Base Money and the Birth and Use of Credit Money

Standard macroeconomic texts teach about different levels of monetary aggregates. The simplest of these is the base-money stock. Banks accept base money as deposits and lend out a significant portion of it. In exchange, the banks offer the depositors claims to base money. These claims tend to circulate as media of exchange so long as buyers and sellers believe that these claims are redeemable. Thus, the extension of credit is equivalent to an expansion of the money stock. The details of this process are complex. Our understanding can be improved by tying aggregate concepts to a narrative of the evolution of money and credit.

Although governments create fiat base money in modern monetary systems, it is simplest to imagine base money as commodity money. During the days of the gold standard, the base-money stock was simply gold money. Gold circulated hand-to-hand in exchanges. It was costly, however, for owners of gold to keep all of their gold in their possession. Gold is heavy and can be stolen. Holders of gold preferred to leave their gold at the local storehouse and carry instead claims to gold. The claims to gold could be used as money while the gold rested in a secure location. Eventually, the storehouses found that lending the gold at interest allowed them to earn profits from these deposits and share a portion of these profits with depositors. Thus, fractional reserve banking was born and, with it, the dynamics of base and credit moneys.

Demand for Money

The creation of financial instruments — deposit claims in the above case — adds complexity to the standard presentation of money supply and money demand. When the banking system creates money through providing credit, it is responding to an increase in demand for money. This demand could be met by creating additional base money, but that would take a significant period of time.

Milton Friedman, in “The Quantity Theory of Money: A Restatement,” noted that demand for money is a function of alternative means of holding one’s wealth. These include bonds, equities, physical goods, and human capital. Here we are concerned with bonds and equities. Bonds represent claims to a future stream of payments. They represent a form of lending. Equities, such as shares of Apple stock, are claims to shares of enterprises’ returns.

We can generalize these two forms of wealth holding, bonds and equities, as securities, or tradeable claims to money. Bonds represent a claim to some fixed value and some rate of return associated with that value, whereas equities represent claims to a value that adjusts to changes in demand for or supply of the equities. Deposit accounts fit nicely with this framing. Deposits are more liquid than bonds and equities and are commonly used as money itself, rather than as a means to acquiring money. Money in deposit accounts receives interest. Instead of the depositor directly lending to a borrower, the deposits are intermediated by a bank that lends to a variety of borrowers. The bank offers a portion of the return from this lending to the depositor and collects a portion of the return for itself.

Composition of Credit

New credit is created in many forms. Some of the credit is generated when traditional banks create loans by lending money from deposit accounts whose funds can be withdrawn quickly. Deposits in accounts of this sort, along with base money, comprise M1. Other credit money is created in time-deposit accounts, money market mutual funds, short-term bonds, stocks, futures contracts, and so forth. These moneys constitute even higher levels of aggregation of the money stock. Even funds invested in these forms can serve as a store of value — one function of money — that can be used to quickly access money. Thus, these instruments actually act as money, further alleviating downward pressure put on prices from increases in demand for money.

A problem arises when applying the equation of exchange using different measures of the money stock. Standard measures — M1, M2, and so forth — fail to account for the differences in liquidity of different financial instruments. This creates difficulty for the quantity theory as not every dollar of credit money exerts equal influence on prices. William Barnett has approached this problem with the divisia measures of the money stock, which weight the value of financial assets according to their liquidity. This solution appears to fit well with the above theory that treat all financial instruments as playing a monetary role to some extent.

Creation (and destruction) of credit moneys necessarily impacts demand for base money. Imagine there exists a demand for money, which can be met by either base money or credit money. If demand for money is met through the creation of credit, this alleviates demand for money that would otherwise have put upward pressure on the price of money, or, in other words, lowered the prices of goods. An increase in demand for money represents a fall in demand for non-money assets. However, if an increase in demand for money can be met by the creation of credit, which maintains demand for non-money goods by channeling savings to borrowers, then the increase in demand for money can be met while alleviating the downward pressure put on prices by this demand.

Visualizing Dynamics

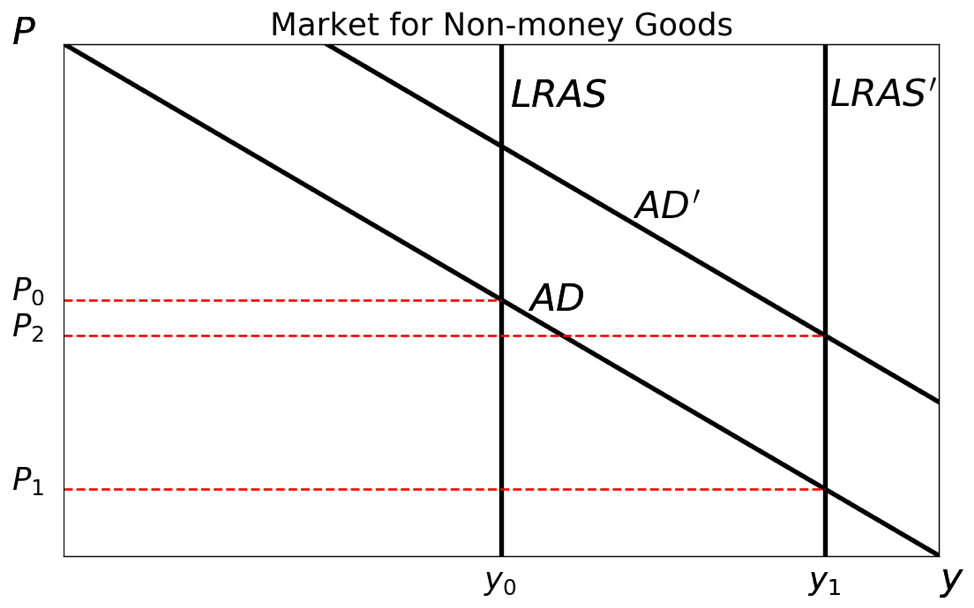

Using the equation of exchange, we can more clearly describe the relationship between the supply of credit money and demand for base money. Suppose, as discussed above, the credit stock expands because of an increase in demand for money. The response of the credit stock reverses the effect of the increase in demand for base money. If the increase in demand for money was due to an increase in real income, y, then we can represent graphically all of the effects together.

The rate of productivity increases, represented by the rightward shift in the long-run aggregate-supply curve (LRAS). This would push down prices, if not for the response of the market for money. The market for money responds to an increase in demand for money by creating more of it, thus increasing aggregate demand (AD). This occurs in two ways: credit money is created through lending, and producers of base money in a commodity-money-based economy increase production. The initial response occurs in the financial sector because increasing the quantity of securities can be quickly accomplished compared to increases in the quantity of commodity money. This will be associated with an increase in the expected interest rate since the rate of economic growth has increased, meaning that those who invest expect to receive higher rates of return. Thus, borrowers will be willing to pay a higher rate of interest (implicit or explicit) in return for the new credit. In the case in which credit markets are unable to fully meet the higher level of demand for money, producers of commodity money will respond by increasing their level of production.

Conclusion

The complexity of credit markets creates difficulty for teaching monetary theory purely through reference to observed data. Rather, an appropriate framing should follow the evolution of money and credit, starting with the simple and building to the complex. The use of dichotomy establishes this framing and provides the anchor required for diving into the complexities of the monetary economy.