Banking Unbanked Bitcoiners

Cryptocurrencies like bitcoin are often lauded as tools of financial inclusion. They promise to connect those who haven’t yet been reached by the banking system. Anyone who once had a bank account but was cut off can be reconnected with cryptocurrency.

For now, volatility and lack of user-friendliness have limited the ability of cryptocurrencies to reach the populations of unbanked and debanked. If cryptocurrencies have had some influence on financial inclusion, it is in the opposite direction. Having adopted bitcoin, those who already have bank accounts often find that they’ve suddenly lost access to their account. Bitcoin debanks the banked.

Why is that? Risk-averse bankers fret that people who use their accounts to buy or sell cryptocurrencies are involved in tax evasion, money laundering, or drug dealing. They fear that this could attract the baleful eye of regulators and law enforcement. Rather than continuing to serve this potentially risky corner of the market, banks often prefer to terminate these accounts.

Being severed from the banking system is crippling. Cryptocurrency exchanges that suddenly lose their bank account can no longer satisfy customer cash-out requests or accept deposits from those who want to buy cryptocurrencies. Bitcoin market makers without bank accounts can’t settle over-the-counter trades. As for crypto hedge funds, they aren’t able to grow their business if they can’t accept new fiat deposits. And operators of stablecoins can no longer maintain their peg.

Luckily, a special type of banker has emerged that specializes in reaching debanked bitcoiners. California-based Silvergate Bank describes itself as “the leading bank for innovative businesses in fintech and cryptocurrency.” It joins several other financial institutions including Metropolitan Bank, Signature Bank, and Cross River Bank in catering to the financial needs of the growing cryptocurrency space.

Silvergate boasts a number of well-known crypto clients including Gemini, Kraken, Bit Flyer, Paxos, trueUSD, Coinbase, Polychain Capital, and Bitstamp. This sort of banking business is “not for the faint of heart, because there is a lot of risk,” says Alan Lane, Silvergate’s CEO. Banks that serve a crypto clientele must put in extra due diligence to vet their customers. Prior to launching any new initiatives, they must meet up with regulators to get signoff. This is expensive and time-consuming work.

In social media, cryptocurrency advocates often deride banks as dinosaurs. But in Silvergate’s case, this accusation misses the mark. Silvergate has moved quickly to create new infrastructure to satisfy its growing crypto user base. The Silvergate Exchange Network, or SEN, is one example.

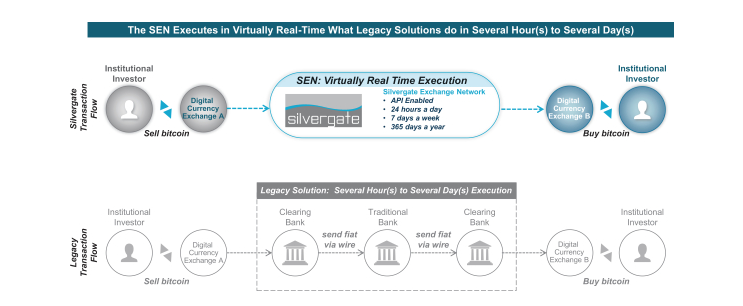

Unlike most financial markets, cryptocurrencies trade 24 hours a day, seven days a week. Which means that cryptocurrency exchanges, crypto fund managers, and market makers need to be able to move U.S. dollar funds between each other all the time in order to settle transactions, even Saturday at midnight. But in most parts of the world it isn’t possible to make wire payments on weeknights or on the weekend. In the United States’ case, Fedwire, the Federal Reserve’s large-value payments system, is closed all of Saturday and Sunday.

Silvergate’s SEN, a 24/7 proprietary network, solves this. Customers open a U.S. dollar account at Silvergate, fund it, and integrate with the SEN API (application programming interface). A bitcoin hedge fund manager now has the ability to use the SEN to transfer, say, $2 million onto a crypto exchange at 11:52 p.m. on Saturday, as long as said exchange also has a connection to the SEN. The manager can then buy $2 million worth of bitcoin on the exchange, sell it five minutes later, and then have the exchange instantly send the fiat proceeds via the SEN back into the hedge fund’s Silvergate account. The entire trade can be settled a minute before midnight.

Introduced in 2018, the SEN has proven to be quite successful. Around $12.7 billion was transferred across the SEN in the first two quarters of 2019, up 374 percent from last year.

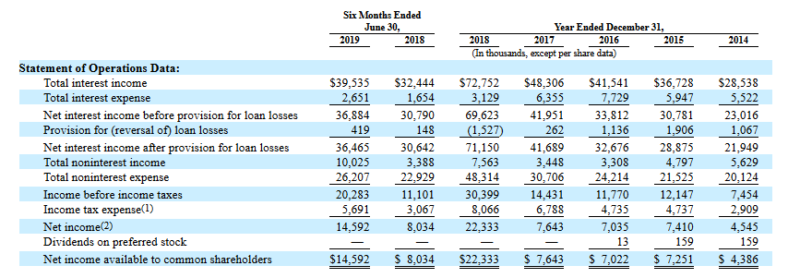

Providing banking services to unbanked cryptocurrency users has proven to be highly lucrative for Silvergate. According to documents filed for its upcoming IPO, the bank made more profits in the first six months of 2019 ($14.6 million) than it did in all of 2017 ($7.6 million). Before-tax income is up by 83 percent so far this year, and the bank’s return on equity is registering at a healthy 14.6 percent, far higher than the 8 percent of a few years back.

The promise of making a profit is one of the best forces for broadening financial inclusion. Once a group of financially excluded individuals or businesses reaches a large-enough size, banks like Silvergate will compete to connect them. For instance, last month I wrote about how Walmart has used prepaid debit cards to reach consumers like immigrants and low-income Americans, many of whom can’t get traditional bank accounts. Robert E. Wright tells the story about the Bank of Bird-in-Hand, which has chosen to focus on Pennsylvania’s Amish population.

If regulators and politicians want to promote financial inclusion, one of the best ways to do so is to allow for a vibrant ecosystem of competing financial institutions. The more Silvergates, Walmarts, and Bird-in-Hands vying for consumer attention, the better served the unbanked, underbanked, and debanked will be.

In practice, this may mean keeping an open mind to Libra, Facebook’s new and controversial payments effort. Or, as I wrote here, it may mean granting financial-technology companies direct access to central bank services so that they can better compete with banks in providing payments services to the public.

As for Silvergate, its blossoming profits will no doubt attract attention. Other bankers will try to emulate it by reaching out to the cryptocurrency community, the ensuing competition driving down the financial costs of being a cryptocurrency user.

If anything, the relationship between Silvergate and its clients reveals an interesting paradox. In their marketing material, Silvergate’s crypto clients like to portray themselves as disruptors of the existing world order. But, in practice, the opposite seems true. Cryptocurrencies and cryptocurrency service providers are being increasingly embedded into traditional finance. Old-fashioned banks aren’t being toppled so much as innovating in order to better graft the renegades into the existing payments system.

This is a good thing. It is a sign of a thriving financial system.