The Economic Performance of Coronavirus Sweden

Four months ago, I first wrote about the pandemic and Sweden. Lots have happened since – and at the same time, almost nothing has changed. Back then, the mayhem was all financial: stock markets crashing, oil prices going nuts, central banks adding zeros faster than anyone even thought possible.

Slowly, a new normal set in, where the disease was spreading to more countries and the closures of travel – to work and abroad – all but ended. We argued over the causes, the spoils, how best to maintain incomes for people innocently sacked and ensure that business could taper themselves over this temporary setback. And naturally, about how to protect health care workers and save those infected from harm. All the while the elderly kept dying.

And then there was Sweden (and Iceland and initially, the UK) refusing to obey the invasive government measures to restrict freedom so prominent elsewhere. Mid-March, the U.K. dropped its strategy and adopted the same restrictive measures dominating other countries, seemingly to no avail as the British death rates kept rising no matter how many freedoms were taken away.

On Monday, Jonathan Sumption in The Telegraph asked provocatively if we were to “surrender our humanity as well?” There was no end to the heavy hand of government control, it seemed. Verging on hyperbole, Simon Dolan wrote earlier this month about the UK lockdown experience:

“For not only does this week mark 100 days since our liberties were stolen, it also marks 100 days of rising inequalities, countless avoidable deaths and the ruin of a generation.”

In Iceland, aggressive track-and-trace policies, effective quarantining, and closed borders had the country’s infection peak in early April. Soon enough we all forgot about them and their single-digit deaths.

Instead Sweden became the black sheep. The stubborn outlier kept its society comparatively open. Shops and cafés and workplaces introduced some changes, like putting screens between customers and shop-workers. The Scandinavian nation leveraged its high internet accessibility to work from home, and public policy and persona alike appealed to common-sense behavior – like staying at home if ill, keeping physical distance, and using sanitizer (though not as religiously as the Icelanders).

While pundits of either ideological persuasion lined up to defend it or attack it, Sweden’s elderly population kept dying. The strategy’s focus on openness, we were told, was directly to blame for care homes being unable to shield their vulnerable residents.

Except, it turned out, that the elderly and those in nursing homes elsewhere were dying all the same: in New York, in England, in Italy, in New Orleans, stringent government restrictions or not.

Since then, the novelty of coronavirus mania has worn off, but the controversy remains the same. Less about whether hospitals and governments could source masks, more about how to divvy up the free money surging forward from governments and central banks alike.

From the beginning, defenders of freedom threw up their hands in despair, pointing to the absurdity of closing society for a disease that harms relatively few – and a select group that we could and should have protected. Even so, the public response across the world was mostly exaggerated, we said: a virus of this minor caliber is not worth freezing society over.

We said that the economic pains for tens and hundreds of millions could not possibly justify the health damage to tens of thousands. In any case, a hibernated economy could only survive for so long, government checks or not. We pointed to the fatal dangers of a disrupted society, of the chaos emerging from economic ruin.

Slowly, the economic indicators are coming in. For Sweden, already in April card spending figures suggested that the drop-off in consumer spending was surprisingly mild. One critical feature was an environment where industries did not have their labor force cut off, where life mostly continued as usual, where schools were kept open so that working parents could do their jobs instead of unexpectedly becoming baby-sitters. Shopping malls remained open, to the delight of Danish citizens whose closed society had them happily cross the Öresund for some Saturday afternoon shopping in Sweden.

Capital Economics, a macro consultancy, reported this month that some of their economic trackers for Sweden were almost back to pre-crisis level. They forecast Swedish full-year GDP growth of -1.5%, an astonishing feat in a world that otherwise paused for a few months. While overly optimistic (especially among contrarian voices), the same consultancy places Denmark and Norway at -3% for the year. The picture of Sweden as an economic success, all things considered, is slowly unfolding.

In June, the OECD’s biannual Economic Outlook summary put the full-year GDP growth forecast for Sweden between -7.8% and -6.7%, depending on the severity of a potential second wave. It puts Denmark slightly ahead with between -7.1% and -5.8%, with estimates for the UK (between -14% and -11%) and the U.S. (-8.5% or -7.3%) noticeably worse.

The European Commission is slightly less dismal, estimating a eurozone GDP decline for the year of 8.7%, but Sweden (-5.3%) and Denmark (-5.25%) as the second and third best-performing member states after Poland (-4.5%).

Recent numbers from Statistics Sweden report that household consumption has fallen by some 4.5% year-to-date – a catastrophic number in any other year. In contrast, for the period March-May, American household consumption fell by over 10% compared to the same period last year.

Earlier this spring, the Riksbank invoked great uncertainties about the economic future and offered two forecasts instead of their usual one: GDP losses for 2020 of 6.9% in the more optimistic case, or a 9.7% decline otherwise. In July, long after anyone with a disaster-prone mind had stopped listening, the central bank quietly updated its projection.

The two scenarios now projected -4% and -5.7% in GDP growth for the full year – considerably below what most other rich countries are expecting. The U.S. GDP fell in the first quarter by over 5%, whereas Sweden reported miniscule growth, hovering around zero. In macroeconomic terms, that’s a world of difference. For the U.S. we’ll have better numbers on Thursday when the Bureau of Economic Analysis releases its advance GDP estimate for the second quarter and updates to its first-quarter estimates.

In contrast, the American unemployment rate of over 14% in May compares very unfavorably with the Swedish experience, stabilizing at just above 9%. By a large margin, fewer Swedish workers report that they have had their working hours cut during the pandemic than anywhere else.

In the last three months, the Swedish currency has also rallied, appreciating 12.5% against the dollar and over 5% against the euro (5.5% using the trade-weighted KIX-index). Lars Calmfors, frequent policy commentator and professor at Stockholm University, reluctantly admits that Sweden has so far done economically better than most other places, but that it’s still too early to conclusively say. If there’s a second wave in the fall, Calmfors says, the economic gains Sweden has carved out for itself will have been for nothing.

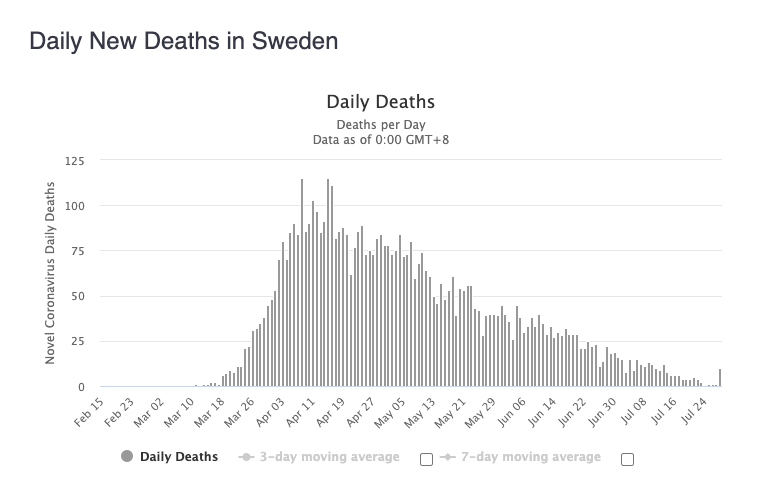

Perhaps. Judging from Google mobility data, however, Swedes are back to pre-corona level movements, yet new infections are at low double-digits a day – on par with the health-success of Denmark – and COVID deaths are now only a handful a week. Perhaps only a seasonal effect, and we’ll have to wait for the fall.

Selectively using some economic forecasts rather than others can still portray Sweden in an unflattering light. If you compare some more dire Swedish projections with the most optimistic Danish or Norwegian ones, for instance, the Swedish experiment looks barbarous.

Judging by per-capita deaths, Sweden has clearly done worse than the U.S. Still, Stockholm, Sweden’s worst-hit area, has done much better than New York City, America’s worst-hit region. Compare Sweden to similar-sized NYC, Massachusetts, or New Jersey, and the Nordic black sheep looks much better.

There are more dishonest takes too, like this story in the New York Times, where the writer compares the Riksbank’s pre-corona projection with its current estimate for GDP growth (with no account of the revisions in-between) and pretending that it weighs against Sweden’s corona strategy.

The spread of the virus and the economic damage the countermeasures are causing are not yet fully understood. For every Iceland and Denmark and New Zealand against which Sweden looks bad, there’s a Spain, a UK, and a New York City against which it looks marvellous. While Sweden’s experiment has not been an uncontested success, much of its economic data so far suggests that it’s doing better than many other places – and much better than we thought just a few months ago.

Almost everywhere we look, the disruption of life and commerce, financial loss and economic ruin, has been smaller in Sweden than elsewhere; the International Monetary Fund says so too. The effects on Sweden’s already prudent public-sector debt has been muted.

Perhaps “counting coppers” is vile, but we do it in normal times, so why not in corona times? Unfortunately, conclusive economic data doesn’t arrive in real time. Economically, as far as we can tell, Sweden has been comparatively successful, but the projections between various economic institutions and statistics agencies still vary way too much for us to be entirely certain about this. In a year where models and forecasts have been widely off the mark, we should interpret this conservatively. In this – Professor Calmfors is right: the full judgement of the Swedish experiment must wait a while.