Actually, the Gilded Age Was Awesome for Equality

The Triumph of Injustice, the much-discussed book written by Emmanuel Saez and Gabriel Zucman, argues that there is a rapid increase in economic inequality that can only be resolved through the implementation of a wealth tax. Much has been said about the potential data problems with the wealth-inequality estimates contained in the book.

To be sure, the calculation problems raised by economists on all sides of the political spectrum are considerable and ought not be dismissed. However, these problems constitute only a minor share of the flaws contained in the work of Saez and Zucman (and others who follow in their footsteps).

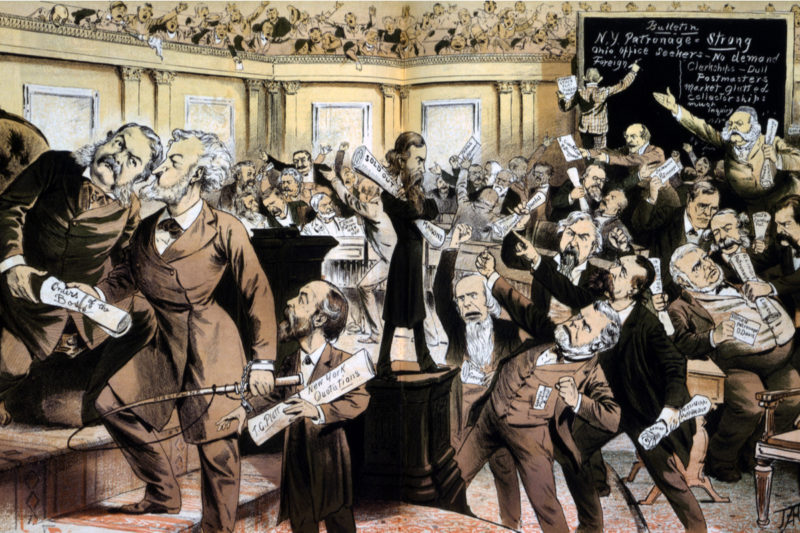

At a conference hosted by the Peterson Institute for International Economics, Emmanuel Saez locked himself in a virulent debate with Lawrence Summers. After a series of criticisms raised by Summers, Saez asked the former if he had ever heard of the “robber barons.” It is not the first time Saez, Zucman, and others (such as Thomas Piketty) have referred to this image.

The robber barons were key political villains during the “Gilded Age” (circa 1865 to circa 1900). The image they conjure is one of unfettered capitalism and rising inequality. The late decades of the 19th century constituted periods of rapid economic growth and momentous technological changes. However, the robber barons (i.e., captains of industry) captured the bulk of these gains in living standards. The poor were, supposedly, left behind. This meant that, thanks to their wealth, the wealthy could corrupt politicians to do their bidding and ignore the plight of the poor.

The association is supposed to be instantaneous: rising inequality with phenomenally wealthy individuals in a politically corrupt environment.

Yet there are numerous holes with that storyline. The first is that we know that inequality fell on a score of important dimensions. For example, we know that inequality in life expectancy at birth fell markedly over the course of the 19th century. We also know that inequality in life expectancy at later age points (to exclude the effect of falling infant mortality) fell in the early decades of the 20th century. Other health outcomes (such as height) suggest that there was diminishing inequality in the later decades of the 19th century. We also know that there was diminishing inequality between men and women and diminishing inequality regarding educational outcomes.

Secondly, we now know that the cost of living fell more slowly for the rich during the 19th century than it did for the poor. Research in the early 2000s by Peter Lindert, David Jacks, Patricia Levin, and Philip Hoffman revealed that, in Britain, there was a pronounced egalitarian trend from 1800 onward. In subsequent research forthcoming in Cliometrica, Peter Lindert and myself extend this work to Canada, the United States, and Australia. We found a similar trend: the cost of living of the poor was falling much faster than that of the rich.

Why? One reason is that the productivity of the poor was rising so fast that their wages were increasing. However, these wages were a key component of the services that weighed much more heavily in the basket of goods and services consumed by the rich. Thus, because the poor were getting richer, the opportunity cost of hiring them as servants for the rich rose. This means that when you deflate the “nominal” income of the rich and poor by their respective cost-of-living indexes, you find a smaller increase (and maybe even a small fall on measures that exclude the top 1 percent) in “real” income inequality.

How can these facts be reconciled with the Gilded Age/robber baron image? The answer is simple: you cannot do it. At least, you cannot do it without importing a key nuance regarding the role of government.

Let’s draw a more accurate portrait of income inequality — one that focuses on the top 1 percent. It is clear there was an increase in the share of total income earned by the richest 1 percent (there are however signs of compression below that centile so that the bottom rose and grew more compressed and closer to the richest than before).

So what caused this increase?

A share of that increase did come from technological innovations that generated considerable profits that were captured by the inventors/entrepreneurs who adopted them. However, as William Nordhaus pointed out, the monetary profits from such gains are only a small share of the total gains. Indeed, the sum of all gains in welfare includes much more than just these monetary transfers. The welfare to consumers is a much more encompassing concept that speaks to utility and not income.

In fact, the fall in inequality on dimensions other than income confirms this point. The poorest were gaining on these other dimensions because they were willing to purchase the goods that made a few entrepreneurs exceptionally wealthy. Thus, a share of that increase in income inequality between the top 1 percent and the bottom 99 percent is not at all worrisome because it speaks to a leveling on a more broadly defined conception of living standards.

However, there is a share of the increase that can be damned. It is the share that speaks to the role of the “robber barons” who got rich because of political machinations. Few are the historians who have labored to distinguish the wealthy of the late 19th century according to how they got rich. The recently deceased Richard Sutch made such an effort just before he died (unfortunately, his very promising work may have died with him). His work suggests that most of the great fortunes in 1870 were made from business rather than inheritance. In this, he echoed much of the pioneering work of Stanley Lebergott and more recent work that argues that extraordinary fortunes dwindle fast.

A complementary, but equally relevant, nuance is provided by Burton Folsom. In a frequently re-edited volume, The Myth of the Robber Barons, Folsom distinguished between market entrepreneurs and political entrepreneurs. The distinction is made to highlight that fortunes can be built by serving customers or by catering to politicians. The former approach tends to generate fortunes that are less contentious and controversial. The latter generates fortunes that are acquired through rent-seeking. There were many such fortunes in the late 19th century: railway magnates that got rich from state subsidies, manufacturers that profited from trade tariffs, state-level bankers who were protected from out-of-state competitors, and so on. The unease about such “political fortunes” is understandable.

Yet, this latter nuance — which fits well with other findings in the fields of economic and social history — is nowhere to be found in The Triumph of Injustice. This is to be expected, as the answer to such a type of inequality is not a wealth tax, which would harm the deserving and the undeserving rich. Rather, the answer is a rolling back of the practices that create political fortunes. It entails constraining politicians in their ability to grant preferential treatments.

The invocation of the Gilded Age like a cheap political talking point is bad economics and bad economic history. A more careful study of economic history provides a clearer, more nuanced answer. It may be politically harder to sell such an answer. This, however, does not make it any less accurate or true.