A Cautious Retrospective on Bitcoin

It’s time for a retrospective on Bitcoin, released 11 years ago this January. What have we learned? What are the prospects for the future?

I was a slow convert to the very idea that Bitcoin could work. This is because I had seen so many failed attempts in the 2000s to create an independent money for the Internet. I had concluded that it could not work, so when Bitcoin came along I had already ruled out the idea that it would amount to something. What I had overlooked is that previous attempts had failed for specific technological reasons – fixable reasons.

When I came around, the exchange rate of dollar to Bitcoin was $14 to 1BTC. It was upon using it – the speed and awesome power of ownership of money outside the government and banks – that I saw that it was likely undervalued. If this was real, the value could be much higher.

Thus did I enlist among the early bulls. That was then, and times have changed. For nearly two years now, we have not seen much in the way of upward movement of this currency, as glorious a technology as it is. The “to the moon” doctrine of the early adopters does not seem to be happening, which is not to say that it won’t happen in the future. Maybe the HODLers are right and they will all be rich in the future.

However, there are five solid reasons to think that the doctrine needs some adjustments in light of changes to the technology and to market conditions that have gradually unfolded over 10 years.

Consider the core data.

Transactions per day are at 2016 levels.

Exchange volume is at 2017 levels.

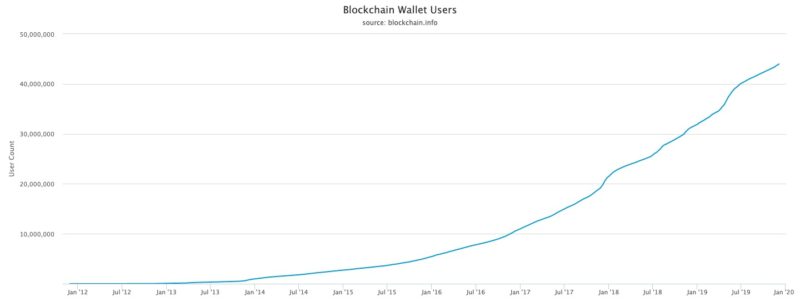

Wallet use is at an all-time high but most new users come in through exchanges and keep their money there, which belies the hope of disintermediated money.

Some additional considerations follow.

1. Underpriced market assets are grounded in information asymmetries. Profits come from possessing valuable insight that others do not share, and acting on that insight. These asymmetries can be large or small. They were very large in Bitcoin from 2009 to 2015 or so. Some of us were convinced while vast numbers of even highly sophisticated people were sure that it could not, and the results were impressive for those who took the risk.

We are now eleven years into this, and the skeptics are now in a small minority. That blockchain technology is awesome is a given. If there were vast asymmetries in knowledge in the past, those have dissipated over time. The process of price discovery might have settled into a confident equilibrium: this stuff is cool, and useful for some purposes, but it cannot be a money for the world. It’s a given that there is no “true price” for Bitcoin but it is also true that the days of astonishment that it worked at all are now settling into the widespread awareness of why it works today.

2. At the same time Bitcoin was launched, so too were released some other impressive payment technologies designed to reduce the price of transactions and make accepting credit cards vastly easier. Back in the day, small merchants had a very hard time accepting credit cards. Thanks to technologies like Square, even a lemonade stand can accept them using a smartphone, which was also launched around the same time. The near-universal use case for Bitcoin was once obvious; apart from specific demographics and interests, the case for broad public adoption is no longer clear. To be sure, there remain vast and important uses for crypto for permissionless remittances and for allowing the unbanked to move money (one of the booming facets of the crypto-asset sector are ATMs), but that will remain true regardless of market valuations.

3. The old pitch for Bitcoin – that it made payments fast, cheap, and permissionless – had been dramatically changed as adoption increased and the portals couldn’t keep up. Permissionlessness still survives but that is not true of fast and cheap. By 2017 it became very obvious to the world that though Bitcoin is wonderful, it is not very practical for payments as compared with legacy systems that had vastly improved. Forks emerged to fix that problem but because the crypto sector is so vast, none could develop the network that Bitcoin obtained as the first mover in the space. Among those crypto innovations have been stable coins that operate as settlement banks. Those in the market for stability will find these more useful than old-fashioned crypto. And let us not forget the greatest lesson of monetary history: it’s the use value of a currency that is its value (there is no such thing as “storing” value).

4. Bitcoin came into a banking world that was dilapidated and anachronistic. But banks and processors felt the heat and adapted in an unusually quick period of time. Now we have peer-to-peer payment systems working within the regular banking systems. We have Venmo, Zelle, Apple, and Google, and many other systems, and, for all their limitations, they are getting better by the day. For that matter, the Fed itself has announced its own plans for a blockchain-like P2P payment system. Competition works. Bitcoin made a major contribution to lighting a fire under the mainstream industry. But that innovation necessarily affects Bitcoin’s prospects.

5. Let’s just say – as many industry experts say to me in private – that the days of endless price increases of Bitcoin are over, and that it settles into a stable price and even gradually falls to 2014 or 2013 levels. That is not beyond the realm of possibility. Nothing about markets are perfectly predictable, and there is nothing baked into the nature of Bitcoin that guarantees any particular future. A major problem hits the essence of money itself: the use case is everything and adoption is the path toward making any money mainstream. The trends here do not look brilliant for Bitcoin.

My own belief is as follows. We now know that a new global currency, privately produced and managed, is a technological possibility. That is not going to change. Once the knowledge is there, no one can make it go away any more than anyone can make algebra go away. These private currencies have proven themselves superior to legacy systems. In time, they will be competitive, and probably within our lifetimes. Which one of the tokens it will be is impossible to say. But it is not beyond the realm of possibility that it will not be any of the existing tokens listed at CoinMarketCap. It could be something else entirely – an Amazon coin, for example.

The great lesson of Bitcoin is the need for humility in market prediction about money. No one knows enough to say what will and what will not work, what will and will not become dominant or even viable. There is no substitute for looking out the window and using whatever knowledge one has to make the best possible interpretation of events.

Bitcoin could still go to the moon. But there are plenty of reasons to believe the opposite too. The most likely immediate future is that Bitcoin will continue brilliantly to service a special type of need. Based on the feeling I get from existing market conditions, I’m ever more convinced of the need for humility here as everywhere in economic affairs.