Bernanke’s Math Problem

In his recent blog, Former Fed Chairman Ben Bernanke rebuts criticism that the Fed’s actions have made income inequality worse by artificially inflating stock prices:

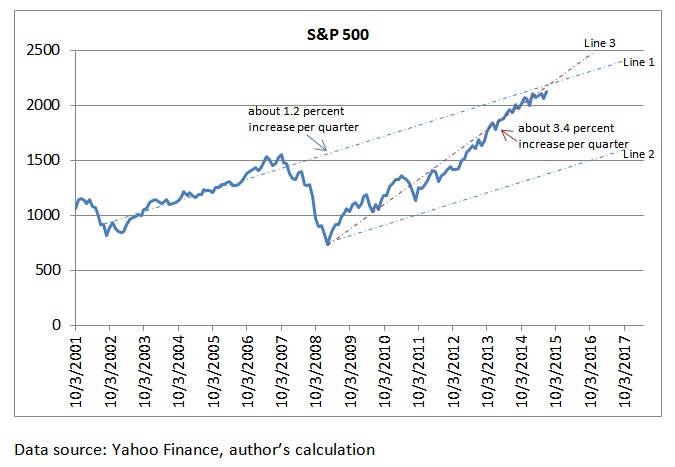

“Stock prices have risen rapidly over the past six years or so, but they were also severely depressed during and just after the financial crisis. Arguably, the Fed’s actions have not led to permanent increases in stock prices, but instead have returned them to trend. To illustrate: From the end of the 2001 recession (2001:q4) through the pre-crisis business cycle peak (2007:q4), the S&P500 stock price index grew by about 1.2 percent a quarter. If the index had grown at that same rate from the fourth quarter of 2007 on, it would have averaged about 2123 in the first quarter of this year; its actual value was 2063, a little below that.”

Mr. Bernanke argues that stock prices have returned to trend by projecting the current S&P 500 based on its growth rate from the fourth quarter of 2001 to the fourth quarter of 2007. But there’s one problem: He did the math wrong.

Indeed, if the financial crisis didn’t occur in 2007, the S&P 500 would have reached about 2123, which is close to its current value, as Line 1 shows on the chart. But this doesn’t mean stock prices have returned to their earlier trend. In the real world – the one in which the financial crisis DID occur – if the S&P 500 returned to its pre-crisis trend, its current value should be below 1500 as Line 2 shows.

In fact, the S&P 500 is following a completely new trend. It has been growing at about 3.4 percent per quarter (Line 3) after the crisis, instead of 1.2 percent as Mr. Bernanke claims. Stock prices didn’t return to the pre-crisis trend. Instead, they have been growing much faster since 2009 than they had before 2007.

Going forward, if this new trend (3.4 percent increase per quarter) continues, stock prices will exceed Bernanke’s projection more and more as time goes by. But how much longer the new trend will last is up for debate.