Auto Sales and ISM New Orders Surge in September

September economic data are off to a strong start as unit auto sales, the Institute for Supply Management’s manufacturing new-orders index, and the ISM nonmanufacturing new-orders index all posted strong gains. While the impacts from Hurricanes Harvey and Irma are still likely to cause some weakness, today’s data suggest the economy is entering the final quarter of 2017 with very good momentum.

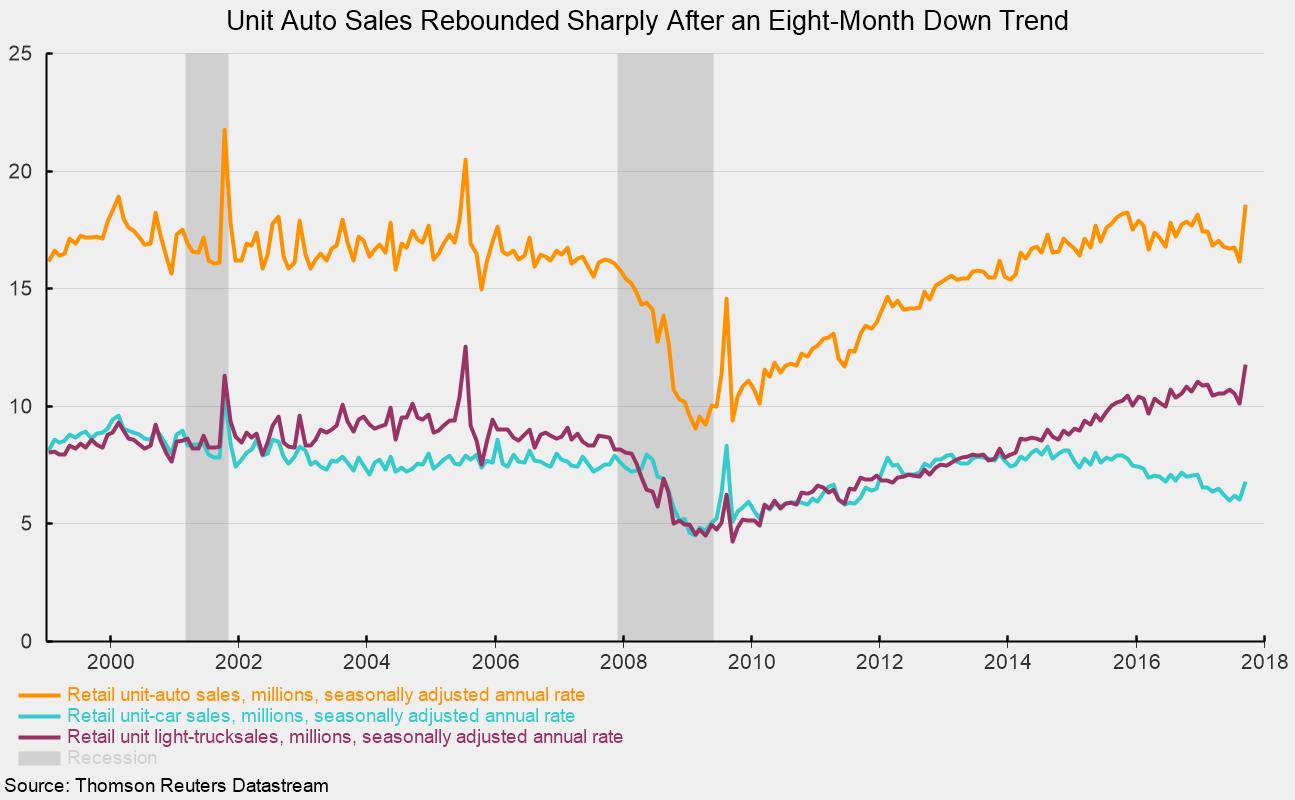

U.S. retail unit auto sales rebounded sharply in September, jumping to an 18.6 million annualized rate, the highest since July 2005. The rebound comes after unit auto sales posted record results in 2015 and 2016 but suffered through an eight-month down trend during which sales fell from an 18.2 million rate in December 2016 to 16.1 million in August 2017 — a drop of 11 percent.

The September surge came from sales of cars and light trucks, both domestically produced and imported. Light trucks continue to be the dominant segment, accounting for 63.3 percent of sales. They posted an annualized selling rate of 11.8 million units in September, with domestic light trucks accounting for 9.7 million, or 82.4 percent, of retail light-truck sales. Domestic light trucks posted a 2.1 million rate for the month.

Passenger-car sales rose to a 6.8 million-unit annualized pace versus a 6.0 million rate in August. Among passenger cars, domestic cars came in at 4.95 million while imports sold at a 1.85 million pace. From December 2014 to September 2017, passenger cars’ share of total light-vehicle sales fell from 48 percent to 36.6 percent.

Overall, the rebound in unit auto sales is a positive sign for consumer spending and the economy overall heading into the final quarter of 2017.

Further positive evidence for the outlook for the fourth quarter comes from the Institute for Supply Management’s two Reports on Business. The ISM Manufacturing Purchasing Managers Index jumped to 60.8 (where 50 is neutral), the highest level since May 2004. The strong result was powered by gains in all of the component indexes. The new-orders index jumped to 64.6 in September, the 4th month in a row and the 8th month in the past 10 above 60. Production, employment, prices, backlogs, and export orders all posted gains for the month.

The ISM nonmanufacturing index gained more than 4 points, coming in at 59.8 for the latest month, up from 55.3 in August. This index has been above the neutral 50 level for 93 consecutive months. Like the manufacturing counterpart, the nonmanufacturing survey showed broad-based gains across all the key areas. Within the nonmanufacturing index, the new-orders index rose to 63.0 from 57.1 while the activity index increased to 61.3 from 57.5. Both have been above 50 for 98 months. Indexes for employment, backlogs, prices, and export orders all rose.

The outlook for continued economic expansion remains favorable, though some weakness from the impact of Hurricanes Harvey and Irma may show through in some economic indicators.