

But since then, bitcoin (BTC, +6.6%)‘s lead over assets from stocks to bonds, oil, banks, gold and tech stocks and the euro has widened.

As of March 4, bitcoin’s year-to-date return, at about 70%, was roughly double that for the next-closest competitor, the energy sector, at about 35%, according to Goldman Sachs’s latest “US Weekly Kickstart” report.”

Furthermore, Bitcoin.com writes,

“Global investment bank Goldman Sachs is seeing huge institutional demand for bitcoin with no signs of abating. A survey of Goldman’s institutional clients shows that 61% expect to increase their cryptocurrency holdings. Meanwhile, 76% say the price of bitcoin could reach $100,000 this year.”

Large companies are also beginning to hold Bitcoin to diversify their assets much like they would hold gold. An SEC filing from Tesla states,

“As part of the policy, we may invest a portion of such cash in certain specified alternative reserve assets. Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.”

We can likely expect such a trend to continue as more companies and business leaders become more comfortable with investing in cryptocurrency.

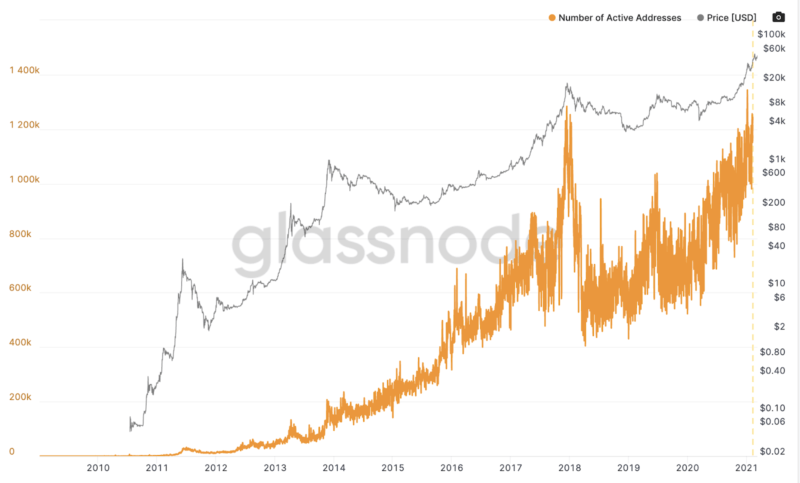

Included below is a graph showing the gradual increase in active Bitcoin addresses from its spike near the end of 2017 which demonstrates that mass adoption is also rising alongside institutional investing.

According to an article published by Forbes in July of 2020, approximately 15% of survey respondents stated that they invested in Bitcoin or Ethereum, and roughly half began investing in 2020. For context, approximately 55% of the US population is invested in the stock market according to Statista. These trends demonstrate increasing interest and comfort regarding Bitcoin on both the institutional and retail investor fronts. It also suggests that there may be plenty of room to grow at this moment.

Bitcoin as an Asset

There is much debate over whether Bitcoin will see mainstream adoption as a form of currency such as the US dollar, which understandably scares many potential investors and raises questions about its soaring value. Matt Frankel from the Motley Fool notes,

“It’s very volatile. You don’t want to buy a type of currency that could be worth twice or half as much in a week.”

This is an important factor to keep in mind as the price can swing violently in a matter of hours and it is unclear what portion of Bitcoin’s value is due to long-term institutional investment and retail investment. Although it is likely that Bitcoin’s long-term value will continue to increase, its short-term price swings fueled by retail investment create a considerable level of uncertainty.

However, it seems the dominant sentiment at the moment is that Bitcoin is a sort of valuable commodity that appreciates in value like gold and silver, which would not require it to be adopted as legal tender to justify its value.

Although that is not to say that Bitcoin has not been seeing increasing use as a form of currency. Jim Barth, a Senior Fellow at the Milken Institute, stated in an interview that he sees increasing consumer use of Bitcoin, its finite supply, and the aforementioned mainstream adoption as an investment as the core drivers of Bitcoin’s justified value increase.

CNBC notes that CEO of ARK Investment Management, Cathie Wood, believes that Bitcoin could become a recommended part of portfolios in a 60-20-20 allocation; 60 percent stocks, 20 percent bonds, 20 percent cryptocurrency.

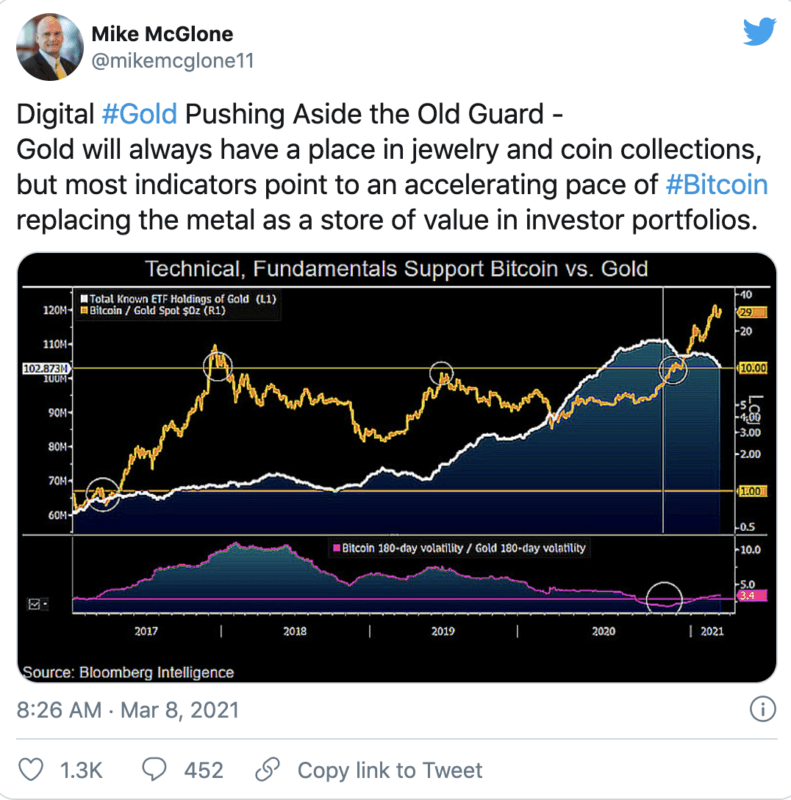

Mike McGlone, senior commodity strategist at Bloomberg made the following tweet on March 8, 2021.

Although McGlone has been overly bullish on Bitcoin in the past, to his credit gold-related stocks such as SPDR Gold Trust (GLD) have fallen in value since the summer as Bitcoin’s value continues to rise. Furthermore, as bond yields spiked near the beginning of March 2021, investors pulled their money out of tech stocks and other speculative assets, sending many stocks into double-digit declines. Bitcoin’s price was relatively unaffected and continues on an upward trajectory at the time of this writing, which may indicate that investors see it as an alternative store of value, not a speculative stock.

Forbes wrote in October of 2020 that

“The bitcoin market has matured since JP Morgan chief executive Jamie Dimon called bitcoin a “fraud” in September 2017—helped by the (still highly volatile) bitcoin price finding support as an inflation hedge alongside gold this year.

Now, JP Morgan has said bitcoin’s strong 2020 could be set to continue, finding the bitcoin price has “considerable” upside in the long-term as it better competes with gold as an “alternative currency.”

As more and more large investors and experts place price targets in the $65,000-$100,000 plus range, alongside growing adoption, and understandable concerns about inflation, the case for Bitcoin’s growth seems quite compelling. At the moment, the idea of cryptocurrency and blockchain technology is still emerging technology but at one point they were considered fringe. Their increasing adoption not only lends support for the ongoing rise of Bitcoin’s value but demonstrates an interesting inflection point for financial affairs.