Manufacturing Survey Suggests Strong Demand, Materials Shortages, and Rising Prices

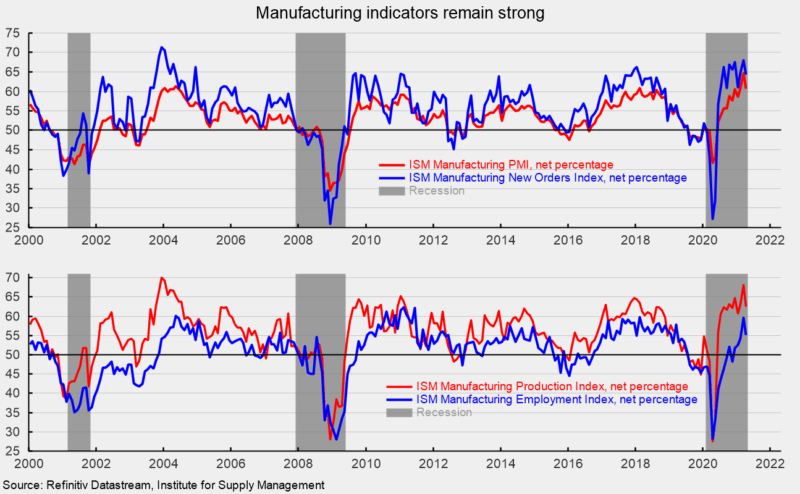

The Institute for Supply Management’s Manufacturing Purchasing Managers’ Index eased back to 60.7 in April, a decline of 4.0 points over the 64.7 percent result in March. April is the eleventh consecutive reading above the neutral 50 threshold (see top of first chart). Over the past 11 months, the Purchasing Managers’ index has averaged 58.1, the highest since January 2019. The survey results suggest that the manufacturing-sector recovery continues to gain momentum.

Among the key components of the Institute for Supply Management’s most recent survey, the New Orders Index came in at 64.3 percent, down 3.7 percentage points from 68.0 percent in March (see top of first chart). The New Orders Index has been above 50 for 11 consecutive months and above 60 for 10 consecutive months. The 10-month average is 64.6, the highest since September 2004. The new export orders index, a separate measure from new orders, rose to 54.9 versus 54.5 in March. The new export orders index has been above 50 for 10 consecutive months.

The Production Index registered a 62.5 percent result in April, down from 68.1 percent in March. The index has been above 50 for 11 consecutive months and above 60 for the last 10 months (see bottom of first chart). The 10-month average is 62.9, the highest since October 2004.

The Employment Index fell in April, losing 4.5 percentage points to 55.1 percent in April. The employment index had been one of the weaker components but has now been above 50 for five consecutive months and six of the past seven months (see bottom of first chart). The Bureau of Labor Statistics’ Employment Situation report for April is due out on Friday, May 7th. Consensus expectations are for a very strong gain of 988,000 nonfarm-payroll jobs including the addition of 58,000 jobs in manufacturing. The unemployment rate is expected to fall to 5.8 percent.

The Backlog-of-Orders Index rose again, coming in at 68.2 percent in April, up from 67.5 percent in the prior month, the highest level since the series began in 1993 (see second chart).

Customer inventories in April are still considered too low, with the index remaining below 50 at 28.4 percent versus 29.9 percent in the prior month (index results below 50 indicate customers’ inventories are too low; see second chart). The index has been below 50 for 55 consecutive months and is the lowest since this index began in 1997. Insufficient inventory may be a positive sign for future production.

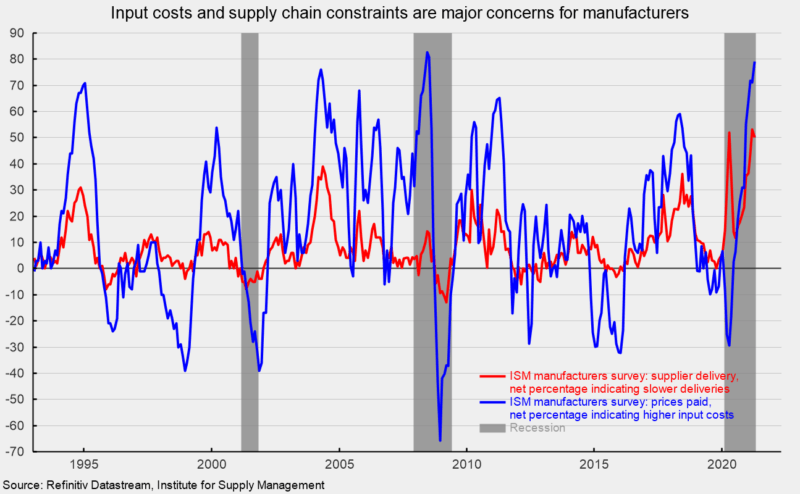

The prices index, reflecting what manufacturers pay for input materials, rose to 89.6 in April, up 4.0 points from 85.6 in March and the highest level since July 2008. Rising input costs reflect shortages of materials, often related to production issues as well as logistical and delivery problems.

Supplier deliveries slowed again in April with the index falling slightly to 75.0 from 76.6 but still a very high level.