Americans Are Worth More, and Saving More Money

We are seeing two additional indications that are positive signs for the economy.

First, household balance sheets are improving. U.S. households saw their collective net worth rise to a record $88.1 trillion at the close of the first quarter of 2016. That compares to a net worth of $87.2 trillion at the end of 2015, an increase of $837 billion, or 1 percent. The increase was a result of a $855 billion increase in total assets, to $102.6 trillion from $101.8 trillion, offset by an increase of $17.8 billion in total liabilities.

The highlights from the report released June 9 by the Federal Reserve include an increase in real estate assets, to $25.8 trillion, the highest level on record, while total home mortgage debt rose to $9.5 trillion, pushing household equity in real estate to $13.0 trillion. That translates into an equity percentage of 57.8, the highest since the first quarter of 2006. On the financial asset side, total financial assets rose by $299.5 billion.

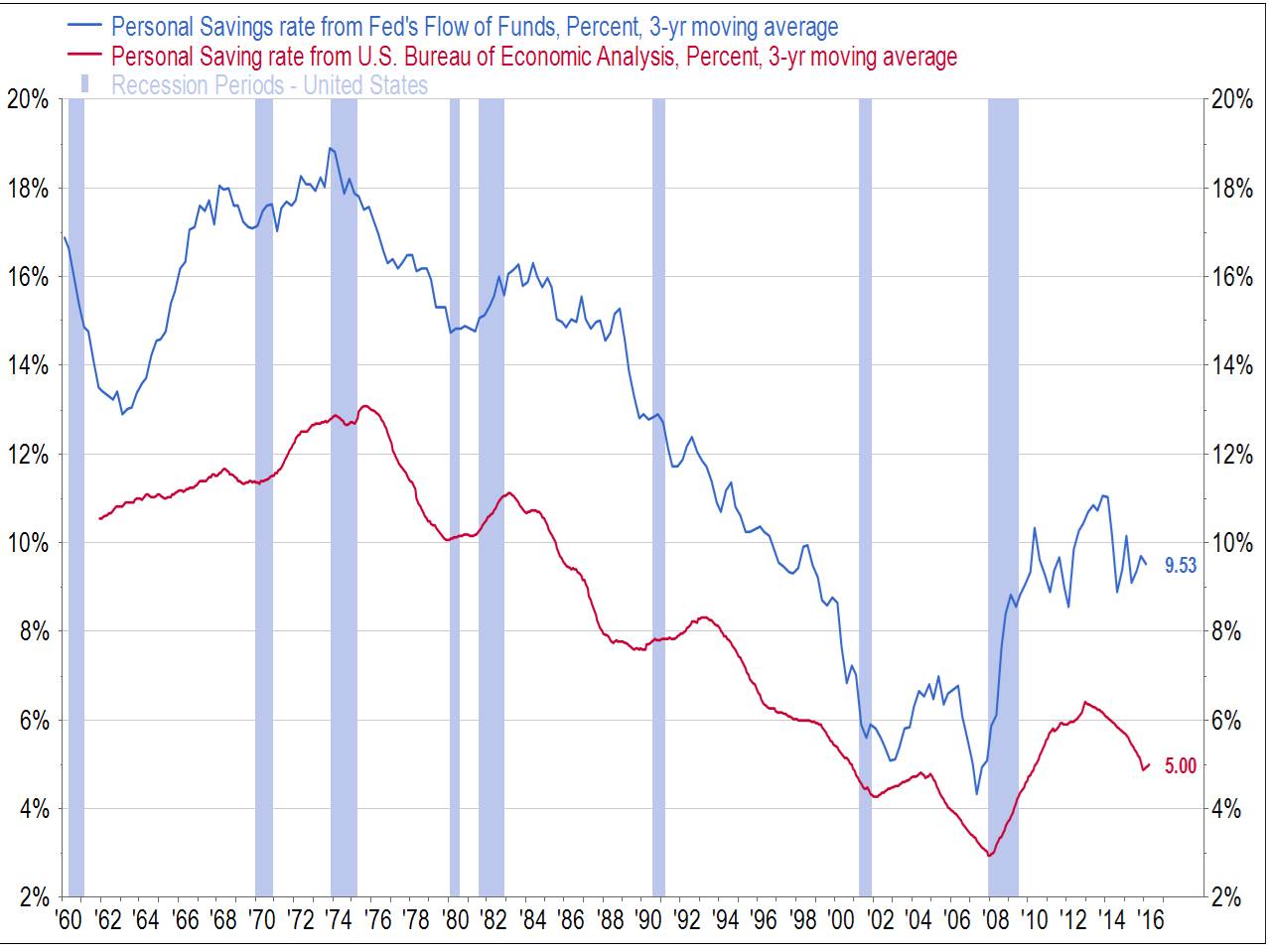

Secondly, Americans are generally putting more money away in savings. As part of the aforementioned report, the Fed calculates a personal savings rate measure that is more encompassing that the savings rate calculated by the Bureau of Economic Analysis. In the latest quarter, the personal savings rate (savings as a share of disposable personal income) was 10 percent, down from 12.2 percent in the final quarter of 2015.

But because these quarterly figures are quite volatile, we look at three-year average rates. Over the past three years, the savings rate has averaged 9.5 percent. Using the BEA methodology, the savings rate over the same period is just 5 percent, about half the Fed measure. The good news is on both measures, the savings rate is up significantly from the lows of the early 2000s. However, that 9.5 percent savings rate is still well below the mid-to-upper-teens savings rate that prevailed for much of the mid-1960s through the late 1980s.

Overall, improving household balance sheets and a healthy savings rate are positives for consumers and the economy.

Click here to sign up for the Daily Economy weekly digest!