Pandemic Lockdown Distortions: Manufacturing Pulls Back While Housing Gains

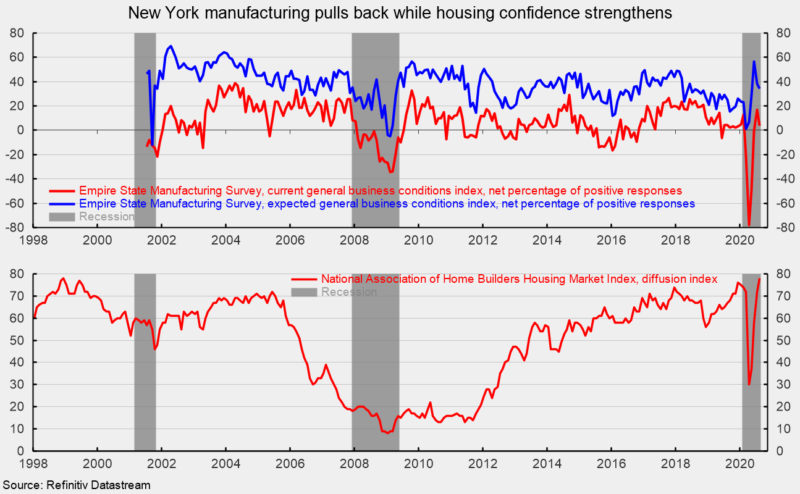

The Empire State Manufacturing Survey shows current general business conditions were less favorable in August with the index posting a 3.7 percent reading versus 17.2 in July, a drop of 13.5 points (see top chart). New orders, shipments, and unfilled orders had similar declines, falling to -1.7, 6.7, and -14.0, respectively.

The current labor indexes, critically important to a recovery, had opposite changes in August. The number of employees index gained 2.0 points to 2.4 while the average workweek index fell 4.2 points to -6.8. Both are generally weak.

Among the forward-looking questions (which give some indications about business confidence), expectations six months ahead were lower across the board. The expected general business conditions index fell 4.1 points to 34.3 in August (see top chart). The expected new orders index and expected shipments index posted declines of 4.7 and 8.6 points, respectively, but remained solidly in positive territory. The number of employees six months ahead index also posted a drop, falling 5.6 points to 15.5 while the average workweek index lost 1.9 points to 2.0.

While the manufacturing sector appears to be struggling a bit after an initial bounce following the easing of lockdown restrictions, the decline in mortgage rates and boost in demand for less dense housing options has helped give a sustained boost to the National Association of Home Builders Housing Market Index, rising for the fourth month in a row. The index gained 6 points to 78 in August (see bottom chart). The index is up from a low of 30 in April and is at the highest level since December 1998 (see bottom chart).

There were gains in all three components of the housing market index. The index for present single-family sales rose to 84 from 78 last month; the index for expected single-family sales over the next six months rose to 78 from 75; and the index for traffic of prospective buyers rose to 65 from 57.

Regionally, all four regions saw increases though three posted strong gains while one showed a weak gain. The Northeast index rose to 77 from 70 while the West index rose to 88 from 80 and the South index added seven points to 79, but the Midwest index managed only a one-point gain to 70.

There have been signs of rising demand for the lower-density housing of suburbs and rural areas given the harder impact of the COVID-19 outbreak and more draconian policy responses in high-density urban areas. Whether this continues to be a sustained trend or begins to fade is likely dependent on whether an effective vaccine is developed, new, permanent regulations are imposed on urban dwellers and businesses, and whether remote work becomes a more popular, acceptable, and permanent option.