Yellen was Right, the Federal Debt “Should Keep People Awake at Night”

In 2017, the level of federal debt as a percent of GDP hovered around 100%. It was in 2017, as she prepared for her exit from the Federal Reserve, that Janet Yellen sounded off about the danger of the growing federal debt.

“I would simply say that I am very worried about the sustainability of the U.S. debt trajectory,” Yellen said. “Our current debt-to-GDP ratio of about 75 percent is not frightening but it’s also not low.”

“It’s the type of thing that should keep people awake at night,” she added.

Yellen cites the level of federal debt held by the public in her description of the “current debt-to-GDP ratio,” which excludes federal debt held by federal agencies. After last year’s fiscal expansion, this measure of debt is now greater than 100% of GDP. The value of all federal debt currently hovers around 130% of GDP.

Despite the growing debt burden, Janet Yellen has pivoted as she steps into her new role as the Secretary of the Treasury. She now advises that “with interest rates at historic lows, the smartest thing we can do is act big.”

The ballooning debt is no longer a worry. We’ve already seen the debt-to-GDP ratio increase by 20% since the emergence of Covid-19. I presume that she would be comfortable with an increase in the debt-to-GDP ratio of another 10 to 20%.

Despite Yellen’s change in perspective, the dangers of a growing federal debt loom larger than they had when she was the Chair of the Federal Reserve. Over two years ago, I reflected on this problem with an op-ed from Michael J. Boskin, John H. Cochrane, John F. Cogan, George P. Shultz, and John B. Taylor in mind. The authors were concerned that given an average interest rate of 5% paid on government debt, half of all tax receipts would be dedicated to the payment of interest.

For more than a decade, the value of current tax receipts as a proportion of GDP has been no greater than 12%. Even using a broader measure, the value has never exceeded 20% of GDP. Now consider once again the dilemma presented by Cochrane and company: an average annual interest rate of 5% paid on a debt whose value is equal to 130% of GDP is 6.5% of GDP. If, as I have hypothesized, the federal debt grows to 150% of the value of GDP, the value of interest would be equal to 7.5% of GDP. In the least, the federal government would be unable to maintain its current level of spending with such a large chunk of current tax receipts being used to cover interest payments.

Of course, so long as investors believe that the U.S. Treasury can honestly repay its debts, there is no problem with the present situation. I think most policymakers expect that tomorrow will look a lot like today which looks a lot like yesterday. We live in an era of unusually low interest rates. If rates rise tomorrow, those rate increases should accompany increases in productivity and, therefore, income. But productivity growth is not the only factor driving increases in the interest rate. Expected inflation matters, too.

This Time it’s Different

America’s last episode of high rates of inflation occurred during the 1970s and early 1980s. At its worst, the price level increased by more than 10% year over year. If the price increases weren’t bad enough, interest rates also followed this trend, with long-term rates in the double digits. Rates on 30-year treasuries rose above 10% for several years. Investors no longer trusted government to restrict the quantity of money in circulation. They no longer trusted government to rely on taxes instead of money printing to fund government spending. The rise in interest rates was demand for compensation of expected dollar devaluation.

At the time, the value of the federal debt was equal to about 30% of GDP (25% if you only consider debt held by the public). It takes time for debt to roll over, so not all debt was subject to these double-digit rates. Even if the average annual rate paid on sovereign debt was 10%, the total value of interest payments would be about 3% of GDP. Under the current situation, an average annual rate of 10% would amount to roughly 13% of GDP (about 10% if you only include federal debt held by the public).

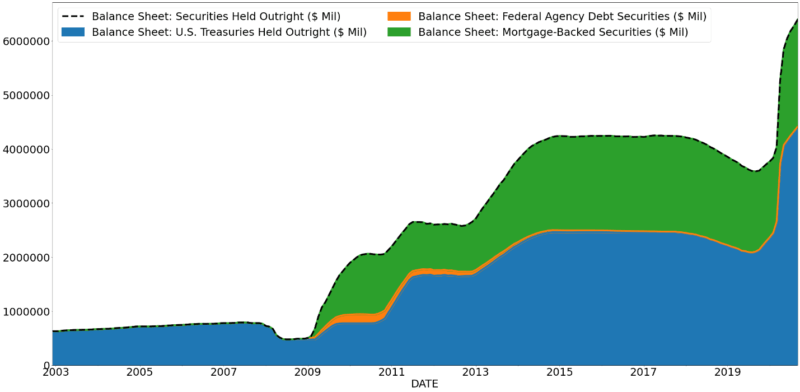

Double-digit inflation is not unthinkable if the federal government does not set its fiscal house in order. Another round of fiscal expansion will likely be accompanied by another round of support from the Federal Reserve. Unless the Federal Reserve plans to soften its support for mortgage markets or reduce its intervention in the overnight lending market, it will have to continue expanding its balance sheet to provide this support. The Fed currently holds over $6 trillion in securities, a value 3 times greater than the monetary base currently in circulation. As the Fed continues to increase support for the U.S. Treasury, it signals to investors that support is not forthcoming from the market, at least not in the form of near-zero rates.

It is not clear that those governing monetary and fiscal policy have a contingency plan in place in case investors begin losing faith in the soundness of the U.S. dollar and the solvency of the U.S. Treasury. For more than two decades the federal debt has increased as a portion of GDP. Not since the Clinton administration has the level of debt decreased as a proportion of GDP. The growth of federal debt that resulted from the fiscal expansion of 2008 never reversed. Under a supposedly conservative Trump administration we observed yet another record increase. With little in the way of calls for moderation, all signs point toward an embrace of deficit spending under the Biden administration.

The Federal Reserve waited nearly a decade before it began tapering expansion that began at the end of 2008. And after only two years of modest tapering, the Fed reversed course. First in September 2019 when a large issue of new debt from the U.S. Treasury appeared to draw liquidity from the overnight lending market. Then, with the Covid-19 pandemic, a modest reversal in policy stance turned into a new round of quantitative easing, supporting massive fiscal expansion. With more fiscal and monetary expansion ahead of us, will it be another decade before we begin to reverse course? Do we have any realistic plan for the U.S. Treasury to lessen the burden of the federal debt? By the time we attempt to reverse course, I expect that financial markets will respond with more than the hiccup that we observed in September 2019. Support from QE has become a fixture of monetary and fiscal policy in the United States.

The danger might not be a decade down the road. It might be just around the corner. While we’ve been distracted by the recent run-up in the price of GameStop shares and we may be observing similar coordination in the silver market from Redditors, how should we respond if these folks or more nefarious forces coordinate a massive short or fire sale on U.S. Treasuries? With a continual need to roll over debt, the size of Federal borrowing is fast becoming a point of vulnerability. Yet many believe that low interest rates will persist. Even if they don’t, they believe that Congress will have time to tighten the budget if rates rise. Still, as the national debt has ballooned, others many have begun to note that it is not only a financial risk, but a national security risk. If the burden of interest payments increases, will Congress make the difficult decisions required to reduce federal spending? What contingency plan do Yellen and Powell have in their back pocket if the dollar suffers a speculative attack owing to an unsound fiscal position?

Yellen was right: “It’s the type of thing that should keep people awake at night.”